Buy PACX Now Before the Acorns Merger, Explained

Investors might want to put their money in Pioneer Merger Corp. (NASDAQ: PACX) now before the blank-check company merges with investing app Acorns.

May 27 2021, Published 12:29 p.m. ET

Investors might want to put their money in Pioneer Merger Corp. (NASDAQ: PACX) now before the blank-check company merges with investing app Acorns.

On May 27, Acorns officials announced that they plan to merge with the SPAC in the second half of 2021.

The deal more than doubles the fintech company’s valuation to $2.2 billion. The company was last valued at less than $1 billion.

"Acorns is not only a category leader but also a category creator. Its value proposition is built around inclusive, long-term financial wellness. With integrity at its core, the brand has an incredibly loyal following and market-leading retention rates. I could not be more excited to partner with Acorns,” said Jonathan Christodoro, the chairman of Pioneer, in a statement.

After the merger is completed, Acorns will trade on the Nasdaq under the ticker symbol "OAKS."

The merger provides a share program for eligible Acorn customers.

As part of the merger, Acorns CEO Noah Kerner and Pioneer’s sponsor will each contribute 10 percent of their ownership in Acorns to fund a program that giving shares to eligible customers.

"Our loyal customers have gotten us here," said Kerner. "They've earned a right to become owners alongside us, and help us grow together into the mighty oak that Acorns was meant to become."

Over four million people subscribe to Acorns.

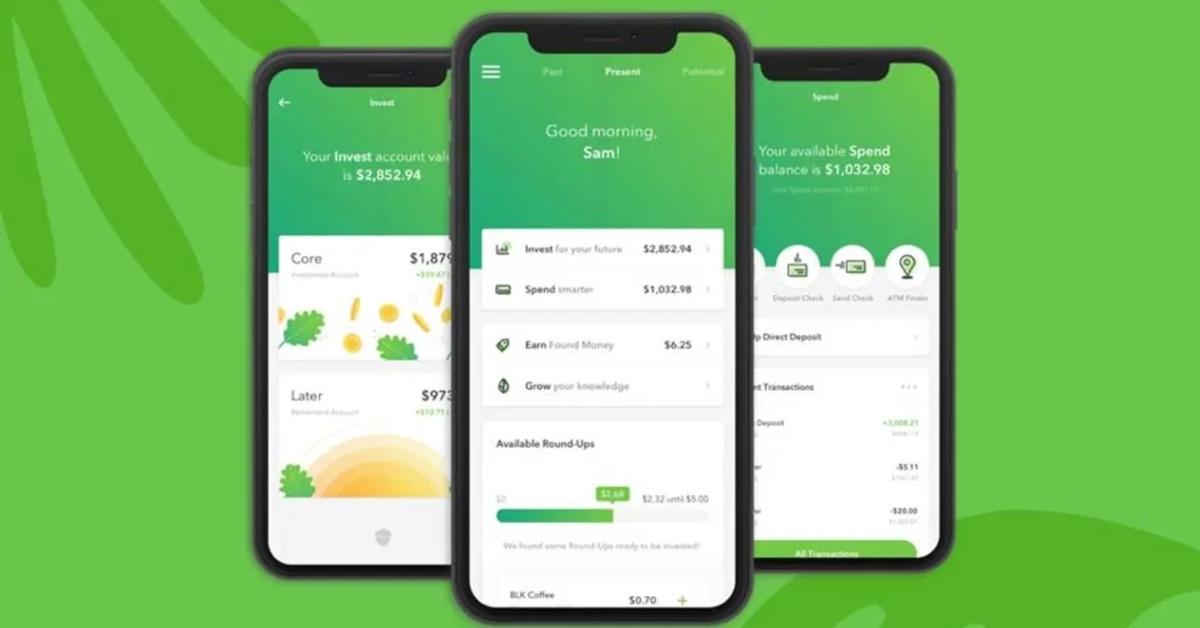

Founded in 2014, Acorns is an investing app that includes education and banking components. Currently, there are three subscription levels for users to choose from, but the company plans to add more tiers in the future.

Users can also choose to have the app connect to their bank account or credit cards and have spare change on transactions rolled into an investing account. For example, if you spend $5.50 at Mcdonald’s, the transaction will roll up to $6 and the extra $.50 will be added to your Acorns investing account.

Acorns is now the largest subscription-based service in consumer finance with over four million subscribers. The Irvine-based company hopes to accelerate the company’s growth by going public. Acorns expects its subscriber base to grow to 10 million by 2025.

“Going public will help elevate our story, introduce many more people to the power of compounding and financial wellness, and bring financial literacy to the mainstream,” Kerner said.

Institutional investors Wellington Management, Senator, Declaration Partners, Greycroft, The Rise Fund, TPG's global impact investing platform, and funds and accounts managed by BlackRock participated in a private investment in public equity (PIPE) at $10 per share.

According to Pitchbook, Acorns also received venture investments from PayPal Ventures, Comcast, and celebrities Ashton Kutcher, Jennifer Lopez, and Dwayne Johnson.

What is Pioneer Merger Corp.?

Pioneer Merger Corp. is a blank-check company founded in October 2020 with the aim to acquire one or more businesses. Its sponsor is an affiliate of Falcon Edge Capital and Patriot Global Management.

The SPAC went public in January through an IPO that closed at $402.5 million. Currently, the shares trade on Nasdaq under the ticker symbol "PACX."

After announcing the Acorns merger, PACX jumped to $10.13 per share. At 11:13 a.m. ET, the shares were trading at $9.93 per share.