How to Buy Manscaped SPAC Stock, Backed by Channing Tatum

Channing Tatum's Manscaped is going public via SPAC. How can investors buy Manscaped stock? See if it's the right move for you.

Nov. 24 2021, Published 10:53 a.m. ET

When it comes to SPACs, size matters. Manscaped, a men's below-the-waist grooming company that actor Channing Tatum backs, is going public in a back-door deal worth $1 billion.

If you want to invest in Manscaped, there are some things that you need to know. Here's how to buy Manscaped stock and whether it's the right move for you.

Bright Lights Acquisition will take Manscaped public via an SPAC IPO.

A SPAC named Bright Lights Acquisition (NASDAQ:BLTS) has announced that it will take Manscaped, a men's grooming company, public via a reverse merger.

The SPAC deal values Manscaped at $1 billion, which puts it in unicorn territory. The grooming company is expected to receive $305 million in gross transaction proceeds, part of which stems from a $75 million PIPE (private investment in public equity).

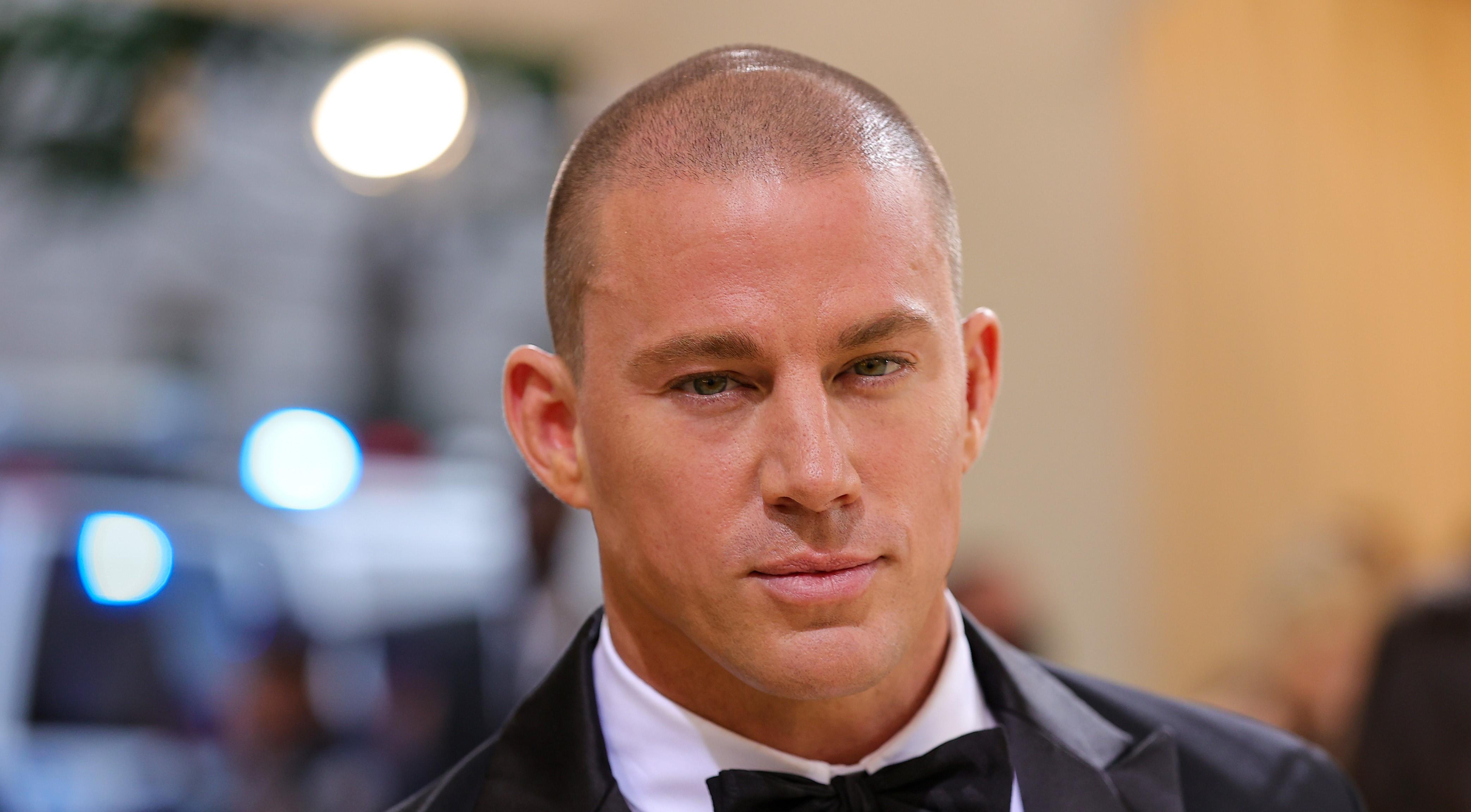

Channing Tatum backs startup Manscaped.

Manscaped is a San Diego-based startup that launched in 2016. A year after its founding, an angel round raked in $500,000 for the company. Tatum is one of the key backers. His own net worth is estimated to be around $80 million, but that metric might not include the recent influx of capital following the Manscaped SPAC deal.

Other existing institutional investors alongside Tatum include Endeavor Group Holdings, Signia Venture Partners, Saban Capital Group, and Guggenheim Investments.

