Best Growth Stocks for Investors in 2022 After a Volatile 2021

Growth stocks have whipsawed in 2021 and many have underperformed. What lies ahead for growth stocks in 2022 and could there be a rebound?

Dec. 13 2021, Published 8:05 a.m. ET

Growth stocks have whipsawed in 2021. There was a sell-off in February as bond yields rose. Also, the “stay-at-home” growth stocks have been particularly weak. Their top-line growth dropped much sharper than what markets anticipated at the beginning of the year. What lies ahead for growth stocks in 2022 and could there be a rebound?

While the S&P 500 hit a new closing high last week, some of the growth stocks are languishing near their 52-week lows. The underperformance of some of the growth stocks is best captured in the performance of ARK ETFs.

Cathie Wood’s growth funds have underperformed in 2021.

Cathie Wood of ARK Invest is among the best-known growth stock-oriented fund managers on Wall Street. However, her funds are underperforming in 2021. Her flagship ARK Innovation ETF (ARKK) is down almost 23 percent YTD, while the S&P 500 is up 25 percent for the year. If not for top-holding Tesla, ARKK would have had an even more dismal year.

Michael Burry also revealed a short bet against ARKK ETF, while Tuttle Capital launched an ETF that tracks the daily inverse performance of ARKK and trades under the ticker “SARK.”

What can investors expect from growth stocks in 2022?

At the Fed's meeting this week, it's expected to increase the pace of tapering and also stop referring to inflation as “transitory.” The rise in interest rates especially hits growth stocks since most of their earnings are skewed towards the future.

That said, stay-at-home growth stocks won't face the unfavorable YoY comparisons in 2022 as they did in 2021. In 2022, markets will get a better sense of the kind of sustainable growth that these companies can report as the COVID-19 pandemic boost dies down.

Investors are looking for the best growth stocks to buy for 2022.

The following look good growth stocks to buy for 2022:

- NIO

- Zoom Video Communications

- Peloton

- Meta Platforms

Barring Meta Platforms, all of these stocks have underperformed in 2021 but could see better days in 2022.

NIO looks like a good growth stock for 2022.

For NIO, 2021 turned out to be the mirror opposite of 2020. The stock was among the best-performing EV stocks in 2020 and rose above 1,100 percent. However, with a YTD loss of almost 30 percent, it's underperforming most EV stocks in 2021.

The company’s upcoming NIO Day could be a catalyst that takes it higher. Also, NIO’s valuations look reasonable compared to newly listed EV companies like Rivian and Lucid Motors.

Stay-at-home growth stocks could rebound in 2022.

Among the stay-at-home growth stocks, Zoom Video Communications and Peloton look like good buys for 2022. Zoom is launching several new products that should drive its growth. Also, as a hybrid business model, where some employees continue to work from home, looks like a reality. Companies like Zoom should see sustainable growth.

As for Peloton, nothing went right for the company in 2021. From fatal accidents involving its equipment to supply chain issues, the company faced several challenges. The stock fell to a 52-week low last week.

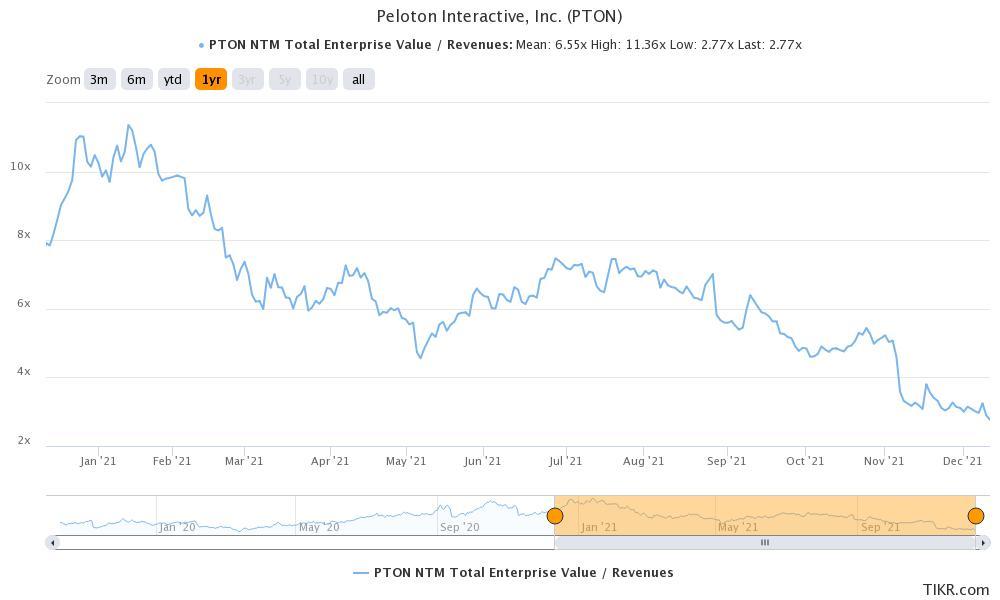

While Peloton is witnessing a growth slowdown and higher competition and its brand value has dropped considerably, it looks a good buy at current NTM (next-12 month) enterprise value to sales multiple of 2.8x.

Meta Platforms is a good growth stock to play the metaverse theme.

Facebook, which changed its name to Meta Platforms, is another good growth stock for 2022. The company’s focus on metaverse and the strong moat in the core social media business make it a good growth stock to buy. From a valuation perspective also, it’s the cheapest FAANG stock and should see an expansion of trading multiples.