Is It Time for Some Bottom Fishing in Aphria Stock?

Aphria (APHA) and Tilray (TLRY) stocks have fallen sharply. Is it time to do some bottom fishing and buy Aphria stock now?

Feb. 16 2021, Published 10:48 a.m. ET

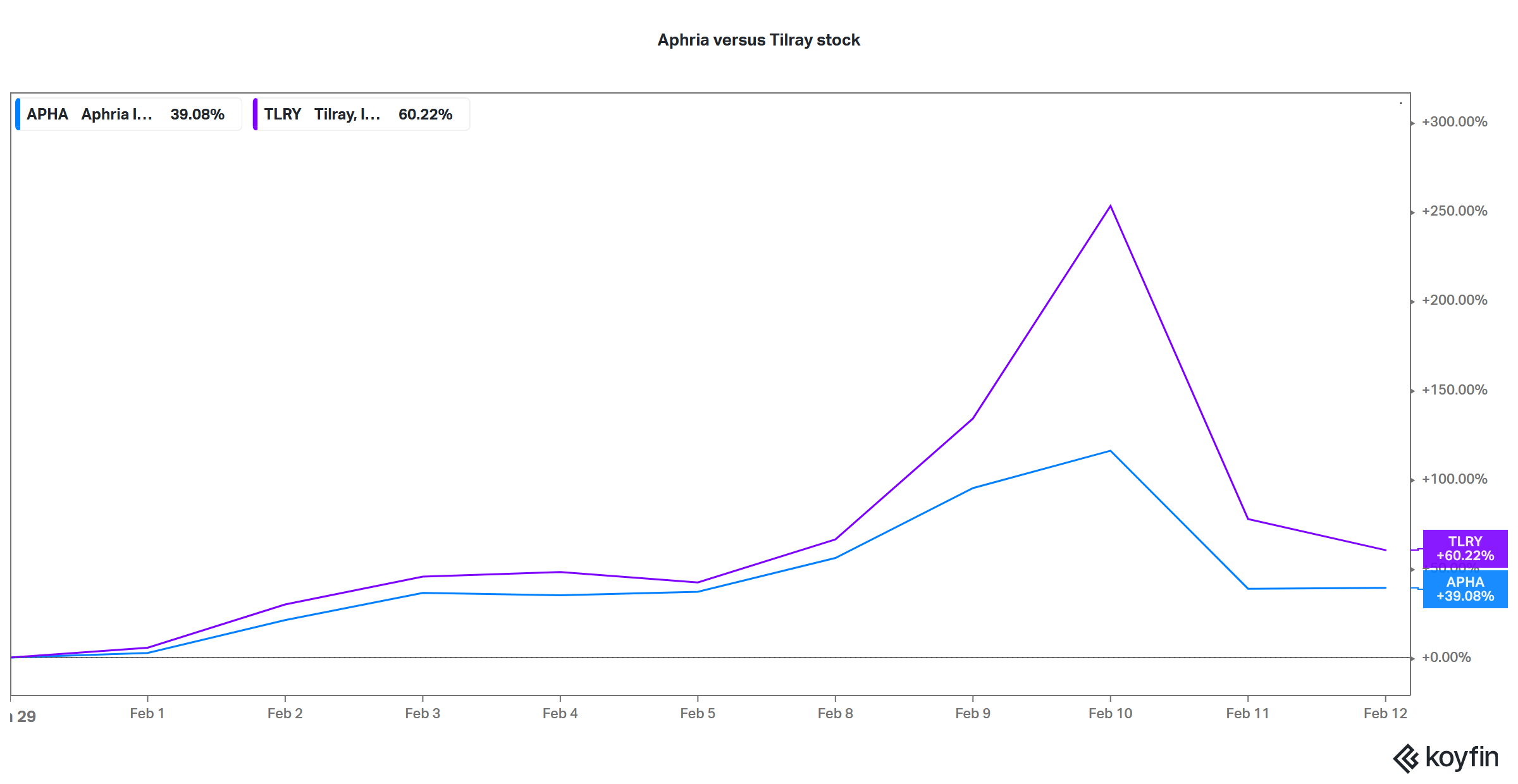

Marijuana stocks aren't for the faint-hearted since they are much more volatile than the broader markets. When we combine the usual volatility of marijuana stocks with the spirited fight against short-sellers from Reddit group WallStreetBets, we see the kind of volatility that we’ve seen in Tilray and Aphria stocks. Aphria stock has lost 48 percent from its recent highs, while Tilray has lost 57 percent. Should you buy Aphria stock now after the recent fall or stay away from the company?

The fall in Tilray stock is higher than what we have seen in Aphria. At their peaks, there was a big disconnect between their stock prices based on the merger ratio. In 2020, Tilray and Aphria announced a reverse merger, which is expected to be completed in the second quarter of 2021.

Merger arbitrage in the Tilray and Aphria merger

Previously, I pointed to the juicy merger arbitrage in Tilray and Aphria stocks. According to the merger terms, Aphria stockholders will get 0.8381 Tilray shares for each Aphria share. Theoretically, Aphria stock should trade at 0.8381x of Tilray stock.

Looking at the closing prices on Feb. 15, Aphria trades at 0.584x of Tilray stock. While the merger arbitrage opportunity has fallen from what we saw earlier this month, it's still quite attractive.

