Bill Gates Just Bought Coupang (CPNG) Stock, Good Investment

The Bill and Melinda Gates Foundation Trust has disclosed a new stake in e-commerce company Coupang (CPNG). Should you buy CPNG stock?

May 24 2021, Published 11:31 a.m. ET

The Bill and Melinda Gates Foundation Trust has disclosed a new stake in South Korean e-commerce company Coupang (CPNG). However, it has exited the stake in Apple and Twitter. Should you follow the foundation and buy CPNG stock?

The Bill and Melinda Gates Foundation Trust has bought 5.71 million shares of CPNG. The stake is valued at around $220 million at the current prices. Coupang went public in March and had a strong listing. However, it fell amid the sell-off in growth names. At one point, Coupang was trading below the IPO price of $35.

Coupang stock and the Bill and Melinda Gates Foundation Trust

The Bill and Melinda Gates Foundation Trust is the world’s largest charitable trust with assets of almost $50 billion. The foundation has put its trust in CPNG stock even though it has trimmed stakes in some of the other tech stocks.

CPNG stock valuation

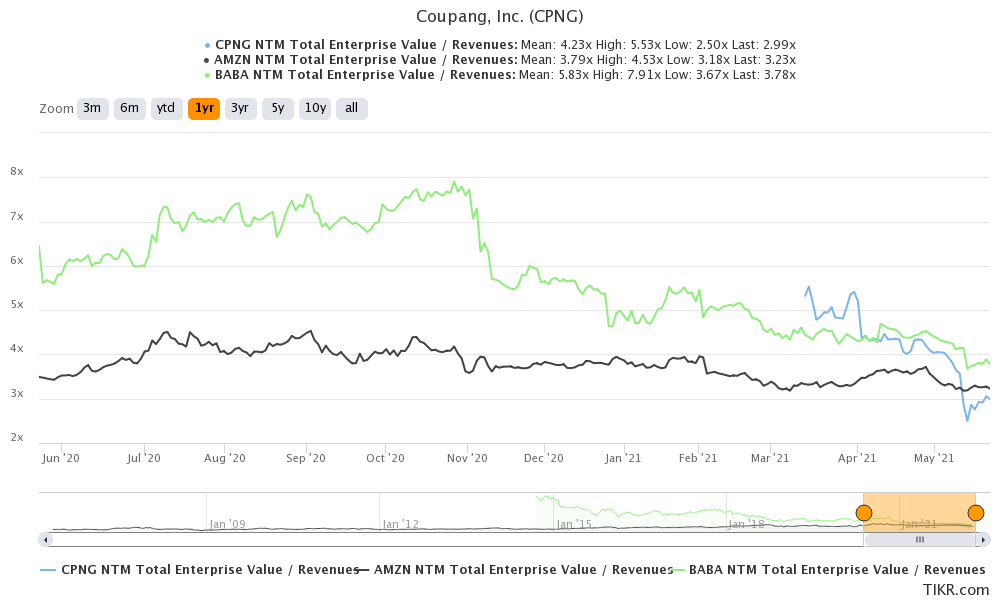

CPNG stock trades at an NTM (next-12 month) EV-to-EBITDA multiple of 2.99x. The multiples have averaged 4.2x since the company went public and hit a high of 5.53x. The current valuation multiples aren't far away from the all-time low multiples of 2.5x. Since the stock only listed recently, we don’t have enough time-series data to arrive at a conclusion.

Is CPNG stock undervalued?

CPNG has backward integrated operations and it doesn't use third-party delivery services like other e-commerce companies. Also, we don’t have a real comp set for the company. While Amazon and Alibaba are also e-commerce plays, they have cloud operations as well. Incidentally, Amazon’s cloud operations account for most of its profitability.

CPNG valuation versus BABA and AMZN

Meanwhile, CPNG’s valuation multiples are at a discount to both Alibaba and Amazon. While Coupang is growing its top line at a faster pace than these companies, it's currently posting losses. Amazon and Alibaba are both posting profits.

Coupang stock forecast

According to the estimates compiled by TipRanks, CPNG has an average target price of $47, which is a premium of 23.6 percent over its closing prices on May 21. The stock’s highest and lowest target prices are $39 and $62, respectively.

Among the six analysts covering the stock, only two have a buy or equivalent rating, while the remaining four analysts have rated CPNG as a hold. Goldman Sachs is the most bullish brokerage on Coupang and has a street-high target price of $62.

Earlier this month, Coupang released its first earnings as a publicly traded company. While its sales were slightly ahead of the expectations, it posted a wider-than-expected loss in the quarter. Citigroup and Mizuho lowered the stock’s target price after the earnings release. Last week, Deutsche Bank upgraded the stock from a hold to a buy.

CPNG stock is a good buy.

Growth stocks have been out of favor with investors and CPNG stock has also been a casualty of the painful sell-off in growth names. However, Coupang has the market-leading position in South Korea and a strong brand in the country. After the IPO, it has enough cash to fund its growth and bridge the cash burn before the business starts generating positive free cash flows.

I think that Coupang stock is an attractive buy at these prices. It looks like a good way to play the e-commerce industry in South Korea at reasonable valuations.