Best Healthcare Stocks for Investors to Buy Now, Defensive Bet

Healthcare stocks can be a good defensive bet in current times. What are the best healthcare stocks that you can buy in 2021?

July 26 2021, Published 8:55 a.m. ET

Healthcare stocks are generally defensive. Within the healthcare space, there are several types of companies that you can look at including hospital companies, clinical-stage companies, diagnostics companies, health equipment companies, pharma companies, as well as the medical insurance industry. What are the best healthcare stocks to buy now?

Overall, 2020 was a mixed year for the healthcare sector. While some of the pharma companies outperformed after emergency use approvals for their COVID-19 vaccine candidates, some healthcare stocks were under pressure. Hospitals were impacted negatively by the COVID-19 pandemic. Elective surgeries took a backseat amid the pandemic.

Best healthcare stocks to buy now

The following are the best healthcare stocks to buy in 2021:

- Clover Health

- United Health Group

- Senseonics

- GlaxoSmithKline

Clover Health looks like a good healthcare stock to buy.

Clover Health (CLOV) was listed in 2021 through a reverse merger with one of Chamath Palihapitiya’s SPAC. The stock has been under pressure and trades below the $10 price level. CLOV stock looks a good buy after the crash. The stock’s average target price is $9.50, which is a premium of 18 percent over the current prices.

According to Clover Health, Medicare Advantage spending in the U.S. was $270 billion in 2019, which is expected to more than double to $590 billion by 2025. The expected increase is a massive market opportunity for CLOV.

United Health Group

United Health is the largest health insurer in the U.S. Earlier in July, the company upwardly revised the 2021 EPS guidance to $18.30–$18.80. The stock is up almost 20 percent so far in 2021 and is outperforming the S&P 500. United Health stock trades at an NTM PE multiple of 21.5x, which is higher than its historical averages.

United Health has a median target price of $457.50, which is a premium of 9.5 percent over the current prices. The stock has received 24 buys, three holds, and one sell rating from the analysts polled by CNN Business.

Why Senseonics looks like a good healthcare stock to buy

The market for diabetic care is expanding fast. Senseonics produces the Eversense CGM (continuous glucose monitoring) system, which can revolutionize the market. It's an implantable device that can help in diabetic monitoring.

The stock has come off its 2021 highs but like many other penny stocks, it capitalized on the rise in its stock to issue new shares. In the April release, Senseonics said that it expects its revenues to be between $12 million and $15 million in 2021. The revenues are expected to rise significantly over the coming years if the Eversense product gets successfully commercialized.

GlaxoSmithKline is a dividend czar.

GlaxoSmithKline (GSK) stock has been a consistent underperformer and the stock hasn't delivered any returns over the last five years even though the markets have surged to record highs over the period. However, GSK has an attractive dividend yield of 5.5 percent, which looks very healthy considering the low yields on fixed income instruments.

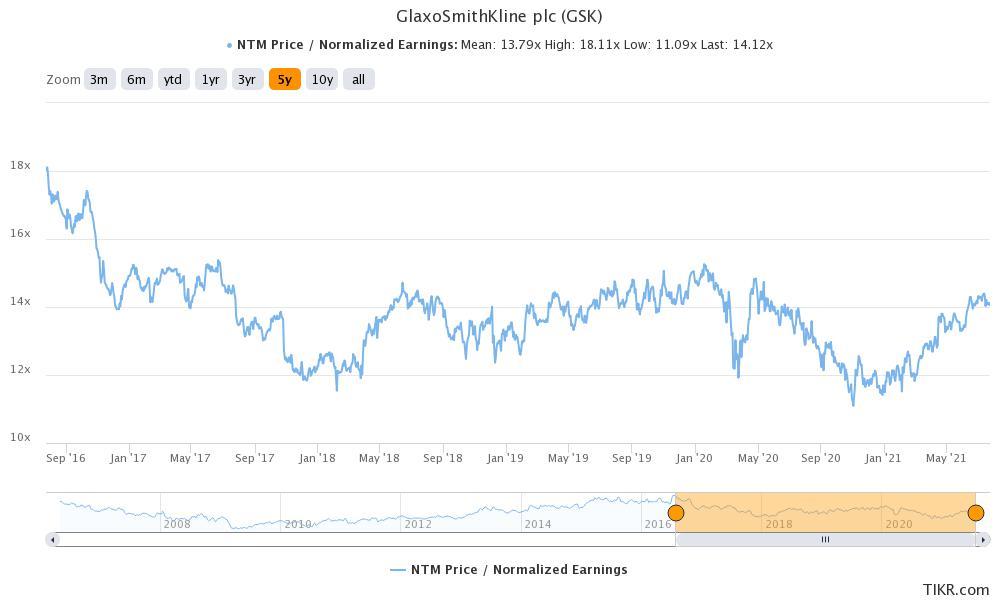

GSK stock trades at an NTM PE of 14.1x, which is in line with its long-term averages. The stock’s median target price is $42.36, which implies an upside of 7.2 percent over the next 12 months. Meanwhile, most analysts are on the sidelines when it comes to GSK stock. Of the 26 analysts covering the stock, 14 recommend a hold, 10 recommend a buy, and two recommend a sell.

Healthcare ETFs

If you're looking at diversified exposure to the healthcare industry, you can also consider one of the ETFs. The Health Care Select Sector SPDR Fund (XLV) is a good ETF to play the healthcare industry. It's up 16.4 percent so far in 2021. The ETF has 64 holdings, which makes it very diversified. The expense ratio is also reasonable at 12 basis points. The average traded volume is almost 10 million units daily, which makes it highly liquid.