ZOM or SNDL: Which is the Best Penny Stock to Buy Below $1?

Penny stocks are generally riskier than large-cap stocks. However, SNDL and ZOM look good buys.

Aug. 17 2021, Published 8:32 a.m. ET

While penny stocks, assets below $5, are inherently riskier than their large-cap peers, some investors prefer them. Two penny names, Zomedica (ZOM) and Sundial Growers (SNDL) are both now below $1. Which of these is a better buy?

As penny stocks are prone to volatility because it's easier to influence small stocks with a low float, it's no wonder that a lot of the companies targeted by Reddit group WallStreetBets have been penny names.

The best penny stocks to buy below $1

If a stock trades below $1, it becomes a candidate for delisting. Invariably, the company in question goes for a reverse stock split to meet listing requirements.

Whereas many penny stocks trade below $1, two stocks are worth some attention: ZOM and SNDL. Both stocks were targeted by Reddit traders, prompting them to surge and then crash.

It's worth noting that both SNDL and ZOM capitalized on the rise in their stock price to raise cash by selling shares. SNDL, for instance, has more cash on its balance sheet than Tilray, which became the largest cannabis company after the Aphria merger. SNDL now has a flourishing investment business.

ZOM also had a cash pile of $276.2 million at the end of Jun. 2021, ten times more than it had in Jun. 2020. The company has a market cap of only about $453 million, which gives it an enterprise value of $177 million.

Why ZOM and SNDL stocks have fallen

Both ZOM and SNDL stocks have fallen in Aug. 2021 after releasing their second-quarter earnings. Sundial Growers' revenue fell by more than 50 percent in the quarter due to lower sales. Canadian cannabis sales slumped in 2020, and SNDL has been shifting to value-add products.

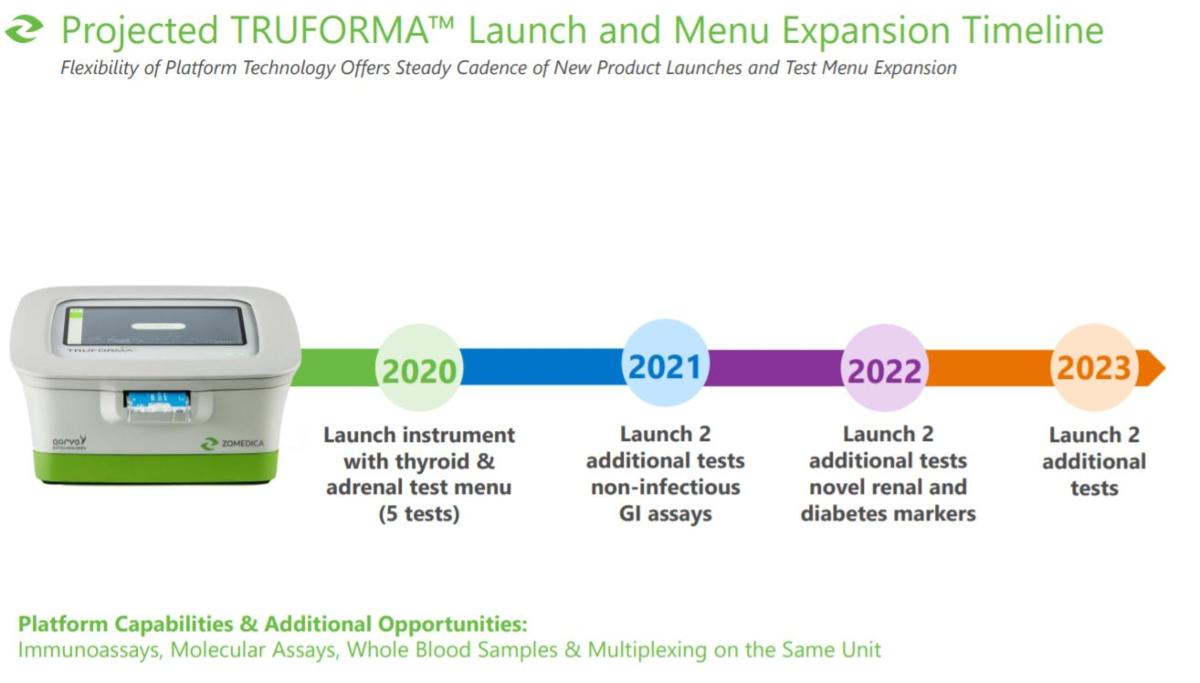

As for Zomedica, its revenue in the second quarter was only $15,693. Truforma sales did not pick up in the quarter, disappointing many bulls. Although the company began commercial sales in Mar. 2021, they have been stagnant. The company attributed the slow sales to delays by its development partner in developing fT4 and ACTH assays.

ZOM also warned that the “market adoption of TRUFORMA® will be challenging until our fT4 and ACTH assays are available for commercial release.” The company expects ft4 assays to be available by the fall, and ACTH by the end of 2021.

As markets were expecting a positive update from ZOM, the stock reacted negatively to the earnings release. SNDL stock also tumbled after the company posted a massive loss in the quarter.

ZOM versus SNDL

Both ZOM and SNDL are in diverse industries. SNDL, a cannabis company, also invests in other cannabis companies. ZOM, on the other hand, is in the animal diagnostic market, where its Truforma could be a gamechanger if commercialized properly.

After their crash, both SNDL and ZOM look like good penny stocks to buy. Though more volatility in both stocks can be expected, the risk is now much lower now than when they were at their peaks.