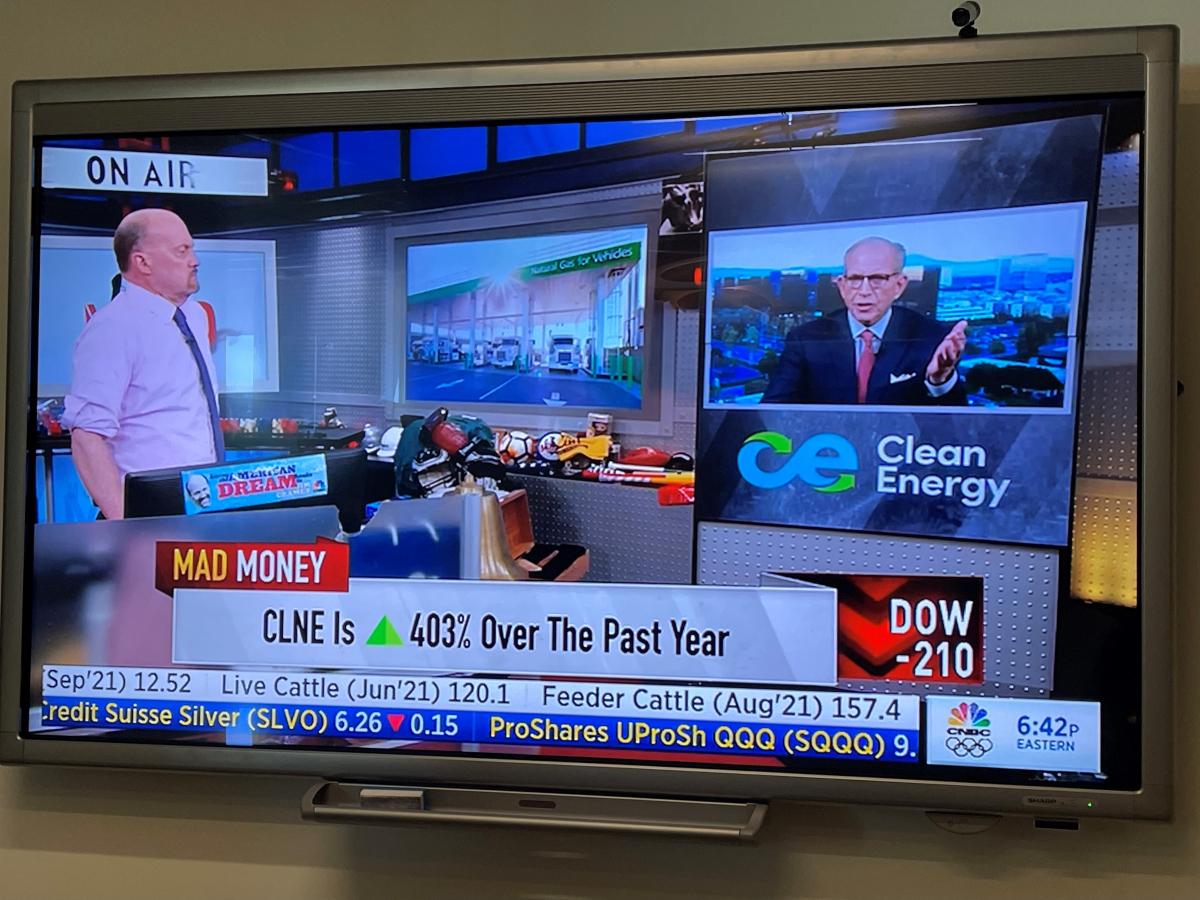

Why You Should Be Interested in Clean Energy (CLNE) Stock

Clean Energy stock is falling amid the broader market sell-off. However, CLNE stock looks like a good buy now after the crash.

Sept. 8 2021, Published 11:58 a.m. ET

Clean Energy (CLNE) was among the most popular names on Reddit group WallStreetBets at one point. However, it isn't featured on the top discussion topics in the group. While Reddit traders don’t seem interested in CLNE stock, you should be. Here’s why CLNE stock looks like a buy after falling from its 52-week highs.

Clean Energy stock is still up massively from its 52-week low of $2.36. Like fellow Reddit names, it also went on a share selling spree and had $254 million as cash and cash equivalents at the end of the second quarter of 2021 thanks to a $200 million stock sale in the quarter.

Why CLNE stock is going down

Like all other Reddit stocks, CLNE stock has also whipsawed. It made a 52-week high of $19.79 but currently trades below the $8 price level. The stock is trading flat for the year and has pared all of its 2021 gains.

CLNE stock is falling on Sept. 8 amid the broader market meltdown. The Russell 2000 was down over 1 percent at 11:00 a.m. ET, while CLNE stock was trading almost 4 percent lower at that time. There hasn’t been any company-specific news. The fall in CLNE reflects the general market sell-off. Green energy stocks are among the worst affected. FuelCell Energy and Plug Power were also trading sharply lower.

CLNE stock forecast

CLNE is among the Reddit stocks where Wall Street analysts have a bullish forecast. Its median target price of $13.50 is a premium of over 70 percent. The highest target price of $27 is a 240 percent premium over the current prices. The stock even trades 26.3 percent below its street low target price of $10.

Among the seven analysts covering the stock, four have a buy rating, while two have a hold rating or some equivalent. One analyst has a sell rating on CLNE stock.

CLNE stock valuation

CLNE stock trades at an NTM EV-to-sales multiple of 4.5x, which is twice what the multiples have averaged over the last five years. Now, there are two ways to look at the valuation. While it might look overvalued compared to historical averages, the entire green energy space has seen some serious valuation multiple rerating over the last year.

On that note, many people doubt Clean Energy's green credentials. The company is the largest RNG (renewable natural gas) supplier to the North American transportation industry. Now, RNG isn't really green energy because it's produced from organic waste.

However, and as Clean Energy points out, “Fleets that are looking to lower their emissions are switching to RNG because it can provide immediate and significant carbon reductions.” RNG would be particularly useful in running heavy-duty trucks.

Is RNG really green energy?

The company also said, “They’re finding that RNG is the easiest and most cost-effective way to meet sustainability goals.” The EPA lists “greenhouse gas emission reductions” as one of the benefits of RNG. Clean Energy has announced several partnerships that would help it scale up the business. The company also has a partnership with Amazon.

Clean Energy has joint ventures with Total and BP. Overall, CLNE stock looks like a niche way to play the transition towards a low carbon economy. The steep fall in the stock looks like an opportunity to buy it at an attractive valuation. While Clean Energy isn't among the most popular names on Reddit right now, it looks like an attractive bet.