Aphria stock's valuation

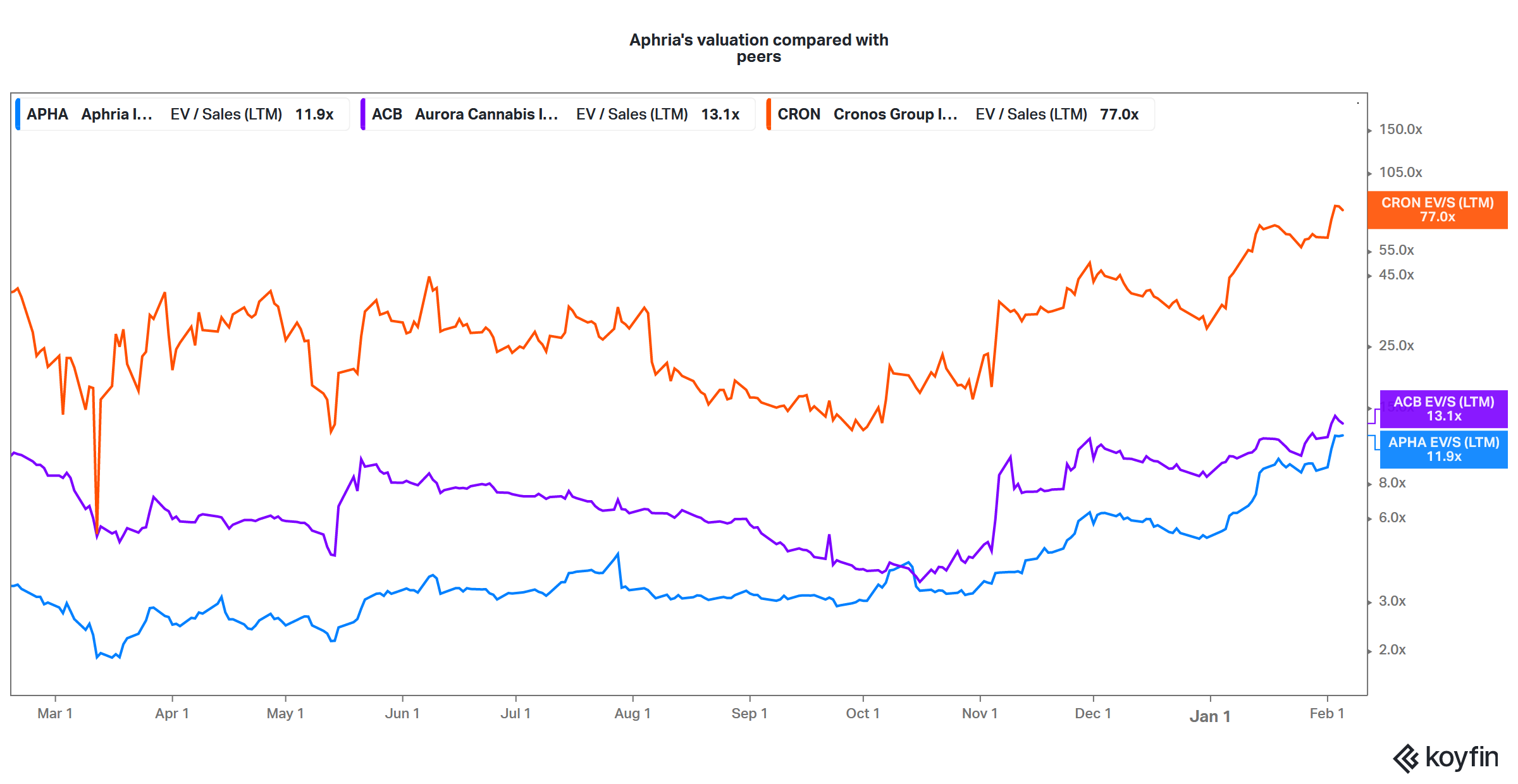

Currently, Aphria stock trades at an LTM (last-12-month) EV-to-sales multiple of 12x. While the multiple is almost five times what we saw a year ago, it's still a fraction of the 162x LTM EV-to-sales multiple that we saw at the peak in 2018. Also, Aphria stock is trading at a discount to some of its peers.

For example, Aurora Cannabis (ACB) stock is trading at an LTM EV-to-sales multiple of 13.1x, while Cronos Group is trading at an LTM EV-to-sales multiple of 77x. After the merger between Aphria and Tilray, the combined entity would become the largest marijuana company with global operations.

Tilray has good exposure to the medical marijuana industry in Europe and has been expanding its reach there. Recently, it entered into an agreement with U.K.-based Grow Pharma to import and distribute its medical marijuana products in the U.K.

Is APHA stock a buy after the crash?

The marijuana industry's outlook is strong. The Biden administration is expected to push for the federal legalization of marijuana, which would help lift adult-use marijuana sales in the country. Medical marijuana is also gaining traction globally. After the Tilray and Aphria merger, the combined entity would be a diversified play on the marijuana industry with exposure to both medical and recreational marijuana.

Also, given the merger arbitrage, it would make sense to buy Aphria stock at the current prices. Markets also seem to be warming up to Aphria and Tilray stocks after the massive fall. Both of the stocks opened higher on Feb. 16.