How Cryptocurrency Staking Can Increase Your 'Savings'

One of the more popular DeFi features utilized by crypto pundits is staking cryptocurrency. The feature lets investors grow their wealth through passive earnings.

Jan. 10 2022, Published 8:39 a.m. ET

With the increasing interest in cryptocurrency and the influx of new investors, more products and platforms are emerging. One of the more popular DeFi (decentralized finance) features utilized by crypto pundits is cryptocurrency staking.

A concept similar to keeping a savings account, staking mechanisms help investors grow their wealth through passive earnings.

What is cryptocurrency staking?

Cryptocurrency staking involves users depositing funds as holdings to support a blockchain network and verify its transactions. Essentially, you deposit funds, similarly to how you would put money into your saving account at your bank. The funds accrue rewards based on an APY (annual percentage yield).

Your rewards are calculated based on the amount of capital deposited relative to the total pool of funds for that particular crypto and the APY.

Usually, this form of passively generating funds can help users more than double their initial capital deposit, assuming that the token doesn't decline in value.

The price decline is often the biggest risk of staking given the volatility of crypto.

How does cryptocurrency staking work?

When users deposit cryptocurrency to be staked, they're contributing to the PoS (proof-of-stake) network of the particular asset. In contributing crypto, users are contributing to making the blockchain more efficient and secure. In exchange, the network rewards users for putting their capital to work.

Generating staking rewards is a calculated and technical process. Similar to how miners are rewarded in PoW (proof-of-work) blockchains when they successfully validate transactions, a node that successfully validates a block is awarded staking rewards.

What platforms offer staking?

With the increase in the popularity of investors seeking this particular financial service, more platforms and exchanges are starting to offer cryptocurrency staking as a standout feature.

Coinbase, a centralized cryptocurrency platform, supports staking for certain cryptocurrencies like Cosmos (ATOM), Ethereum (ETH), and stablecoin DAI (DAI). Users can earn up to 5 percent depending on the currency with the more assets held, the more rewards earned.

FTX, a competitor to Coinbase, also supports staking for some of its cryptocurrencies, including the popular Solana (SOL). According to the platform, users can stake SOL for an 8 percent APY for deposits up to $10,000. Deposits that exceed $10,000 will have a lower APY of 5 percent.

Other notable platforms that offer staking protocols are blockchain, play and earn game Axie Infinity. Staking its governance token, Axie Infinity Shards (AXS,) users can earn staking rewards with an 88 percent APY.

What are some popular tokens to stake?

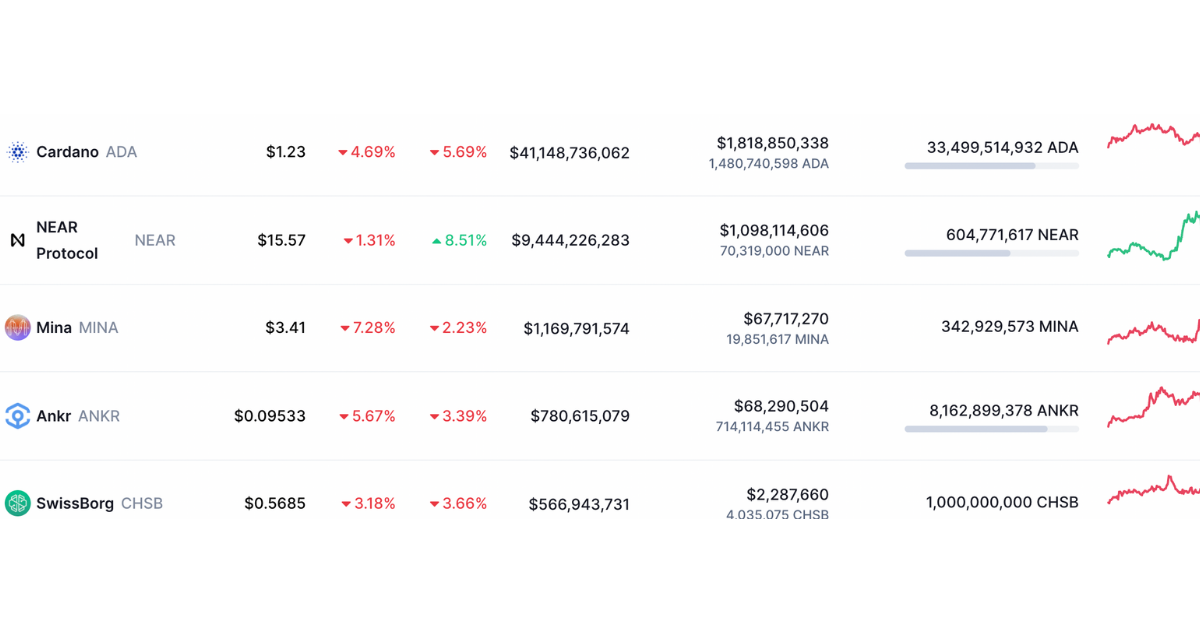

According to CoinMarketCap, these are the top five staking tokens:

- Cardano (ADA)

- Near Protocol (NEAR)

- Mina (MINA)

- Ankr (ANKR)

- Swissborg (CHSB)

Other popular tokens that DeFi natives are staking are Polygon network's MATIC, Polkadot's DOT token, and Solana's SOL.

As the interest in cryptocurrency continues to increase and industries slowly start to integrate its products, it will be interesting to see how the SEC responds.

While it's certain SEC Chairman Gary Gensler has already had his eye on such products, a lot of progress has happened since the early contentious days in 2021.