Mark Cuban's Advice for Retail Investors as GameStop Stock Plunges

Billionaire investor Mark Cuban sees a new breed for retail traders emerging. Cuban shared his advice for them after the sharp fall in GME stock.

Feb. 3 2021, Published 8:15 a.m. ET

GameStop (GME) stock fell by 60 percent on Feb. 2 and fell below $100. In January, short-sellers bore the brunt as GME stock spiked. Now, investors who were long on the stock are taking the hit. GME stock is down over 81 percent from its January highs. Billionaire investor Mark Cuban shared his advice for retail traders after the sharp fall in GME stock.

The fall isn't limited to GameStop. AMC Theatres, another stock that was being pumped by WallStreetBets, also fell by 41 percent on Feb. 2 and is now down 62 percent from its 52-week highs.

Mark Cuban's advice about GameStop

“Sometimes its [sic] expensive to learn,” Cuban said on the Redditt message board. He added. “Anyone who has traded for a while has learned an expensive lesson they couldn’t [sic] afford. I know i [sic] have.” He also thinks that traders on WallStreetBets have successfully taken on the big funds on Wall Street and changed the game.

Referring to WallStreetBets traders, Cuban told CNBC, “I think now that they’ve recognized their power and now that they’ve learned some lessons, we’re going to get more of it, not less of it.” He thinks that traditional valuation metrics like the PE ratio are getting emphasized less now.

It's difficult to justify the valuations of many companies including Tesla and NIO based on the PE multiples. Snowflake is also trading at exorbitant valuations if we take the traditional valuation approach. That said, even Warren Buffett’s Berkshire Hathaway invested in Snowflake.

Is GameStop overvalued?

