PSFE Stock Is Rising on WallStreetBets Pumping—How High Can It Go?

PSFE stock is rising amid interest from WallStreetBets traders. The stock could rise higher and another 20 percent rise looks likely.

June 28 2021, Published 8:09 a.m. ET

Paysafe (PSFE) stock rose almost 10 percent on June 25 and was trading higher in premarket on June 28. The stock got picked up by Reddit group WallStreetBets. The group has pumped several stocks in 2021. How high can PSFE stock go amid the pumping by WallStreetBets?

Paysafe went public through a merger with Bill Foley sponsored Foley Trasimene Acquisition Corp. II (BFT). The merger was completed in the first quarter of 2021. PSFE stock fell thereafter amid the sell-off in fintech stocks. The company’s earnings miss for the first quarter of 2021 didn't help matters either.

Why PSFE stock is going up

PSFE stock is going up for three main reasons. First, the stock started to look attractive after the crash. Second, the stock got picked up by WallStreetBets traders. The stock is among the most discussed topics in the group. Finally, PSFE stock is getting added to the Russel 3000 index. It's common for stocks to go up before inclusion in an index.

In 2020, the Dow Jones Industrial Average Index and the S&P 500 also made several changes to the constituents and the added stocks invariably went up. The Russel 3000 index is making a major overhaul and adding several “new economy” stocks, especially from the green energy sector.

Is PSFE a good stock to buy?

Paysafe reported revenues of $1.42 billion in 2020 and an adjusted EBITDA of $426 million. The company has maintained its 2021 guidance and expects to post revenue of $1.53 billion–$1.55 billion in the year. It expects to post an adjusted EBITDA of $480 million–$495 million in the year and expects the margins to improve to 32 percent.

Between 2020 and 2023, the company expects to increase its organic revenues by more than 10 percent annually. It also expects the adjusted EBITDA margins to expand 35 percent during the period. The projections look reasonable considering the expected growth in the different businesses that Paysafe is targeting.

PSFE stock's long-term forecast

Looking at the projections provided by PSFE, the company could post revenues of almost $1.9 billion in 2023. If it manages to achieve an adjusted EBITDA margin of 35 percent, it would mean an adjusted EBITDA of almost $670 million in 2023. The company currently has an EV (enterprise value) of $10.8 billion.

Based on the forecasts, PSFE is valued at a 2023 EV-to-EBITDA multiple of around 16x. The multiples look reasonable. There are also inorganic growth opportunities for Paysafe. There's also a possible upside potential from the legalization of sports betting. Paysafe is the market leader in the iGaming market.

How high can PSFE stock go?

So far, PSFE stock has risen only about 10 percent after it got picked up by Reddit traders. Most of the stocks picked up by WallStreetBets have seen much bigger spikes. The targeting by WallStreetBets notwithstanding, PSFE stock could rise another 20 percent from these levels based on its fundamentals. Looking at the consensus estimates, Wall Street analysts see another 40 percent rally in Paysafe stock over the next 12 months.

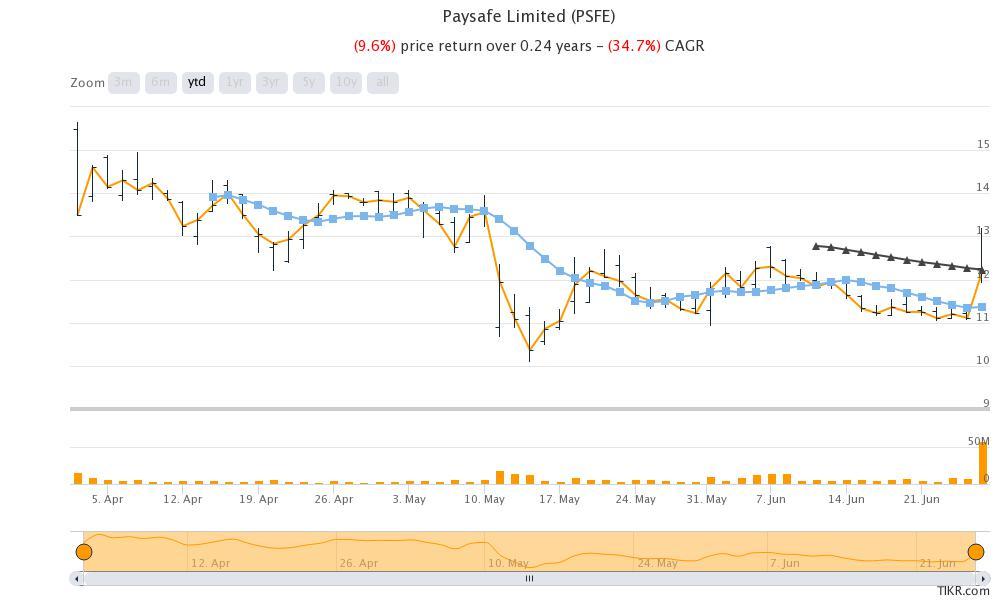

PSFE stock chart

The stock looks strong on the charts and has crossed above its 10-day SMA (simple moving average). It went above the 50-day SMA amid the spike last week but closed marginally lower than the level. If PSFE stock can convincingly break above the 50-day SMA it will signal technical bullishness also.