Plug Power and Walmart Green Hydrogen Deal Is a Gamechanger

Plug Power has announced a green hydrogen deal with retail giant Walmart. What are the key details of the deal and is it a gamechanger?

April 19 2022, Published 11:32 a.m. ET

Plug Power stock is trading higher in the early price action on April 19 after the company announced a green hydrogen deal with retail giant Walmart. What are the key details of the deal and will it be a gamechanger for the hydrogen industry?

Despite the rise on April 19, Plug Power trades at less than half of its 2021 highs. Most of the green energy stocks made their all-time highs in the first quarter of 2021 as markets were excited about the sector’s outlook under President Joe Biden. However, the markets got a little too carried away and most of the green energy stocks with the notable exception of Tesla, trade well below their Q1 2021 highs. Tesla CEO Elon Musk is among the biggest critics of hydrogen fuel cells.

What’s the Plug Power and Walmart deal all about?

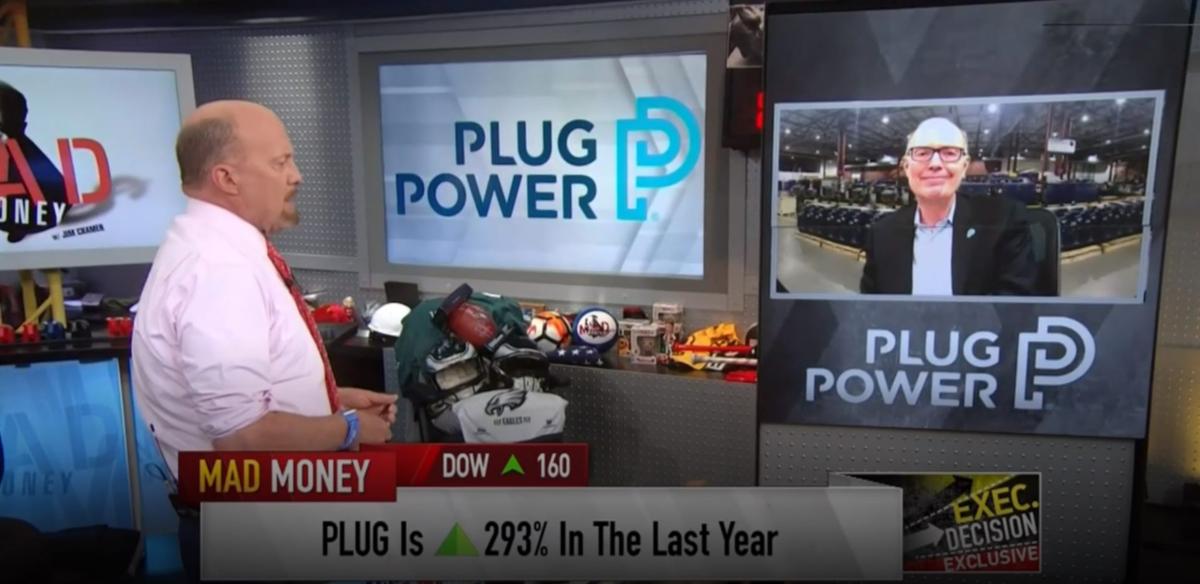

Plug Power has signed a deal with Walmart to supply 20 tons of green hydrogen for up to 9,500 lift trucks spread across Walmart distribution and fulfillment centers. “Walmart has been an early adopter of innovative hydrogen and fuel cell technology for over a decade, and our hydrogen-powered solutions offer a tool to enhance productivity improvements for Walmart’s operations,” said Plug Power CEO Andy Marsh.

Marsh added, “Now our green hydrogen solutions will provide Walmart with the ability to achieve significant carbon reduction. We are honored to expand our relationship with Walmart and realize our shared vision for a green hydrogen future.”

Walmart has been among Plug Power’s customers.

Walmart has been among Plug Power’s major customers. Amazon and Home Depot are the other major customers. Walmart has set a target to become carbon neutral by 2040 and is among the first buyers of green hydrogen from Plug Power.

Walmart has been taking several steps to lower its carbon footprint and even installed Tesla solar roofs at some of the stores. The solar roofs were also installed by Amazon at some of the facilities. However, the roofs made news headlines for issues with catching on fire.

What's the difference between green and blue hydrogen?

Critics of hydrogen point out that it isn't as environmentally friendly as it's touted. Hydrogen made from fossil fuels can be quite damaging to the environment at times. Most of the hydrogen made today is termed “grey hydrogen,” which is made from fossil fuels.

The next category of hydrogen is “blue hydrogen” where hydrogen is made from natural gas. The process is known as steam methane reforming where the carbon dioxide emissions can be captured. Critics point out that the hydrogen generated has a higher carbon footprint and it's better if the natural gas was used by itself to generate energy. Also, the process leads to methane leakage.

Green hydrogen is more expensive to produce.

Green hydrogen can help address the issues. However, it hasn’t been that popular as it's much more expensive to produce even though the prices have fallen gradually. According to Plug Power, “Green hydrogen is produced through the electrolysis of water with electricity generated from zero-carbon sources and only harmless oxygen is emitted during the process, making it a clean, secure and affordable energy solution.”

Walmart’s deal with Plug Power is a gamechanger.

Walmart’s deal to buy green hydrogen from Plug Power is a gamechanger. It's a cleaner source of energy and not the “greenwashing” that a lot of companies have been indulging in. As for Plug Power stock, while the deal with Walmart is a long-term positive, the stock might remain under pressure in the short term considering the pessimism toward loss-making growth companies.