Why CCIV Needs Lucid Motors Much More Than Lucid Needs It

Churchill Capital IV (CCIV) SPAC stock is up in premarket trading today despite there being no news on its merger with Lucid Motors.

Feb. 12 2021, Updated 7:44 a.m. ET

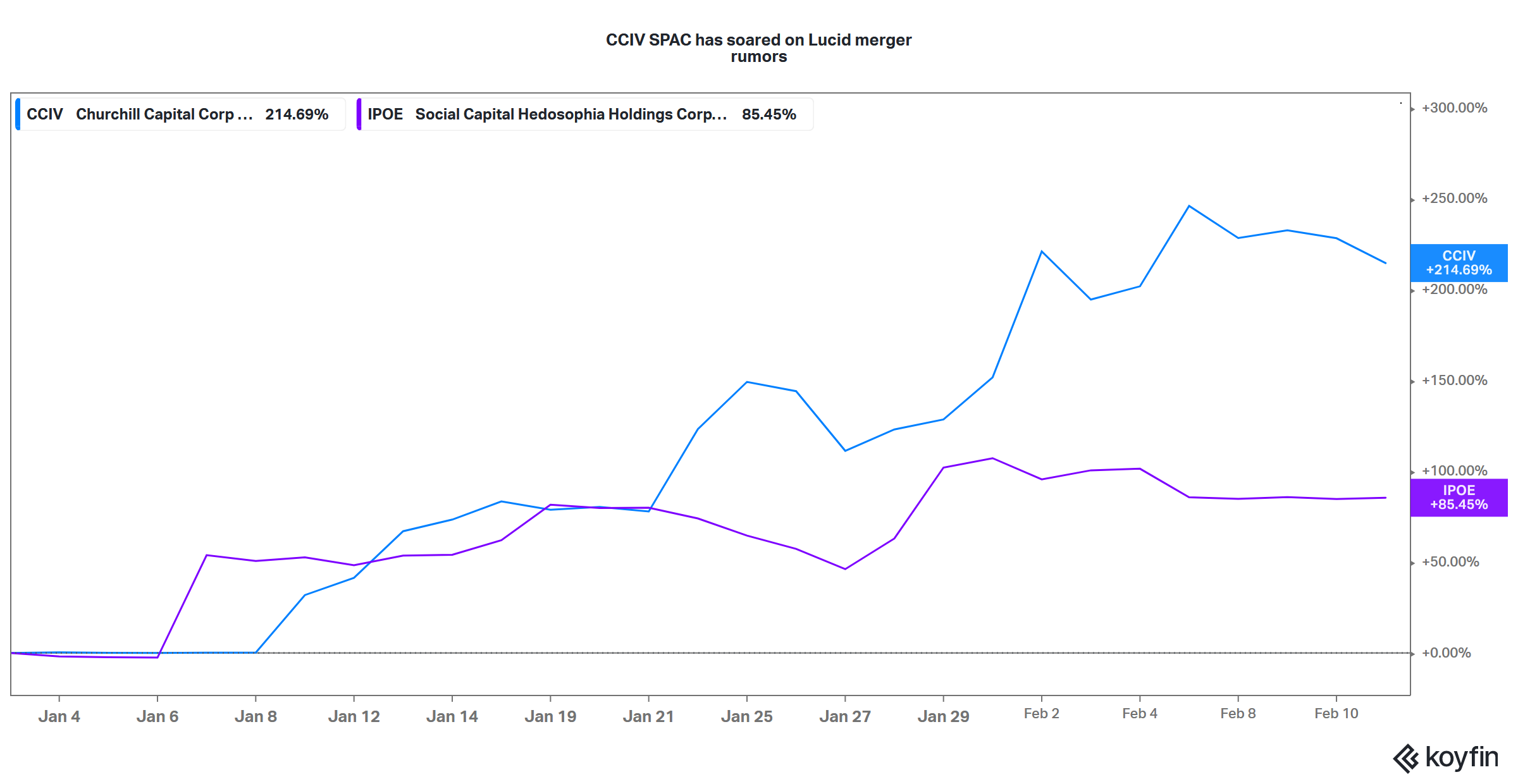

Churchill Capital IV (CCIV), a blank-check company formed by Wall Street veteran Michael Klein, is among the most popular SPACs (special purpose acquisition companies). It's trading at a massive premium over its IPO price on rumors that it's merging with Lucid Motors, an electric vehicle company led by Peter Rawlinson, the chief engineer of Tesla’s Model S. What’s the latest news on the CCIV SPAC merger with Lucid? Is its premium price justified?

SPACs are giving traditional IPOs a run for their money. The SPAC route offers various advantages, particularly for little-known startups. For these small companies, the costs and processes of traditional IPOs could be prohibitive, and they may not generate as much investor interest or achieve the target valuation. According to SPACInsider, 248 SPACs raised $83 billion in IPOs last year. For the first time in history, this figure was close to the amount raised by traditional IPOs.

Does Lucid Motors really need to take the SPAC route?

Lucid Motors doesn't necessarily need to take the SPAC route. There are three ways a company can go public:

- Through a traditional IPO, where the company hires investment bankers to price and market its offering.

- Through a direct listing, where a company sells its shares directly to the public.

- Through a SPAC, where the company merges with a blank-check company.

SPAC mergers versus direct listings

In a direct listing, the company does not offer new shares, and only existing shareholders can sell their shares. Companies tend to list directly if they don't need funds immediately yet want to provide an exit route to shareholders.

In contrast, in the SPAC route, the target company gets funds that the SPAC raised in the IPO along with any PIPE (private investment in public equity). Invariably, the entity that’s sponsoring the SPAC gets a board seat in the target company. While this brings expertise and credibility to small startups, it also means ceding control.

CCIV–Lucid Motors merger news

The CCIV–Lucid Motors merger still hasn't been confirmed. There have been many examples of rumored mergers not happening. However, it's worth noting that Saudi Arabian wealth fund Public Investment Fund owns a majority stake in Lucid. Therefore, Lucid shouldn't face any funding issues. In fact, it may have many doors to the public market to choose from.

Why CCIV needs Lucid Motors much more now

CCIV stock is trading at a 200 percent premium to its IPO price. And in premarket trading today, Feb. 12, it was trading almost 15 percent higher at $36.20, so that premium looks set to grow even further.

Most of CCIV's gains have come after rumors of the Lucid Motors merger. Given that Lucid could choose from several ways to go public, it would be fair to say that CCIV needs Lucid much more than Lucid needs it.