Should You Buy Amazon (AMZN) Stock Amid Bezos's Space Flight?

Amazon founder Jeff Bezos is flying to space on July 20. Will Bezos's space flight have an impact on AMZN stock? Should you buy AMZN stock now?

July 20 2021, Published 10:03 a.m. ET

Amazon founder Jeff Bezos is flying to space on July 20. The space flight comes days after fellow billionaire Sir Richard Branson outflanked Bezos and Elon Musk to become the first billionaire to reach space. Will Bezos's space flight have an impact on AMZN stock? Should you buy AMZN stock now?

In June, Bezos quit as Amazon’s CEO and handed over the baton to Andy Jassy who was leading the company’s cloud business. Cloud and e-commerce are Amazon’s two main business verticals. In the e-commerce business, the company has operations in North America—the company’s biggest revenue contributor. Amazon also has international e-commerce operations that are growing fast and posted positive operating income in the first quarter of 2021.

Jeff Bezos's space flight

On July 20, Bezos will go to space in the New Shepard rocket. He has invested billions into Blue Origin, which is his privately held space exploration venture. Meanwhile, Musk owns SpaceX, which is his privately held space company.

While both Bezos and Musk have a lot in common, including their space ventures, they aren't close friends. In the past, Musk called Bezos a “copycat” and backed calls to break up Amazon.

We might not see much impact from Bezos’s space flight on AMZN stock. If Blue Origin were publicly traded, the stock could have reacted to the flight. Even Branson’s successful space flight didn't have a positive impact on Virgin Galactic stock. Instead, the stock crashed. The company announced a $500 million stock issuance that dampened the sentiments.

There are various estimates for the space travel industry. Virgin Galactic estimates the industry's TAM (total addressable market) at $900 billion, while Morgan Stanley expects the industry to generate sales of $1 trillion by 2040. Several space travel companies have gone public through SPAC mergers. Even Virgin Galactic went for a reverse merger with Chamath Palihapitiya’s Social Capital Hedosophia Holdings I (IPOA)

Amazon stock forecast

Amazon looks like a good stock to buy regardless of Bezos’s space travel. All 32 analysts rated by TipRanks rate AMZN stock as a buy or some equivalent. Its average target price of $4,299.25 is a 21 percent premium over the current prices. Its lowest and highest target prices are $3,775 and $5,500, respectively. The stock even trades below the lowest target price.

Should you buy AMZN stock now?

AMZN stock has entered into a new epoch in its history. Bezos stepped away from the day-to-day operations and assumed the role of executive chairman. Amazon stock looks like a buy even though Bezos has moved on.

Amazon is among the most promising secular growth stories for the next decade. The cloud and e-commerce industries are both growing fast. Apart from strong growth in the organic business, Amazon is also continuously looking at inorganic growth and it has a strong balance sheet to pursue acquisitions.

The digital transformation has expanded amid the COVID-19 pandemic. Amazon is one of the companies that has seen a spike in business. While some of the boost amid the COVID-19 pandemic in 2020 might not be sustainable, many customers who pivoted to e-commerce might continue to shop online.

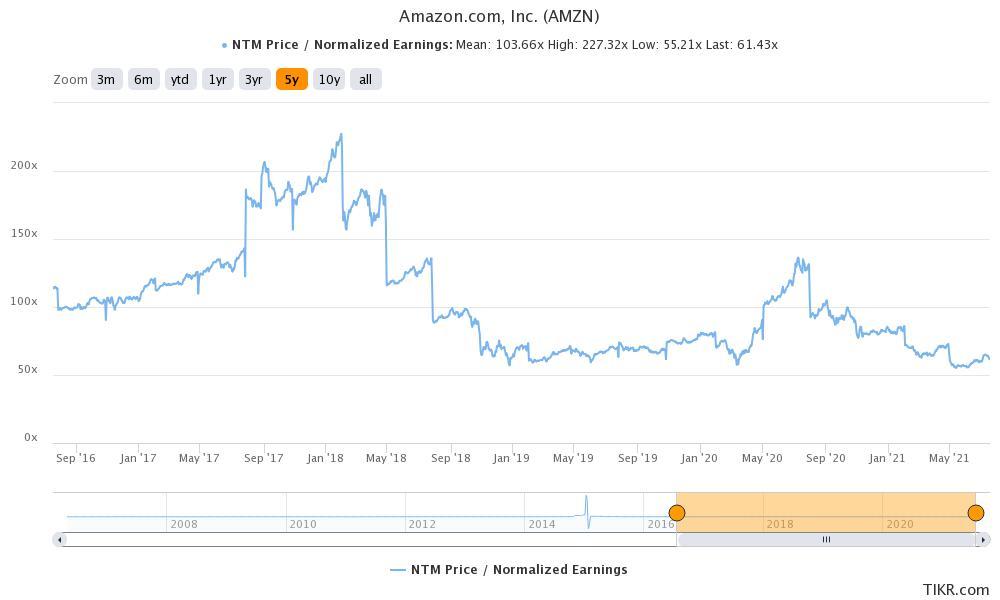

AMZN stock trades at an NTM PE multiple of 61.4x, which seems reasonable considering its growth profile. The company should see earnings rebound now as COVID-19-related costs come down.

AMZN looks like a good long-term buy at these prices. The stock is a good buy even though there are concerns about more regulatory scrutiny and antitrust issues concerning U.S. tech giants including Amazon.