The Mobileye IPO: Its Valuation and Strategy, Explained

Intel, which acquired Mobileye in 2017, has said that it's taking the company public. What’s Mobileye's IPO date and valuation?

Dec. 7 2021, Published 8:36 a.m. ET

Intel, which acquired Mobileye in 2017, has said that it's taking the self-driving company public, and investors approve: Intel stock rose in premarket trading on Dec. 7. In 2021, Intel stock has been subdued and has risen just 2 percent. What’s Mobileye's IPO date and valuation?

Intel isn't the only company separating its business units. Johnson & Johnson, General Electric, and GlaxoSmithKline are also breaking up their businesses.

Demergers can unlock value

Demerger transactions aim to unlock value. When companies grow into conglomerates by diversifying into related and unrelated businesses, some of their businesses' valuations may suffer. To combat this, Johnson & Johnson and GlaxoSmithKline are separating their consumer businesses from their pharma businesses, and General Electric is undoing its conglomerate business model.

Why is Intel taking Mobileye public?

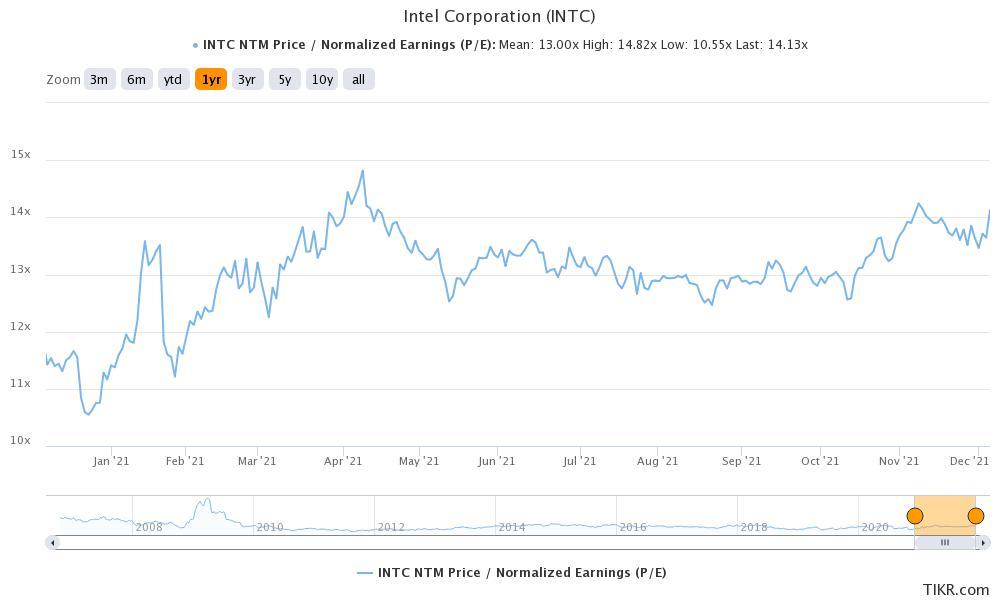

Intel is experiencing a depressed valuation, with a next-12-month PE multiple of just over 14x. Whereas this multiple might appear reasonable for a chipmaker, it's low for a self-driving business like Mobileye.

To understand this further, we can look at Tesla, which has a market cap of $1 trillion. CEO Elon Musk cites the software side of the business, which includes the autopilot and robotaxi verticals, to justify this valuation.

Mobileye will IPO in 2022

Simply put, by listing Mobileye as a separate entity, Intel would be able to unlock value and make Mobileye's price discovery more efficient. Mobileye is set to go public in mid-2022 through an IPO. We don’t know about the IPO price yet, but we’ll get more details as the IPO date approaches.

Mobileye is seeking a $50 billion valuation

Intel is seeking a valuation in excess of $50 billion for Mobileye. That’s more than three times the $15.3 billion it paid for the company in 2017. In Q3 2021, Mobileye's revenue rose 39 percent year-over-year to $326 million, and in the first nine months of 2021, Mobileye generated revenue of $1.03 billion and an operating profit of $361 million.

The $50 billion valuation that Intel is reportedly seeking for Mobileye doesn't look unjustified considering the financials and high valuations that self-driving companies attract.

Intel will continue to be Mobileye's majority owner

After the IPO, Intel expects to retain majority ownership of Mobileye and aims to remain its strategic partner. Mobileye, testing markets’ appetite for pure-play self-driving units, will be a major IPO to watch in 2022.