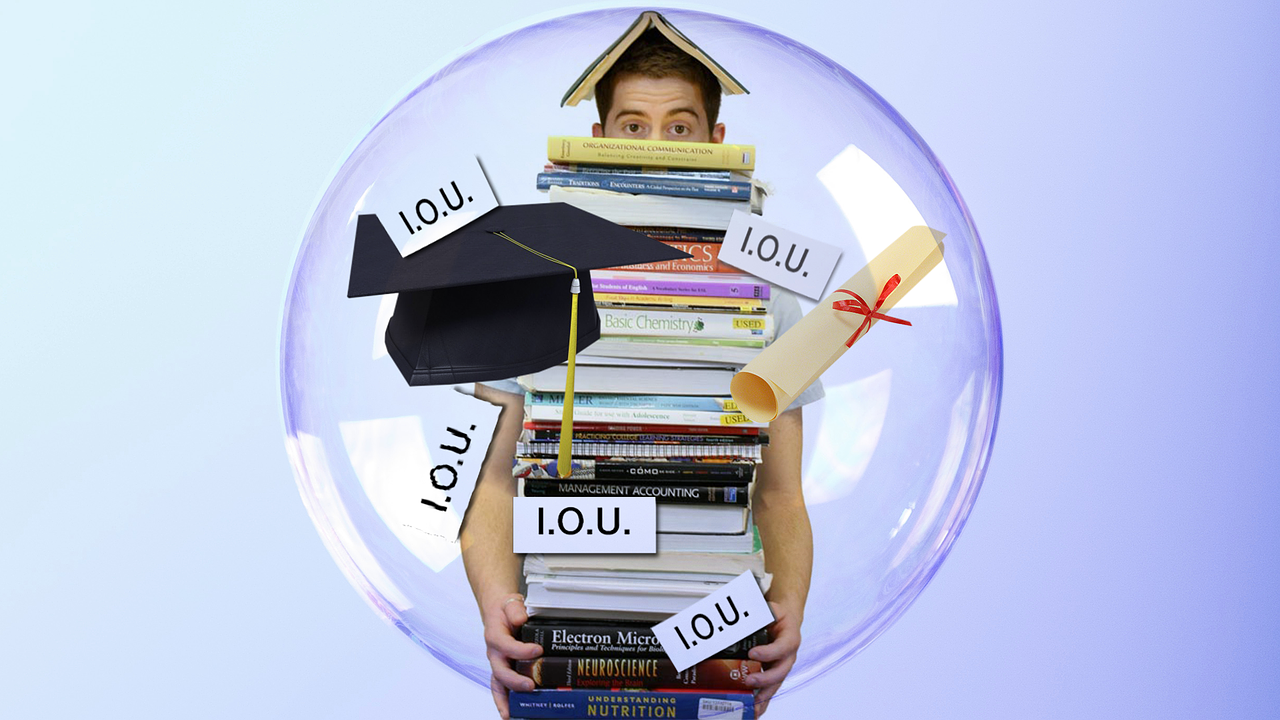

When Paying Off Student Loans While in College Could Be a Good Idea

Should you pay off your student loans while in college? Or should you wait until after you've graduated?

Jan. 4 2022, Published 8:27 a.m. ET

The Biden administration threw a financial lifeline to people with student loan, delaying payments until May 1, 2022, from Jan. 31, 2022. This is the third extension granted in view of the ongoing pandemic and the new omicron variant.

Now, people are wondering if the moratorium will continue and if the president will cancel student loans completely. Given these circumstances, should you pay off student loans while in college?

You're not obligated to start paying student loans until after graduation. And in the case of direct subsidized, direct unsubsidized, or federal family education loans, even after graduation, you get a six-month grace period before you start paying off the loan. The repayment period also begins if you drop below half-time enrollment or leave school (plus a grace period, if applicable).

Reasons to pay off your student loan while still in college

You can pay off your student loans early by paying more than the minimum due each month, taking up a part-time job in college, or establishing a college repayment fund.

It's generally a good idea to pay off your loans as early as possible, especially if your student loan carries a high rate of interest. There's no penalty for paying off that debt early.

Moreover, in some types of loans, such as unsubsidized federal or private student loans, interest starts accruing from the date of loan disbursement. Therefore, economically, it makes sense to start repaying to avoid accumulated interest. You can also start paying in college just to cover interest, which can make a huge difference down the line.

In some cases, this interest is capitalized and added to your principal, which means you end up paying interest on accumulated interest as well. So, the sooner you start paying, the better. Paying off debt early in any case will help you to build flexibility and help you pursue other financial goals more easily.

When does it not make sense to pay off your student loans early?

If you don’t have enough savings to start paying your student loans early and you'd be using emergency funds to make repayments, it might not be the best idea. It's crucial to have a reserve equal to at least three to six months of your expenses before you start to think about repayment.

Also, if you have a lot of credit card debt or personal loans, it should be your priority to pay those off first before turning to student loans, as interest on credit cards and personal loans is higher.