THBR Stock Is an Attractive Bet Before the Indie Semiconductor Merger

THBR SPAC is merging with Indie Semiconductor, which is an automotive chip and software company. Is THBR stock a buy?

March 18 2021, Published 9:31 a.m. ET

Indie Semiconductor, an automotive chip and software company, is gearing up to go public through a reverse merger with Thunder Bridge Acquisition II (THBR). The THBR SPAC raised about $345 million in an August 2019 IPO. What's the THBR-Indie Semiconductor merger date and should you buy the SPAC stock now?

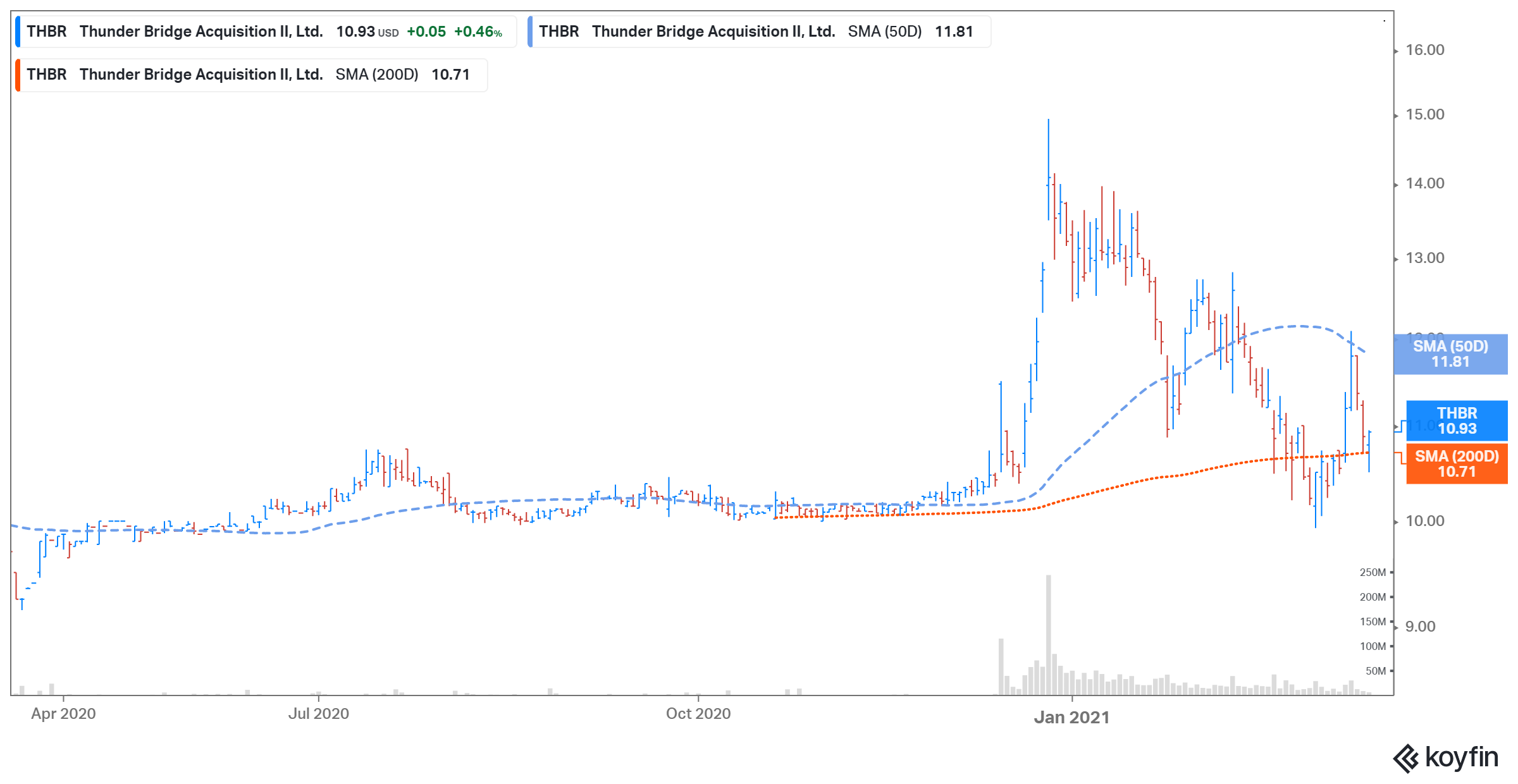

THBR SPAC stock is up 9.3 percent from its IPO price of $10 per share. However, the stock is still down 26.8 percent from its 52-week high. On March 17, the stock rose 0.5 percent and closed at $10.93.

THBR and Indie Semiconductor merger date isn't final

The THBR and Indie Semiconductor merger is expected to close early in the spring of 2021. The transaction, subject to approval by THBR shareholders and other customary closing conditions, is set to have a pro forma enterprise value of $982 million. The combined entity will be listed on the Nasdaq under the ticker symbol “INDI.”

THBR and Indie Semiconductor merger details

The deal will provide Indie Semiconductor with nearly $495 million in cash to fund the company’s growth initiatives. The amount includes about $345 million of cash held by THBR in trust and an additional $150 million in PIPE (private investment in public equity) at $10 apiece. Existing Indie Semiconductor shareholders will likely own about 62.2 percent of the combined entity when the deal closes.

Indie Semiconductor will benefit from the global semiconductor shortage.

Founded in 2007, Indie Semiconductor manufactures automotive chips and software platforms. The company focuses on EDGE sensors used in autonomous vehicles. Indie will likely benefit from the global supply shortage of automotive chips.

In a press release, Indie said, “From a longer-term perspective, the current supply shortage across the automotive semiconductor industry is underscoring the need for an additional vendor with scale who meets all key quality standards. indie is particularly well positioned to capitalize on this enormous strategic market opportunity.”

Outlook for Indie Semiconductor

According to IHS, Indie’s automotive semiconductor portfolio has an addressable market size of $16 billion, which is set to reach $38 billion by 2025. Indie has a strategic order backlog of over $2 billion and an additional $2.5 billion in possible orders. The company’s key customers include Valeo, Aptiv, and Magna.

THBR Stock Price

Is THBR SPAC stock a buy before Indie Semiconductor merger?

Indie Semiconductor expects to generate sales of $44 million in 2021 and forecasts its sales growing by 107 percent in 2022 and 124 percent in 2023. The company expects to be profitable in 2024. In 2025, Indie expects to report sales of $501 million and an EBITDA of $154 million. The company projects an EBIT margin of 30.1 percent in 2025.

THBR valued Indie at a pro forma implied equity value of $1.45 billion. Meanwhile, at THBR’s current stock price, Indie is valued at around $1.58 billion. In comparison, Monolithic Power Systems (MPWR) and Cree (CREE) have market capitalizations of $16.1 billion and $12.9 billion, respectively.

In Indie's presentation announcing the transaction, the company provided a comparison with its competitors. Its 2022 EV-to-sales multiple is 10.8x, which looks attractive compared to other key semiconductor companies. In comparison, MPWR’s and CREE’s multiples are 13.1x and 12x, respectively. The 2024 EV-to-sales multiple for Indie is 2.8x compared to Velodyne Lidar’s multiple of 3.4x. However, Indie Semiconductor looks expensive based on the NTM EV-to-sales multiple.

Between 2020 and 2022, Indie expects its revenues to grow at a CAGR of 99 percent compared to MPWR’s 13 percent and CREE’s 7 percent. Based on Indie's strong growth outlook and valuations, THBR stock looks like a good buy. However, the stock is a speculative play until the THBR and Indie transaction closes.