Rover Stock Forecast: Good Long-Term Investment After NEBC Merger

Investors want to know Rover's stock forecast after the NEBC merger approval. What can investors expect after the deal closes?

July 27 2021, Published 8:42 a.m. ET

Online pet care marketplace Rover (ROVR) is going public via a SPAC merger deal with Nebula Caravel Acquisition (NEBC). The transaction, which gives Rover an implied pro forma equity value of $1.6 billion, is about to close. What's Rover's stock forecast after the NEBC SPAC merger? Is the stock a good buy now?

After the transaction closes, NEBC public shareholders will own 17 percent of Rover, while PIPE (private investment in public equity) investors will own 3 percent. Rover’s co-founder and CEO Aaron Easterly will continue to lead the combined company.

NEBC and Rover merger date

Voting on the proposed transaction is scheduled to take place on July 28 at 1:00 p.m. ET. The deal is expected to close immediately after it gets approved by NEBC shareholders. Rover’s common stock will start trading on the Nasdaq under the ticker symbol “ROVR.”

Rover’s stock forecast after the merger

According to MarketBeat, analysts' average target price for NEBC stock is $17, which is 77 percent above its current price. Both Wall Street analysts tracking NEBC recommend a buy.

Is Rover stock undervalued?

Based on NEBC’s current price, Rover has an enterprise value of $1.3 billion. Based on this value and Rover’s projected total revenue, its valuation multiples for 2021 and 2022 are 13.4x and 6.5x, respectively. Considering that Fiverr International and Etsy are trading at NTM EV-to-sales multiples of 26.6x and 10.9x, respectively, Rover looks undervalued and worth considering.

Rover stock is a good long-term investment.

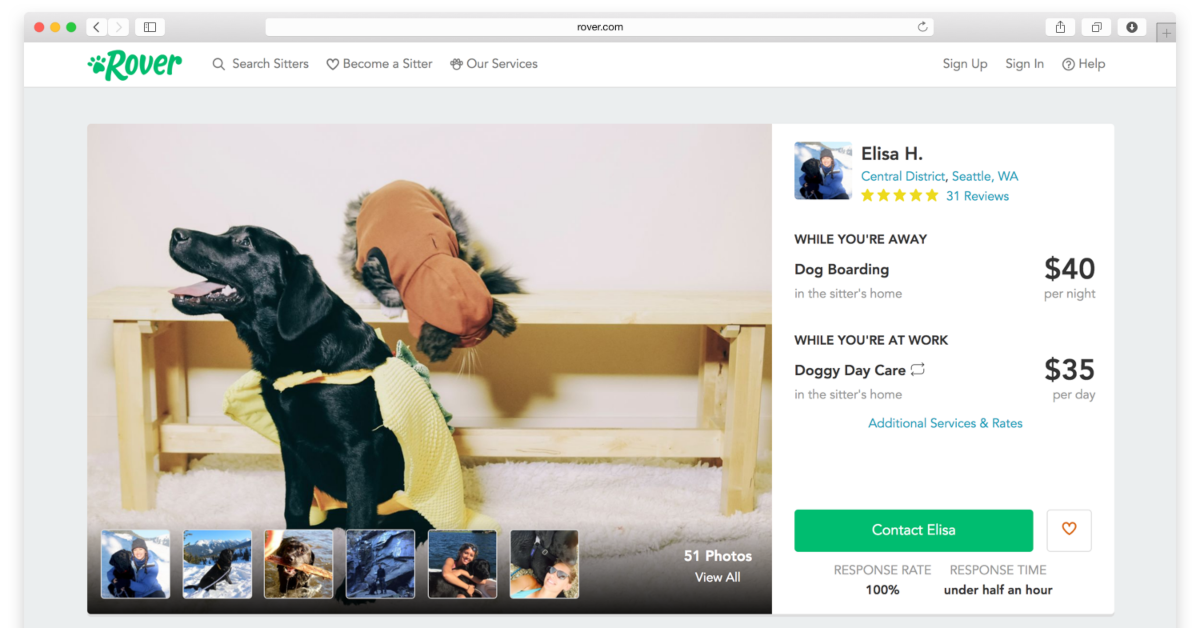

Rover connects pet owners with local, high-quality pet care providers who offer various services including in-home pet sitting, doggy daycare, drop-in visits, dog walking, and grooming. Since its inception in 2020, over 2 million pet owners have booked services on Rover with around 500,000 pet care providers across the U.S. and Europe. Rover thinks that the total addressable market size is expected to reach $113 billion in 2030 from $79 billion in 2020.

Rover expects to generate sales of $97 million in 2021 and forecasts its sales growing by 107 percent in 2022. It expects to turn adjusted EBITDA positive in 2022 and projects an adjusted EBITDA of $35 million in 2022. Rover also expects to report $855 million in total gross bookings in 2022.

As part of its merger with NEBC, Rover will receive around $325 million in gross cash proceeds to pursue its growth plans. The amount includes about $275 million in cash held by NEBC in trust and an additional $50 million in PIPE.

What happens to NEBC after the merger?

NEBC stock will immediately convert to Rover stock after the deal is completed and cease to exist in its SPAC avatar. As a result, NEBC investors will become shareholders in Rover.

What happens to NEBC warrants after the merger?

NEBC warrants will become exercisable on the later of 30 days after the completion of the transaction or 12 months from the closing of the IPO. The exercise price of the NEBC warrant, like for other SPAC warrants, is $11.50.