Is It Worth Buying Pre-IPO Stock on Robinhood? Probably Not

With about 31 percent of IPOs falling in price on the first day of trading, buying pre-IPO stock on Robinhood might not be worth it.

July 21 2021, Published 8:41 a.m. ET

With about 31 percent of IPOs falling in price on the first day of trading, buying pre-IPO stock on Robinhood might not be worth it.

In May 2021, Robinhood introduced IPO Access, a platform that allows retail investors to buy company stock shares at their IPO price, before trading begins on public exchanges.

Traditionally, IPO shares have only been available to wealthier investors and Wall Street institutional investors. The rest of the public was limited to buying shares once they started trading on an exchange, such as the Nasdaq or NYSE.

Some stocks rise in price even before they start trading on an exchange. IPOs are usually priced to increase by 15 to 30 percent on the first day of trading. In 2020, IPO stock “pops” on the first day averaged about 36 percent, CNBC reports.

Robinhood wants to democratize IPO investing

Robinhood’s IPO Access aims to democratize IPOs so that even amateurs can make money on new company IPOs. “With IPO Access, everyday investors at Robinhood will have the chance to get in at the IPO price,” states the Robinhood blog.

Unlike SoFi, which acts as an underwriter to enable investors to buy pre-IPO stock, Robinhood is not acting as an underwriter. Instead, the online brokerage is partnering with investment banks to allocate shares, CNBC reports.

Buying pre-IPO stock might not be very lucrative. Although the average IPO pop from 1980 through 2020 was 18.4 percent, about 31 percent of IPOs fall in price on their first day of trading, according to Nasdaq.

Investors are using IPO Access to buy Robinhood stock

In an interesting twist, the access to purchasing pre-IPO shares through Robinhood has benefitted retail investors looking to buy Robinhood shares before its IPO on Jul. 29.

In one of the most anticipated IPOs of 2021, Robinhood is looking to sell 52.4 million shares at between $38 and $42. The company hopes to raise $2.3 million through the IPO. Robinhood shares will trade on the Nasdaq under the ticker symbol “HOOD”. Twitter buzz suggests many retail investors are already putting their orders in for Robinhood pre-IPO shares.

“Just pre-ordered IPO shares for robinhood via robinhood (ipo date: 7/29) and i’m laughing bc their ticker is HOOD. Also laughing at how they gave IPO access on their platform for their own stock,” tweeted one investor. “Is it odd that robinhood would release IPO access just before its own IPO?” tweeted another.

How can you buy pre-IPO shares on Robinhood?

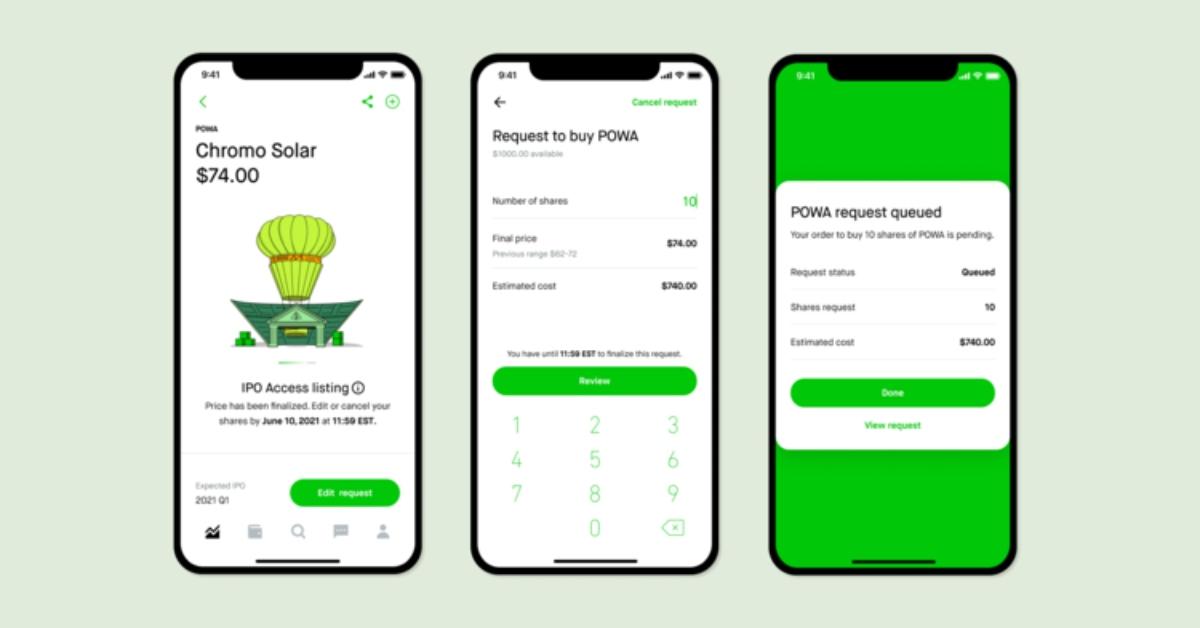

Buying pre-IPO shares on the Robinhood app can be done in three steps through its IPO Access option.

- Select the upcoming IPOs that you want to follow from a list provided.

- Put in a request to buy shares at the IPO price.

- Watch and wait.

“IPO shares can be very limited, but all Robinhood customers get an equal shot at shares regardless of order size or account value,” the Robinhood blog states.