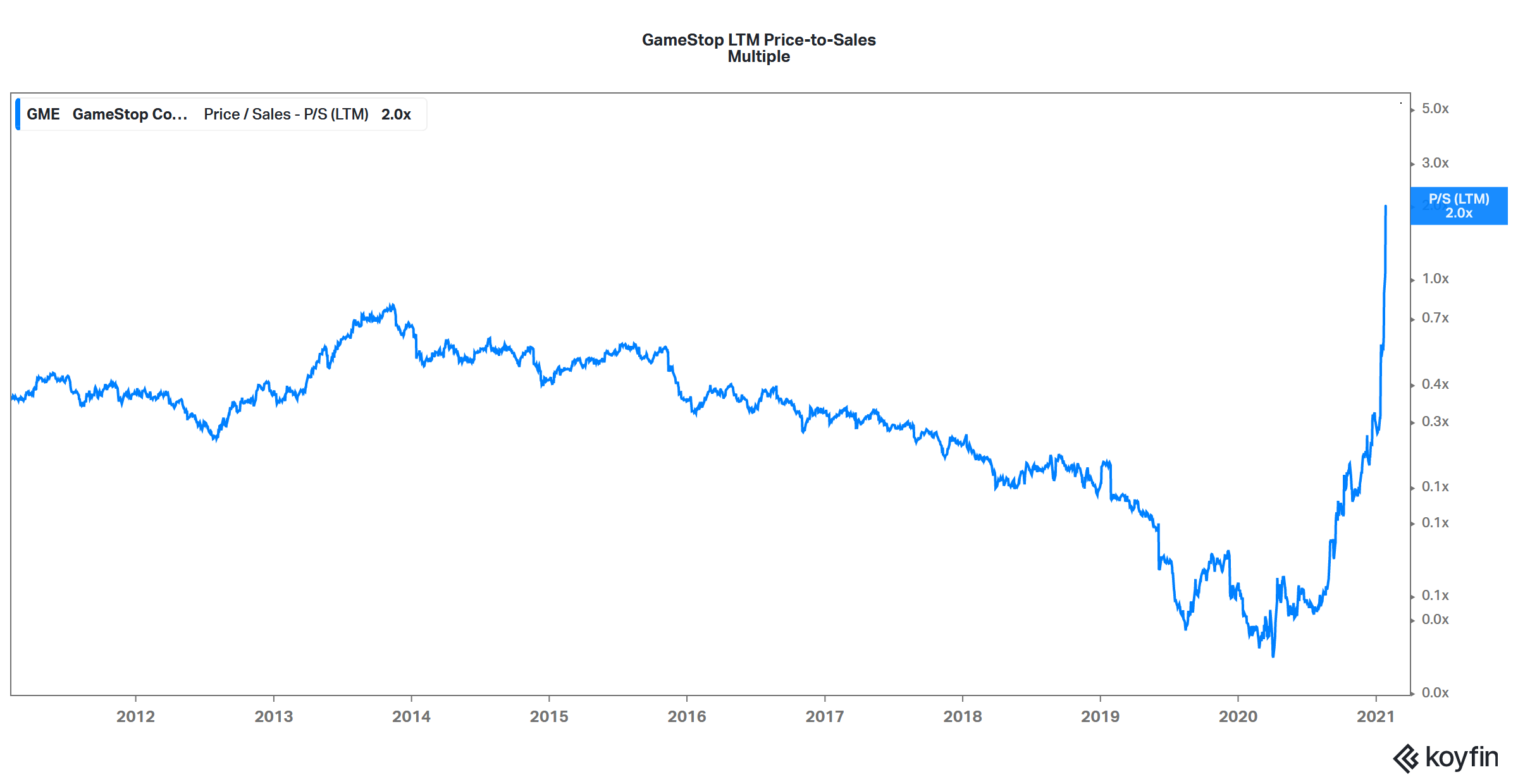

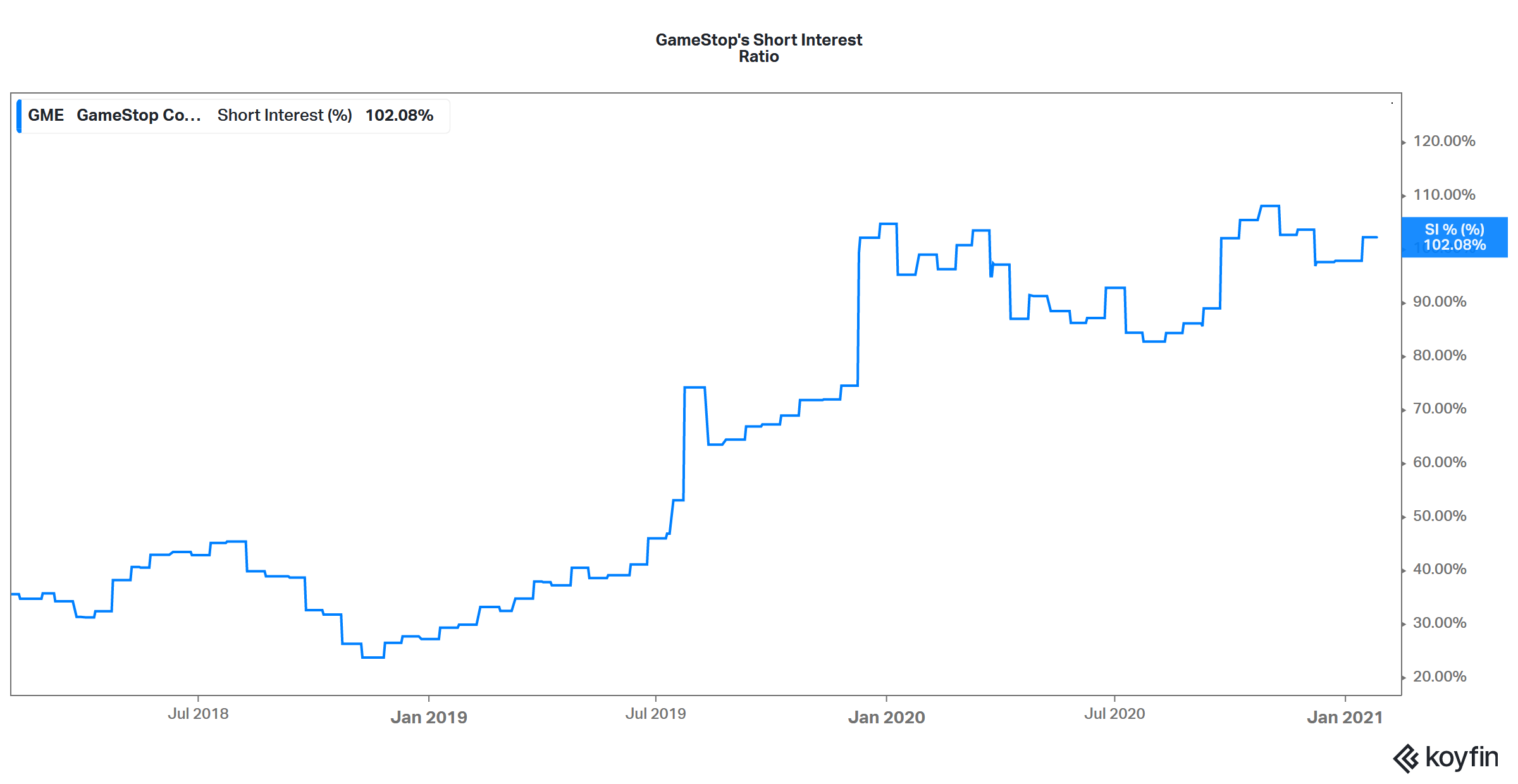

Short-seller Citron Research listed five points to substantiate its bearish thesis on GameStop stock. Among these was the stock’s high valuation metrics based on the NTM (next-12-month) numbers. GME's valuation looks high by historical standards as can be seen in the graph above. However, valuing GME stock only on the NTM numbers would be myopic since the company is a turnaround candidate.

That said, at its peak, GameStop stock had surged to levels that were hard to justify no matter what valuation framework one might consider. But, the short squeeze and the buying frenzy from retail traders drove the stock higher.

Mark Cuban’s views on stock markets

Cuban was among those who thought that U.S. stock markets overvalued as they rallied sharply in 2020. Stanley Druckenmiller, Jim Rogers, and Paul Tudor Jones were among others who predicted a stock market crash in 2020. However, retail traders nicknamed “Robinhood traders” proved Wall Street wrong and kept piling up tech stocks to take the market to record highs.

Cuban isn't very bullish on cryptocurrencies and sees them as a bubble similar to the dot-com boom days. However, retail investors have a different view and have kept buying bitcoins taking them to record highs.

Outlook for GME stock

A lot of short squeeze has already happened in GME stock. Now, the attention will shift to the company’s fundamentals. GameStop could be a fundamentally different company in the future from the brick-and-mortar gaming retailer that it is currently. Its online sales account for almost one-third of its total sales. GameStop's online sales have helped it offset the negative impact from fewer stores.

It's a turnaround story build on the premise that GameStop could become the “Amazon of gaming” with activist investor Ryan Cohen taking a more active approach. Cohen built his reputation by taking on Amazon with Chewy.

The WallStreetBets frenzy might not end anytime soon as a new breed of retail traders takes on the mighty Wall Street funds. Melvin Capital has already seen the power of retail traders and reportedly lost half of its value in January. It looks like a battle royale between tech-savvy Millennial traders and established Wall Street firms.