Sit, Stay, SPAC: What to Know About the Rover IPO

Seattle-based pet care platform Rover is merging with an acquisition company in a SPAC IPO. When will the SPAC IPO take place?

Feb. 12 2021, Published 12:17 p.m. ET

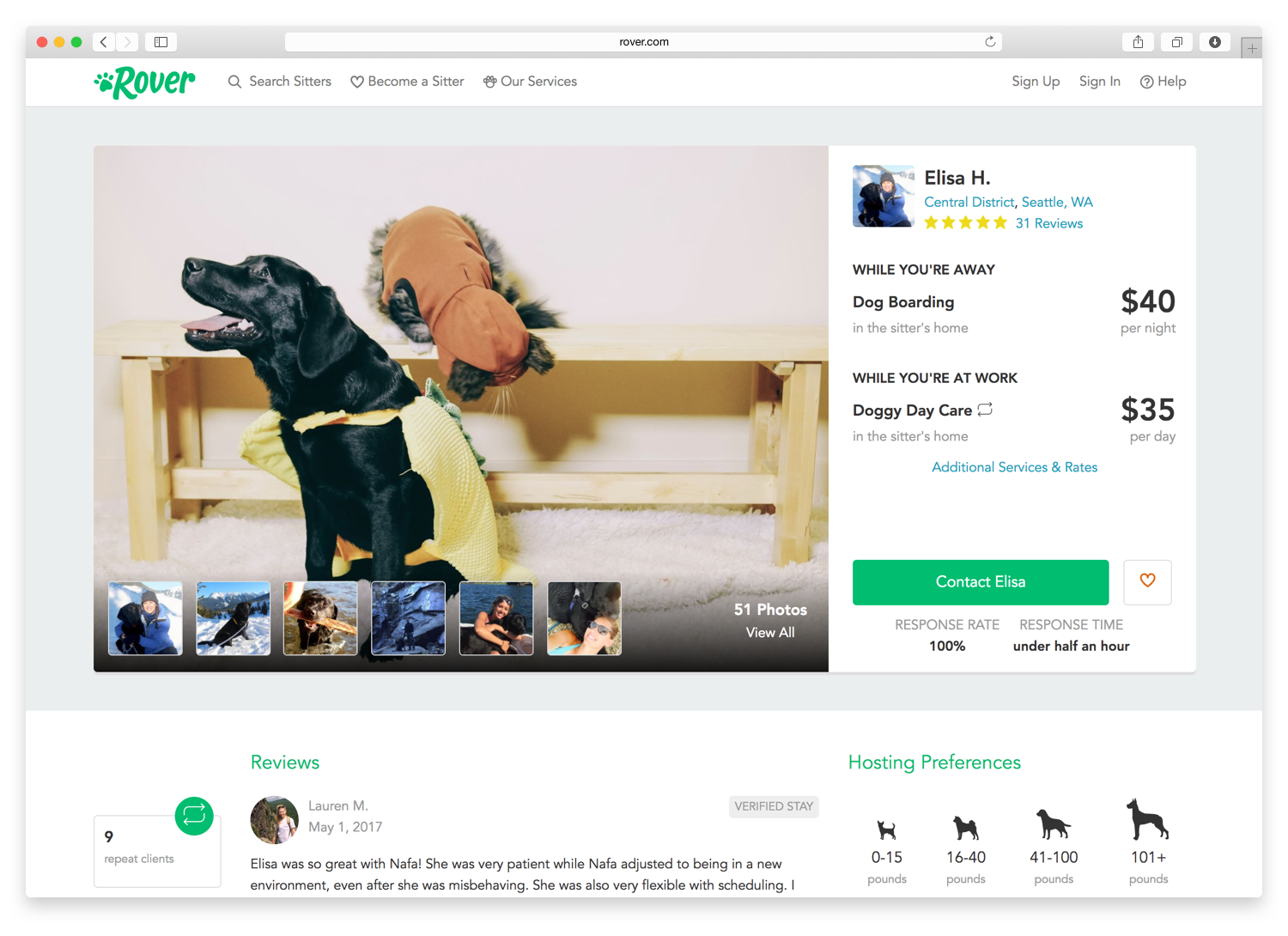

Petco might have gone public for the third time this year, but that doesn't mean that the pet sector is tired. Now, pet care marketplace Rover is taking its chance at the public domain with the help of a SPAC (special purpose acquisition company) called Nebula Caraval Acquisition Corp.

The deal is reportedly in the billions, which could mean many shares for early investors at the covetable SPAC rate.

Rover's valuation

According to the deal with Nebula (which is sponsored by True Wind Capital), Rover is worth a solid $1.35 billion. This includes $325 million in unrestricted cash. Institutional investors will inject an additional $50 million in stocks after the merger closes.

Rover was founded in 2011 by Aaron Easterly, Greg Gottesman, and Philip Kimmey at the Startup Weekend convention. Rover is still considered to be in the startup sector, which gives it the coveted unicorn label, despite hiccups along the way.

Rover's contract with Walmart in Q4 2020 is a good sign

Layoffs were everywhere in 2020 and Rover wasn't immune. This makes sense—with more people at home during the COVID-19 pandemic, fewer people were hiring pet walking and sitting services. The company furloughed 41 percent of its workforce in March, which equated to almost 200 employees.

By November, increased pet ownership and increased travel contributed to the company's resurgence. Rover bulked up and signed a deal with Walmart. According to GeekWire, "customers who book Rover services through Walmart Pet Care will get a $20 Walmart gift card on the first booking, and another $20 if they complete five Rover bookings in six months."

Another day, another SPAC taking a private company public

The market is in the midst of a SPAC windfall as we speak. Blank-check companies, startups, and retail investors alike are excited about the shift. SPACs haven't always been appealing, but in their renaissance, they tend to be less likely to be overvalued.

With 250 SPACs in 2020 equating to $75.1 billion in funding, the word is catching on. After the merger date hits, Rover will likely boost the statistics.

When will Rover stock be available?

The first step in a SPAC IPO is for the acquisition company to announce it's going public. Then, they have to choose a target. In this case, True Wind and Nebula announced Rover as their target. Now, retail investors must wait for the official merge date, which is when the new ticker will list on the exchange.

SPACs tend to progress quicker than traditional IPOs. Retail investors are still waiting for word on the merger date. When it comes, the Nasdaq-traded "NEBC" ticker will transition to "ROVR."

About the Rover IPO, Nebula CEO Adam Clammer said, "We believe that management has built an extraordinary business and we’re excited to support them along their public market journey." With more than 2 million transactions under its belt, Rover's journey is just getting started.