Enphase Energy Might Repeat Tesla's Magic, Joins the S&P 500

Enphase Energy is set to join the S&P 500 in January. Should investors buy the stock before the inclusion? What can investors expect from Enphase Energy?

Dec. 31 2020, Published 9:26 a.m. ET

Enphase Facebook

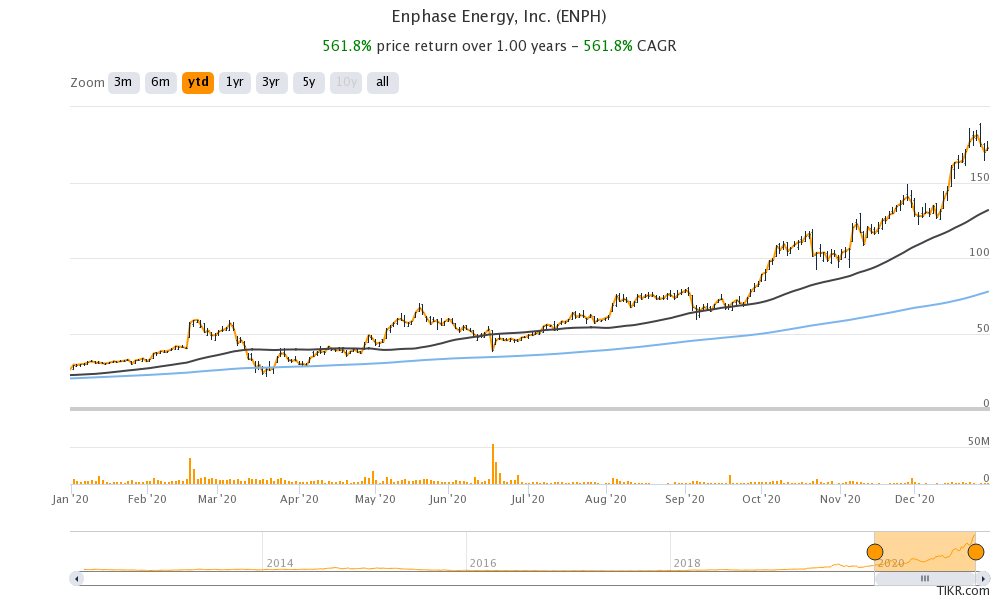

Overall, 2020 was a remarkable year for companies in the green energy ecosystem. Enphase Energy stock has gained over 550 percent in 2020, while Tesla has gained almost 700 percent. In December, Tesla joined the S&P 500. Enphase Energy is set to join the index in January. Should you buy Enphase Energy stock ahead of its inclusion into the S&P 500?

Enphase Energy stock traded on a positive note for most of 2020 barring the sell-off in February and March. The stock rallied more in November along with other green energy stocks after Joe Biden was elected as the next U.S. president. The Biden administration is expected to come up with favorable policies for the renewable energy sector, which triggered a buying spree in these stocks after the election.

Enphase Energy on Stocktwits

Many users on Stocktwits are discussing how inclusion into the S&P 500 could impact Enphase stock. A stock being added to the S&P 500, the world’s most popular index, is a positive and prestigious development. Also, the roughly $5 trillion worth of funds that are indexed to the S&P 500 would have to buy Enphase stock, according to its weightage in the index.

Buying from index funds would lead to more liquidity, which is positive for Enphase stock in the near term. Username valuationgman expects solar and renewable energy stocks to perform well in 2021. The sector did well in 2020 and the momentum looks strong for 2021.

Enphase Energy doesn't pay a dividend

Currently, Enphase Energy doesn't pay a dividend. If you are a dividend investor, then the stock probably isn't for you. However, if you are a growth investor looking at an allocation to the renewable energy sector, then Enphase Energy can add value to your portfolio.

Enphase Energy's stock forecast

According to the estimates compiled by CNN, Enphase Energy has a median target price of $128.50, which represents a potential downside of 25.7 percent over its closing prices on Dec. 30. Most stocks in the green energy space have traded above their target prices for the last few months.

Should I buy Enphase Energy stock?

Enphase Energy stock looks like a good buy based on the positive outlook for the renewable energy sector. President-elect Joe Biden has said that he will rejoin the Paris Climate Deal. The U.S. joining the Paris Climate Deal would help build traction for renewable energy demand.

After the massive surge in Enphase Energy's stock price, the stock’s valuations multiples have also increased. It trades at an NTM EV-to-revenue multiple of 19.2x and an NTM PE multiple of 102x. However, the high valuations multiples are backed by solid growth. Analysts expect Enphase Energy’s revenues to rise 61 percent in 2021, while its earnings are expected to rise 48 percent.