Will Rocket Lab Stock Rise or Fall After VACQ Merger Date?

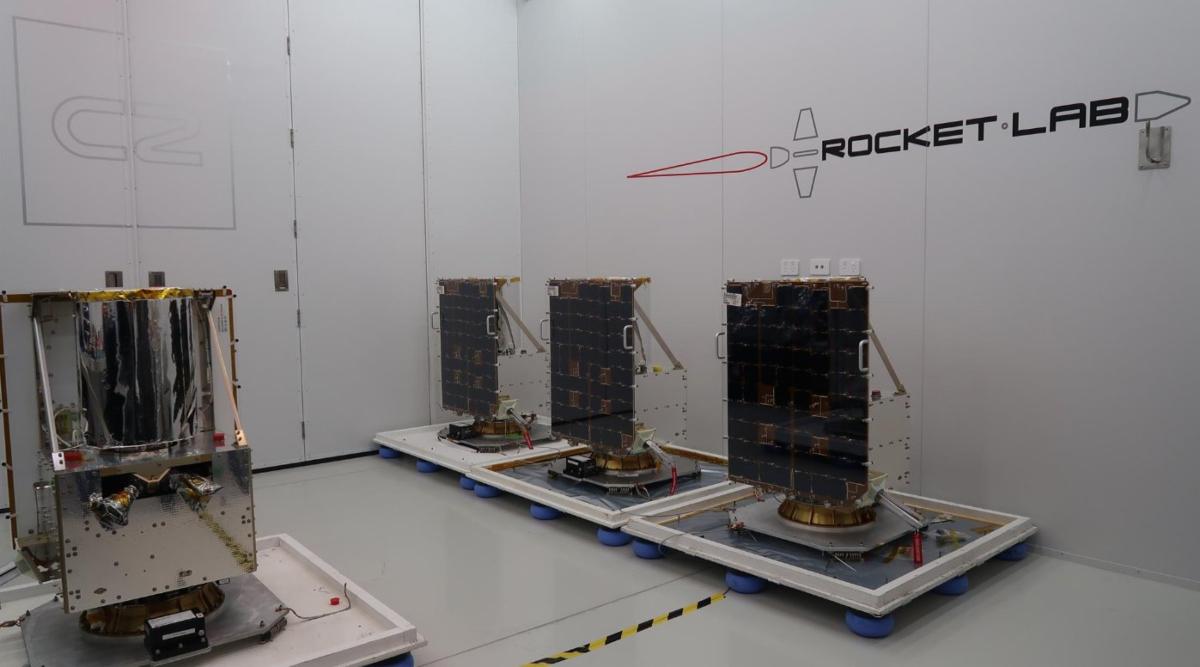

VACQ shareholders have approved the Rocket Lab merger. Will Rocket Lab stock rise or fall after the merger date and what's the forecast?

Aug. 23 2021, Published 8:07 a.m. ET

Vector Acquisition (VACQ) shareholders have approved the merger with Rocket Lab. The merger is expected to be completed on Aug. 25. The new entity would trade under the ticker symbol “RLKB” on the Nasdaq. What’s the forecast for Rocket Lab stock and will it rise or fall after the merger date?

There has been a flurry of SPAC mergers in 2021. However, one concerning aspect has been post-merger fatigue. In most cases, the stock went up on the merger date but eventually pared gains.

Why SPACs fall after the merger

Multiple stocks are trading below the SPAC IPO price of $10 like Beachbody (BODY) and 23andMe Holding (ME). Even SoFi, which merged with Chamath Palihapitiya’s SPAC, has tumbled after the initial post-merger surge.

There are several reasons why stocks have fallen below $10 after the merger. First, a lot of these deals were negotiated when the market was euphoric about growth stocks as well as SPACs. Growth stocks and SPACs have been out of favor with markets for the last few months.

Also, once the post-merger honeymoon fizzles away, markets start questioning the valuations and whether the company can deliver on the projections that they provided in the merger presentation.

Rocket Lab stock forecast

Since none of the analysts cover Rocket Lab stock, we have to rely on the forecasts provided by the company. Rocket Lab has projected revenues of $749 million in 2025, while it expects to post an adjusted EBITDA of $119 million that year. The EV (enterprise value) based on the current stock price is around $4.3 billion.

This would give us a 2025 EV-to-sales multiple of 5.74x and an EV-to-EBITDA multiple of just over 36x. In absolute terms, the company has an equity value of around $5.05 billion. Since Rocket Lab is a competitor to Elon Musk’s SpaceX, there are bound to be comparisons between the two.

SpaceX isn't yet publicly traded even though Musk might take the company public in due course. The company did a private capital raise earlier in 2021, which valued it at $74 billion. ARK Invest, which has a flair for identifying disruptive technologies, thinks that the company could be worth $1 trillion. However, ARK tends to have lofty target prices on companies that it likes.

Will Rocket Lab stock go up after the merger?

The space economy is growing fast. Rocket Lab predicts that the total addressable market for the satellite launch and space application and system market, which currently stands at $350 billion, will grow to $1.4 trillion by the end of this decade. The company has a first-mover advantage, which will be an added advantage.

From a valuation perspective, Rocket Lab stock looks reasonable based on the expected growth in the industry. I would expect the stock to go up after the merger. While it might also be subject to the same post-merger fatigue that most stocks have witnessed after the SPAC merger, I would use any dip as a buying opportunity.

Over the medium term, business updates and quarterly earnings from Rocket Lab would drive the stock after the post-merger excitement dies down.