Why Aphria Looks Like a Good Buy Before the Tilray Merger

Tilray stockholders will vote on the Aphria merger later this week. However, APHA stock looks like a good buy now before the TLRY merger

April 27 2021, Published 8:35 a.m. ET

Marijuana stocks have gone through a boom-bust cycle several times over the last five years. There was a sharp rally in marijuana stocks after President Biden won the election and Democrats took control of the Senate. Since then, marijuana stocks have looked weak and Aphria (APHA) and Tilray (TLRY) aren't an exception. However, APHA stock looks like a good buy now ahead of its merger with TLRY.

The two companies announced the merger in December 2020. APHA stockholders have already approved the merger. However, TLRY delayed the stockholder meeting until April 30 amid reports that it hasn’t been able to garner the votes to get the merger approved.

TLRY and APHA merger date

The Tilray-Aphria merger date hasn't been finalized yet. However, after TLRY stockholders approve the merger on April 30, which looks likely since the company has also lowered the quorum requirement, the merger could be completed in a few days.

The merger between Tilray and Aphria would create a marijuana powerhouse with globally diversified operations. It would rival Curaleaf’s (CURLF) position as the world’s largest marijuana company. While the TLRY and APHA merger is only a few days away, which of the two stocks should you buy now?

Why Aphria stock looks like a good buy now

There are multiple reasons why Aphria stock looks like a good buy. Let’s start by looking at the macro factors first. In my view, the sell-off in marijuana stocks is over. There certainly was an element of irrational exuberance in the rally that we saw towards the beginning of 2021. There has been a healthy correction and marijuana stocks should recover.

Second, in the medium to long term, more jurisdictions will take a favorable view of marijuana legalization for adult use. Also, the medical industry will likely see increasing adoption of marijuana given its health benefits for some ailments.

Buying APHA stock before the TLRY merger

The merger between APHA and TLRY will lead to significant synergies. The two companies forecast that within two years of merger completion, they will realize annual pre-tax cost synergies of $78 million. To put that in perspective, that’s 11.6 percent of the $672 million combined revenues that the two companies have reported in the last 12 months.

That’s a healthy synergy margin given the fact that APHA and TLRY are making losses like most other marijuana companies. After the merger, the combined entity would be able to reach profitability much sooner than many of its peers.

Also, the combined entity would have an enhanced product portfolio across both adult-use and medical marijuana. The complementary geographical and product offerings make the TLRY-APHA merger a win-win for stockholders.

Still some merger arbitrage in Aphria stock

According to the merger terms, Aphria stockholders will get 0.8381 Tilray shares for each Aphria share that they hold. There's still a merger arbitrage of a little above 1 percent in APHA’s favor. While it isn't much, it's another reason to buy APHA stock before the merger with TLRY.

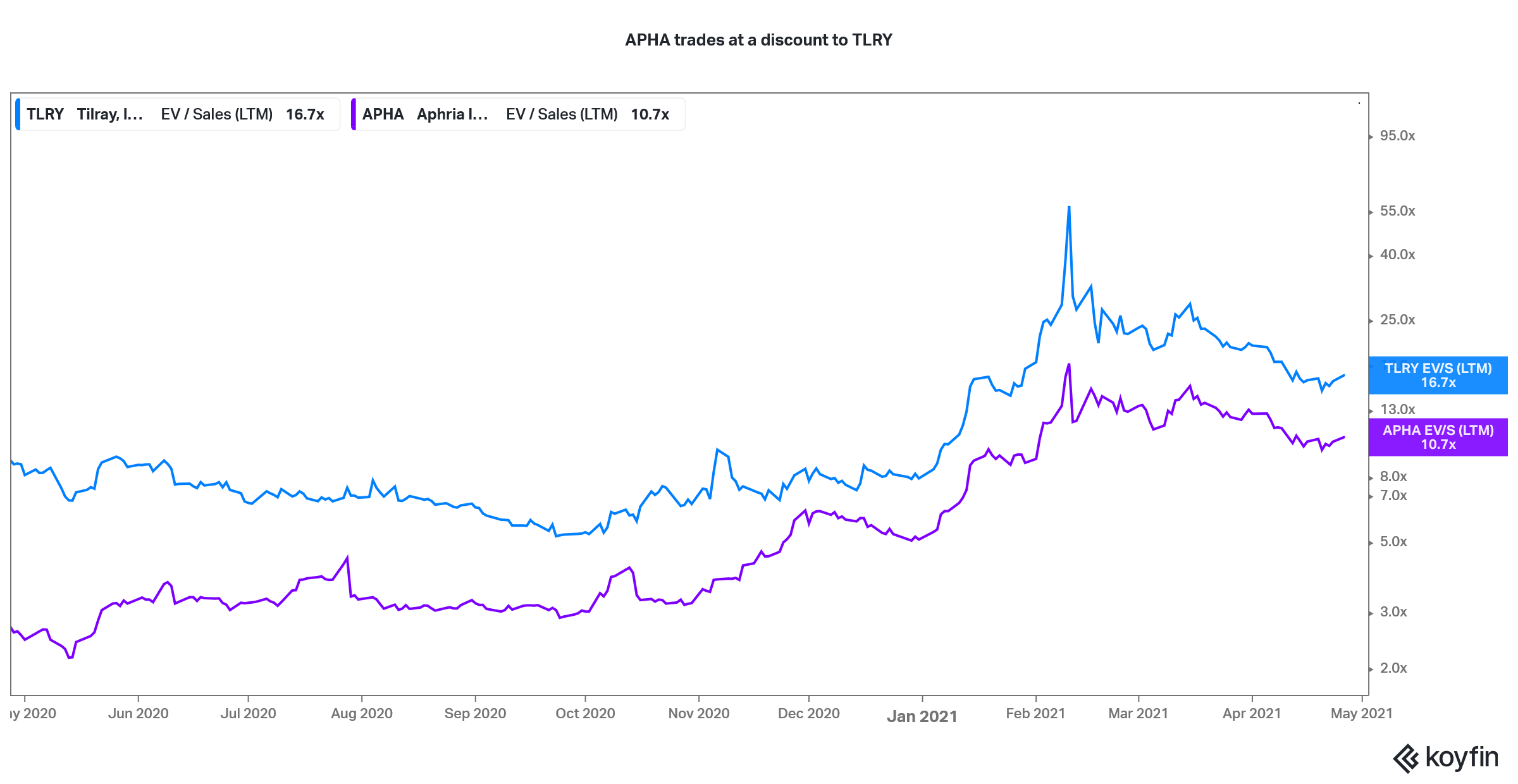

APHA versus TLRY valuation

APHA stock looks undervalued before TLRY merger.

Finally, in the unforeseen event where TLRY stockholders don’t approve the merger with APHA, Aphria looks like a good buy based on its standalone financials. Its gross margins are almost 2.5x that of Tilray. Looking at valuations, APHA trades at an NTM EV-to-revenue multiple of 8.2x compared to 11x for TLRY. To sum it up, APHA stock looks undervalued ahead of its merger with TLRY and looks like a good buy now.