Is Robinhood IPO a Good Buy or Will the Stock Go the Coinbase Way?

Robinhood, the popular trading app, is expected to go public this week. What’s the forecast for HOOD stock and should you buy the IPO or not?

July 26 2021, Published 9:56 a.m. ET

Robinhood, the popular trading app, is expected to go public this week. It's among the most widely awaited IPOs in 2021 and comes a few months after cryptocurrency exchange Coinbase went public through a direct listing. What’s the forecast for HOOD stock and should you buy the IPO or not?

Robinhood’s IPO is coming at a time when there has been a flurry of listings. Given the strength of U.S. stock markets, a lot of companies have gone public in 2021. However, many of the IPOs are trading below the issue price. These include names like Playtika, Compass, Oscar Health, The Honest Company, and AppLovin.

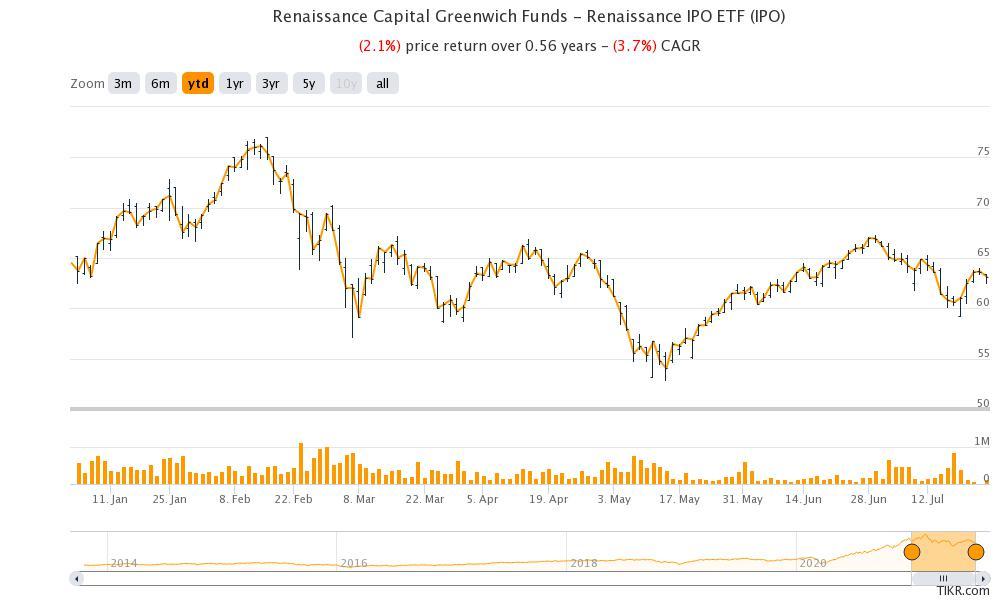

IPOs haven’t done well in 2021.

We haven’t even accounted for Chinese IPOs like DiDi Global and Full Truck Alliance, which have plunged amid China’s crackdown on tech companies. Also, several companies had to lower the IPO price amid the tepid response from investors.

The Renaissance IPO ETF, which outperformed the markets in 2020, is in the red so far in 2021 even though the S&P 500 is up in double digits and near its record highs.

In 2020, there was a huge appetite for new IPOs and many of them doubled on the listing despite high valuations. However, markets have been apprehensive of new listings in 2021 and richly valued stocks including the IPOs have seen a sell-off. As a result, it's important to analyze the Robinhood IPO.

Robinhood IPO date

Robinhood hasn’t specified the IPO date yet, but it's expected to list on July 29. The company plans to offer a third of its shares to retail investors in the IPO, which is way above what other companies do.

The offering goes with the company’s mission of democratizing finance. Coinbase has a similar motto and went public through a direct listing. Coinbase's management interacted with Reddit traders just like other companies do roadshows for institutional investors. Meanwhile, Robinhood’s mission of democratizing finance doesn't go well with the dual share structure where the founders have more voting powers.

Robinhood's IPO price

Robinhood has kept the IPO price between $38 and $42, which would mean a valuation between $27 billion and $35 billion. Many people think that the Robinhood IPO is overpriced considering the high valuations that it's seeking in the IPO.

Is the Robinhood IPO overpriced?

To answer whether the HOOD IPO is overpriced, we’ll need to dive into the numbers. In its S1, Robinhood said that it has 17.7 million MAUs (monthly active users) and has $81 billion of assets under custody. More than half of its customers are first-time customers and over 80 percent of the new customers are either organic acquisitions or are referred by existing customers.

Unlike many other IPOs, Robinhood is a profitable company. In 2020, it posted a net profit of $7 million and an adjusted EBITDA of $155 million. In the first quarter of 2021, it posted an adjusted EBITDA of $115 million compared to a negative EBITDA of $47 million in the same quarter in 2020. Robinhood posted a net loss of $1.5 billion in the first quarter of 2021 on fair value adjustments of notes and warrant liability.

HOOD stock forecast

Robinhood’s top line is growing at an incredible pace. In 2020, its revenues increased 245 percent YoY to $959 million. In the first quarter of 2021, its revenues rose 309 percent to $522 million. Based on the $35 billion valuation, we get a 2020 price-to-sales multiple of just over 36x.

Should you buy Robinhood IPO or not?

Robinhood looks like a good stock to buy if you think the growth rates in the last few quarters are sustainable. However, that isn't the most likely outcome and the company’s growth is expected to come down. Robinhood plans to diversify itself into other businesses including IRAs and shed its image as a “fun gambling app.”

Another aspect worth considering is that most of Robinhood’s revenues come from order flow where it channels the trades to other trading companies and benefits from the spreads. The process has been scrutinized by the SEC and chairman Gary Gensler has raised concerns about it.

He has already taken a milestone decision of imposing a fine on Stable Road Acquisition (SRAC), which is the SPAC that’s taking Momentus public. It was a pathbreaking ruling and could lead to more rulings in the future.

Should you invest in HOOD stock?

HOOD stock might give listing gains and it might even assume a “meme status” given its popularity among retail traders. However, just like Coinbase, the stock could slump after the IPO.