Why Former RIDE CEO Steve Burns's Net Worth Will Likely Tank

Steve Burns, the former CEO of Lordstown Motors Corp. (RIDE), might have lost out on the opportunity for net worth growth.

June 15 2021, Published 11:20 a.m. ET

At three points over the last nine months, stock from Lordstown Motors Corp. (NASDAQ:RIDE) has reached a high peak at or near $30 per share. Now, with the company's CEO and CFO stepping down from their posts, it seems like the potential for a rebound from the current share price of $9.37 is low. How's the net worth of former RIDE CEO Steve Burns responding?

Let's take a look at Burns' assets and swift exit from RIDE.

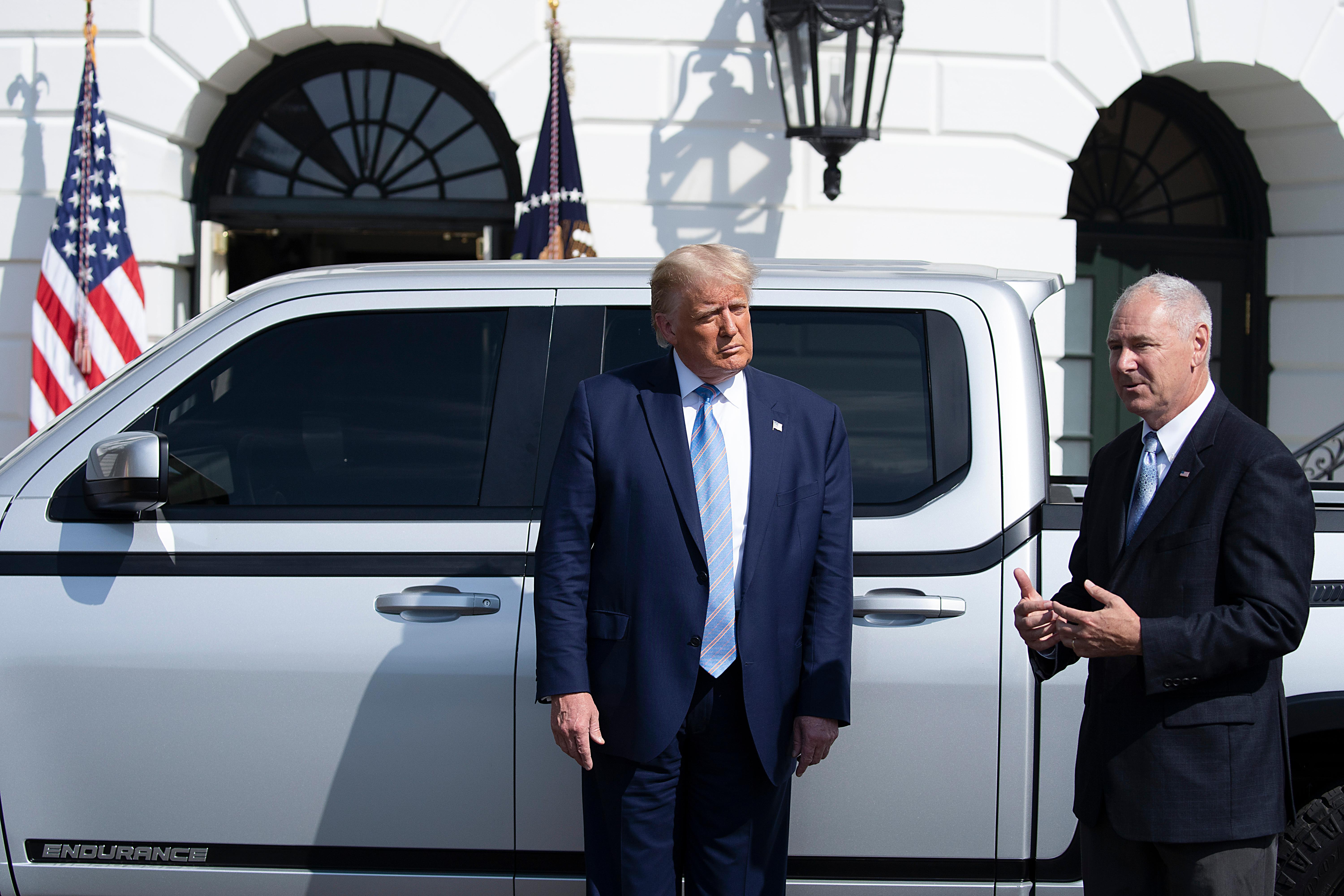

CEO Steve Burns and CFO Julio Rodriguez resigned from Lordstown (RIDE).

On June 14, Lordstown announced a sweeping set of changes to its executive team. According to the company's 8-K, Burns and CFO Julio Rodriguez resigned from their positions.

Where does RIDE stand without its two head honchos? In the interim, three women are in charge. According to the company, "The Board appointed Angela Strand, the Company’s current Lead Independent Director, as Executive Chair of the Company, Becky Roof as Interim Chief Financial Officer and Jane Ritson-Parsons, the current Interim Chief Brand Officer, as Chief Operating Officer."

Burns and Rodriguez stepped down following solidified reports of fluffed contractual claims. Lordstown was built quickly and went public quickly, so it seems it wasn't ready for the pressure of being a publicly-traded company.

Steve Burns's net worth swallows the pain of devalued equity

Burns (not to be confused with Steve Burns of Blue's Clues fame) held a 26.25-percent equity stake in Lordstown. His position opened when he co-founded the company in 2018. RIDE went public in 2020 and has since lost 3.13 percent of its lifetime value.

The company's 2020 SPAC value of $1.6 billion has likely shrunk based on the mild decrease in share price, but the outlook doesn't look appealing for RIDE stock. Burns's 26.25-percent stake in the company would give him approximately $424 million. However, since Burns and Rodriguez are breaking their contracts and resigning from all of their positions within the company, Burns likely doesn't get to walk away with his full amount. It's already less than what he invested in the company in the first place.

Lordstown isn't Steve Burns's only source of net worth.

Burns has been involved in other business ventures. He was CEO of Workhorse (NASDAQ:WKHS) until late 2019 when he resigned to commit fully to Lordstown.

It isn't clear whether Burns held his position in WKHS after his departure, but the company's shares have increased 114 percent over the last five years. Depending on the equity, he might have still been able to profit from his electric vehicle endeavors.

What will Steve Burns do with RIDE behind him?

Lordstown is at serious risk of shuttering within the next year, which could have a negative impact on any investors who are still left in the ring at that time. From a broad perspective, analysts don't recommend sticking around long enough to find out what happens after Burns.

One thing is for sure. Burns gets $750,000 in departure compensation, while Rodriguez gets $200,000 of his own.