GME Stock Is Still Shorted, Investors Have Renewed Enthusiasm

GameStop stock might just be the defining moment of 2021 markets. As of March, GME stock is still being shorted. What can investors expect in 2021?

March 9 2021, Published 10:58 a.m. ET

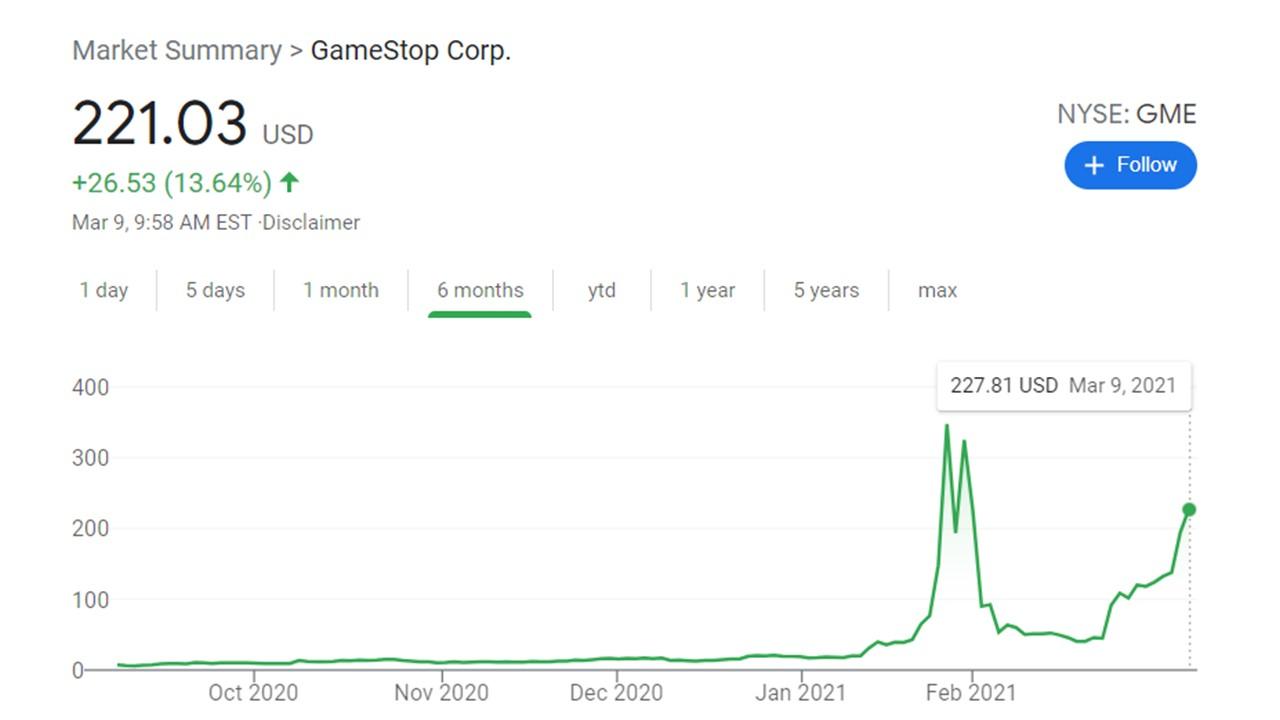

The boom in GameStop Corp. stock in late January seemed like it dwindled fast, but the enthusiasm has returned—even if it isn't at all-time heights. GME stock remains shorted by institutions beyond the retail investing level.

Of course, GME's short interest percentage has drastically reduced during the quarter, but not without casualties.

What percentage of GME shares are shorted?

With share value on the rise once again—although this time more steadily—GME watchers might wonder what the deal is with shorted shares. At its peak, more than 100 percent of GME shares were shorted and hedge funds lost big time. One of the most notorious of these was Melvin Capital, who lost a full 53 percent of its assets under management in January alone. Citron Research, a short seller, was impacted so badly by the squeeze that it vowed to discontinue shorting altogether.

As of March 9, the float shorted percentage for GME stock is 30.22 percent. This is a drastic decrease from previous heights, but it just goes to show that some short sellers are staying put like their life depends on it. For those that remain, it's a war between retail investors and short-sellers.

Many have transitioned over to Discovery, Rocket Companies, and Tanger Factory Outlet Centers, among the most shorted U.S. stocks.

Who's shorting GME?

We don't know exactly who's buying shorted shares for GME, but we do know that people (or companies) are still buying the shares. On Feb. 12, someone sold 16.47 million shares short for $1.68 billion. It probably isn't the original hedge funds that held mega shorted stakes, considering that they lost a ton of their money.

GME's stock forecast

Frankly, I didn't expect GME stock to recover from its January peak as much as it has. After dropping 83.54 percent during the first business week of February, I presumed the deal was done. However, in the two weeks since Feb. 23, the shares have risen 406.58 percent—and they're still on the rise.

With a prominent short interest still in play, retail investors remain dedicated to the cause. For some, that cause might be their own monetization. For others, it's the sheer satisfaction of seeing short sellers get caught in the line of fire.

With GME on the rise, many people say that the fun is just getting started. Some people suggest that other stocks are taking precedence for investors seeking to combat short sellers. Meanwhile, some people think that investors' enthusiasm will only last so long.

WallStreetBets is still loyal

Many WallStreetBets users haven't veered from their initial course of taking GME stock to the moon. The rocket emoji is just as prominent now as it was earlier in the quarter. The ongoing short interest level is definitely part of the cause, but I think it goes beyond that. They are part of something bigger than themselves, something they wouldn't be capable of doing independently. Perhaps, for these retail investors, there's meaning in collective action.