Hayward IPO Isn't Roblox or Coupang—Should You Still Dive In?

Pool equipment supplier Hayward Holdings has priced its IPO. What’s the forecast for HAYW stock and should you buy the IPO?

March 12 2021, Published 10:04 a.m. ET

Pool equipment supplier Hayward Holdings has priced its IPO. It's expected to list on March 12 under the ticker symbol “HAYW.” What’s the forecast for HAYW stock? Should you buy the IPO?

Overall, 2020 was a record year for U.S. IPOs and they broke the previous record set in 1999. Most IPOs delivered good returns with many like Airbnb more than doubling on the listing day. Even Berkshire Hathaway, whose chairman Warren Buffett isn't a fan of IPOs, invested in the Snowflake IPO.

So far, the IPO activity has been tepid in 2021 since SPACs are stealing the thunder. Some SPACs like Roblox opted for a direct listing. However, investors' appetite for good IPOs looks intact, which is visible in strong listing gains from South Korean e-commerce company Coupang.

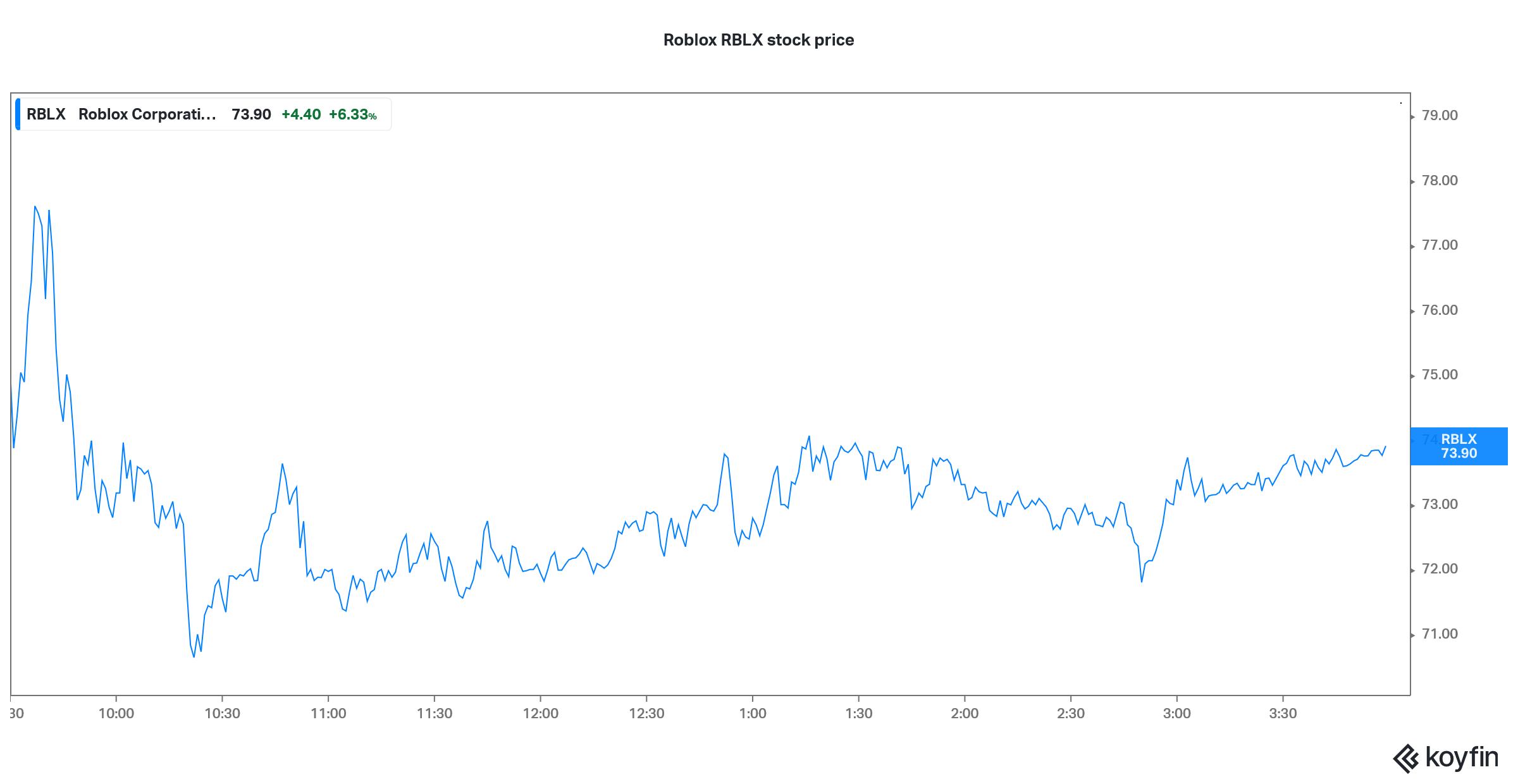

Roblox stock price

Hayward Holdings' IPO price

Hayward Holdings has priced its IPO at $17 per share, which is at the lower end of its guidance of $17–$19. Incidentally, most other companies that have listed over the last year priced their IPOs above the original pricing range. In a rare occurrence, Unity Software took over the IPO pricing from investment bankers and increased the IPO price.

However, Hayward Holdings pricing its IPO at the lower range on the pricing is a sign that markets have been cold towards the IPO. Let’s look at the financials and valuations to get a better sense of whether you should invest in the IPO.

Is HAYW a good IPO to buy?

At the IPO price of $17, Hayward Holdings stock would have a market capitalization of around $4.3 billion. The company posted revenues of $875 million in 2020, which would mean a 2020 price-to-sales multiple of 4.9x. The company’s revenues have grown at a CAGR of 6.7 percent between 2012 and 2020.

Hayward Holdings posted an adjusted EBITDA of $232 million in 2020 with a margin of 27 percent. Its adjusted EBITDA has grown at a CAGR of 9.6 percent between 2012 and 2020. The margins have also expanded during this period. The stock would have an EV-to-EBITDA multiple of 18.5x at the IPO price of $17.

Meanwhile, the company’s net income has fallen from $57 million in 2012 to $43 million in 2020. The net income margins have deteriorated from 11 percent to 5 percent during this period. The stock would have a 2020 PE multiple of 75x. Overall, the multiples look aggressive for a pool equipment supplier.

Wait to buy HAYW IPO stock

HAYW IPO looks aggressively priced. The company’s growth picked up in 2020 since the demand for pool equipment was strong. However, the valuations look stretched. Overall, I would give HAYW IPO a miss based on the aggressive valuations and tepid growth rates.

How to buy HAYW stock

HAYW stock is expected to commence trading on March 12. You can trade in the stock from your brokerage account and place the order for the desired number of shares. However, don’t expect the stellar returns that Roblox and Coupang delivered this week.