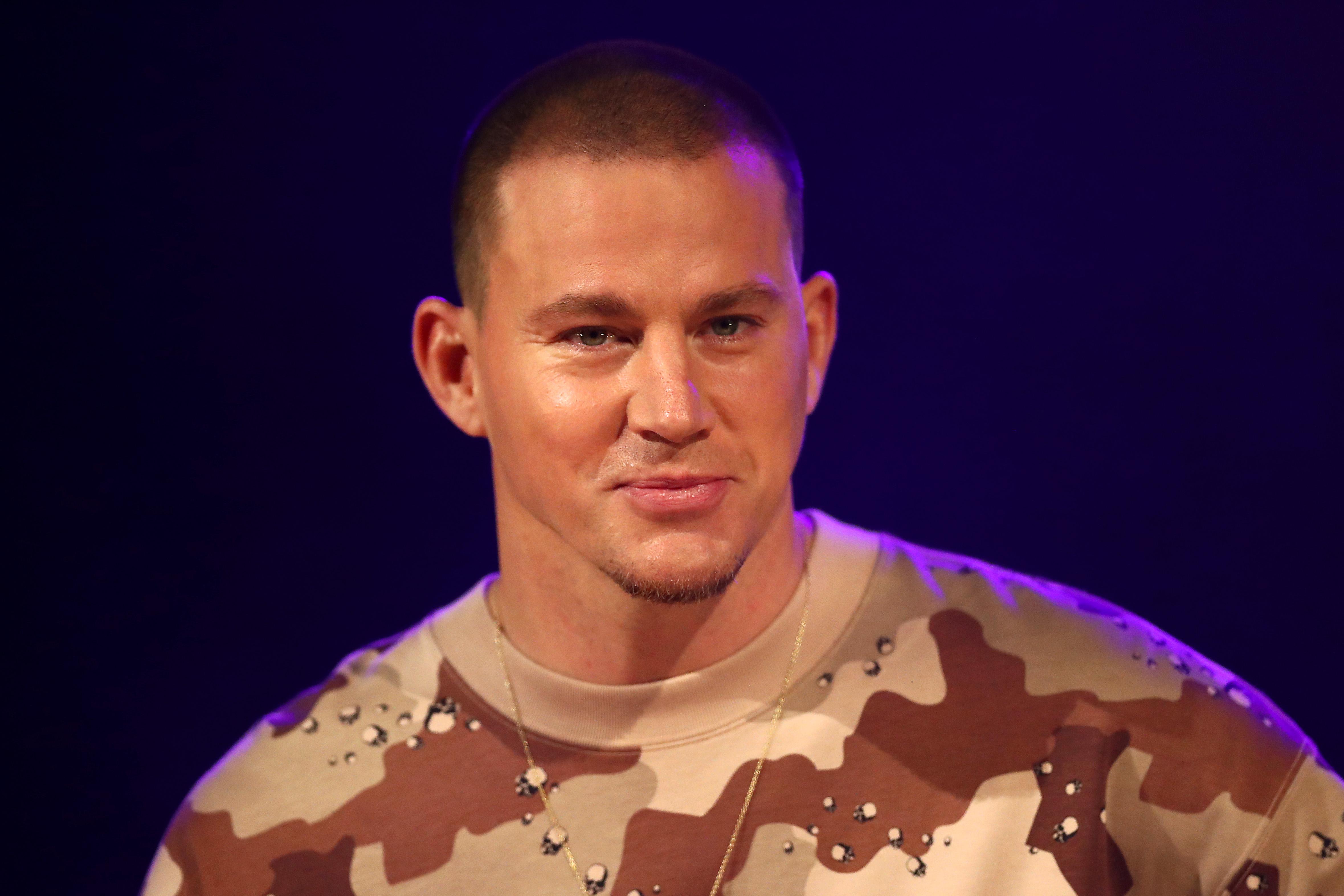

Manscaped stock is poised for 2022 debut—how to buy the stock.

Once Manscaped officially merges with Bright Lights, the new company will be called Manscaped Holdings and will trade under the ticker symbol "MANS" on the Nasdaq Exchange. The stock is expected to hit the market sometime in the first quarter of 2022. Investors can purchase BLTS stock now or wait until the ticker transitions to buy MANS.

Founder and CEO Paul Tran will continue to run the company, which he has been doing for the past half a decade.

Should investors buy Manscaped stock?

As of Nov. 24, BLTS stock is trading at $9.93 per share—up marginally from the holding company's debut price in April. Investors could purchase BLTS stock prior to the ticker transition to MANS since the pair have officially entered a definitive business combination agreement.

One positive sign about the Manscaped SPAC IPO is that the company is entering the merger completely free of debt and standing $235 million in the green.

According to Tran, "The capital raised in this transaction will drive our ability to serve more men in more markets around the world, while also allowing us to grow the Manscaped routine into additional personal care and lifestyle product spaces."

SPACs can often be speculative in nature because they're more likely to cater to startups without proven long-term growth. Also, they're often overvalued upon debut, which makes it difficult to exceed that IPO price. However, 48 percent of IPOs in 2021 were SPACs, and Manscaped's own success ($285 million in revenue in the last 12 months) shows potential for MANS stock.

Whatever you do, don't base your investing decision on what Tatum, or any celebrity, does. As the SEC puts it, "SPAC sponsors generally acquire equity in the SPAC at more favorable terms than investors in the IPO or subsequent investors on the open market. As a result, the sponsors will benefit more than investors from the SPAC’s completion."