GUSH, NRGU Stock Forecast: Buying Leveraged Oil ETFs in 2021

What’s the forecast for leveraged oil ETF stocks like GUSH and NRGU in 2021? Will they keep rising or should you avoid them?

March 5 2021, Published 10:19 a.m. ET

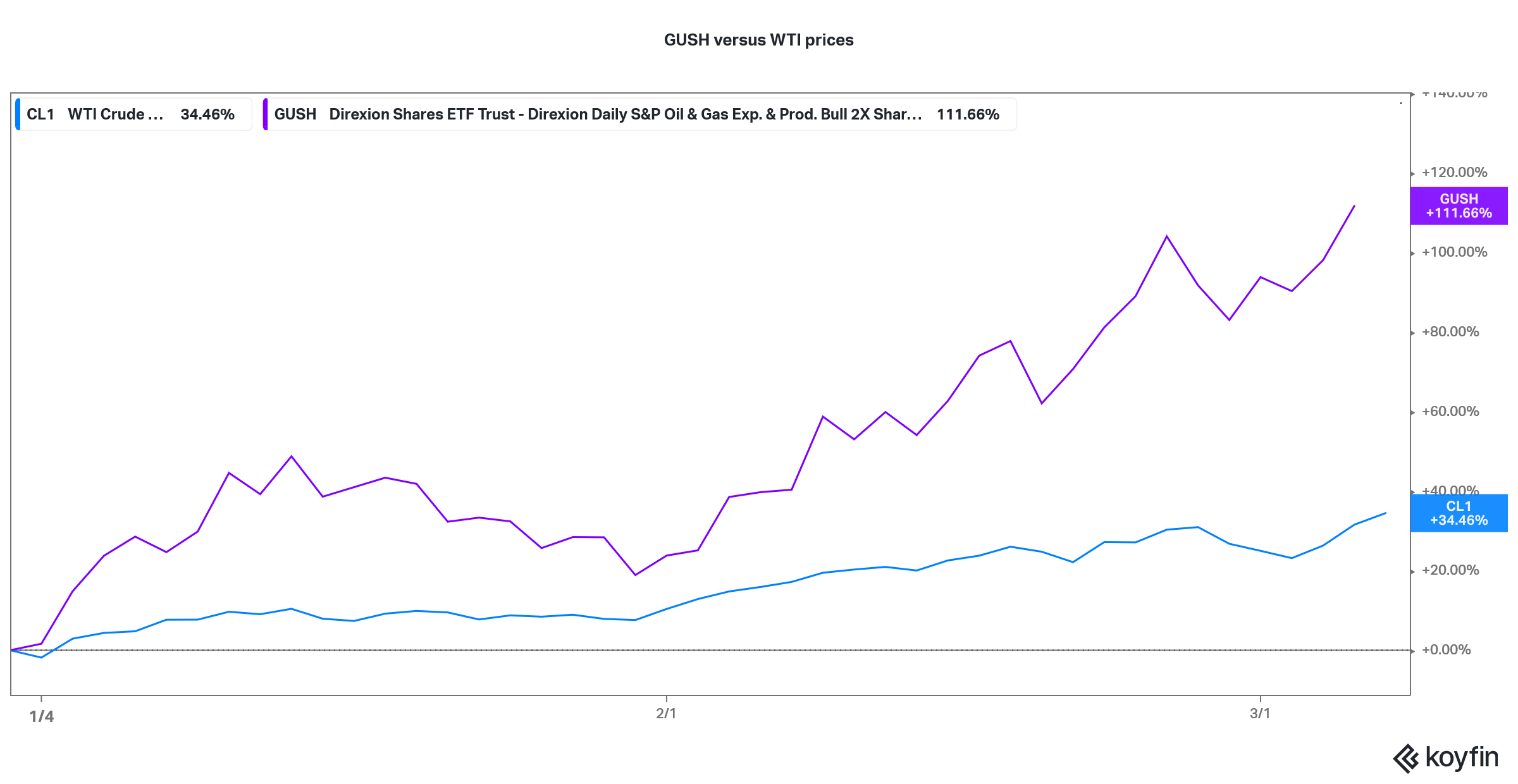

The Direxion Daily S&P Oil and Gas Exploration and Production Bull 2x ETF (GUSH) and the MicroSectors U.S. Big Oil Index 3x Leveraged ETN (NRGU) are up 111 percent and 152 percent, respectively, YTD. What’s the forecast for leveraged oil ETF stocks like GUSH and NRGU in 2021? Will they keep rising or should you avoid them after the sharp rise?

While 2020 was a bad year for oil companies and many of them suspended dividends due to the slide in crude oil prices, 2021 has been a different ballgame. Crude oil prices are back to pre COVID-19 pandemic levels. WTI prices are up almost 35 percent so far in 2021, which has led to a rally in stocks and ETFs in the energy industry.

Why crude oil prices are rising

Crude oil prices are rising due to the positive demand-supply equation. While crude oil demand is picking up globally amid reopening, OPEC has maintained supply discipline. Earlier this year, Saudi Arabia announced a surprise and unilateral production cut.

GUSH versus WTI

OPEC+, which also includes Russia and some other non-OPEC oil-producing countries, has extended the oil production cuts into April. Oil and gas producer stocks have also risen sharply this year. They are tracking the uptrend in crude oil prices.

Leveraged oil ETFs

There are leveraged ETFs available on many assets like stock indexes, precious metals, as well as energy. If you invest in a leveraged ETF, your returns and the losses would be magnified compared to investing in a plain ETF that just tracks the underlying.

Leveraged ETFs are riskier investments than plain ETFs. Your losses and gains would be higher than the underlying. However, if you understand the associated risks and are very bullish on the underlying, which is energy companies for GUSH and NRGU, you can try them out.

GUSH ETF forecast

The GUSH ETF is a 2x bet in the S&P Oil and Gas Exploration and Production Select Industry Index. To get a sense of how bad things were for the ETF in 2020, in August there was a reverse stock split of this ETF. Companies do a reverse stock split when the price falls too low.

The underlying index has a 66 percent exposure to oil and gas exploration and production companies, 23 percent exposure to oil and gas refining and marketing companies, and 11 percent exposure to integrated oil and gas companies.

The forecast for GUSH ETF depends on the movement in crude oil prices. Also, if inflation returns like many people are fearing, it would be positive for energy prices. Energy prices tend to do well in an inflationary environment. Given the positive outlook for crude oil prices, the short-term outlook for GUSH also looks favorable.

NRGU stock forecast

The underlying for NRGU is the Solactive MicroSectors™ U.S. Big Oil Index, which is issued by the Bank of Montreal. It's a concentrated index. The top five holdings are ConocoPhillips, Chevron, EOG Resources, Hess, and Marathon Petroleum. They account for 10 percent each.

Given its consolidated nature and higher leverage, NRGU is a riskier bet than GUSH. The forecast for NRGU also depends on the movement in crude oil prices. GUSH looks like a better ETF based on the diversified portfolio of the underlying index.

Meanwhile, while GUSH and NRGU are a play on energy companies, you can also take a leveraged bet on crude oil prices by buying a leveraged oil ETF like the ProShares Ultra Blomberg Crude Oil (UCO).