Green Energy ETFs Could Be Winners Under Biden’s Presidency

The rally in renewable energy stocks has lifted the ETFs that invest in them. What are the best green energy ETFs for investors to buy in 2021?

Jan. 14 2021, Published 10:41 a.m. ET

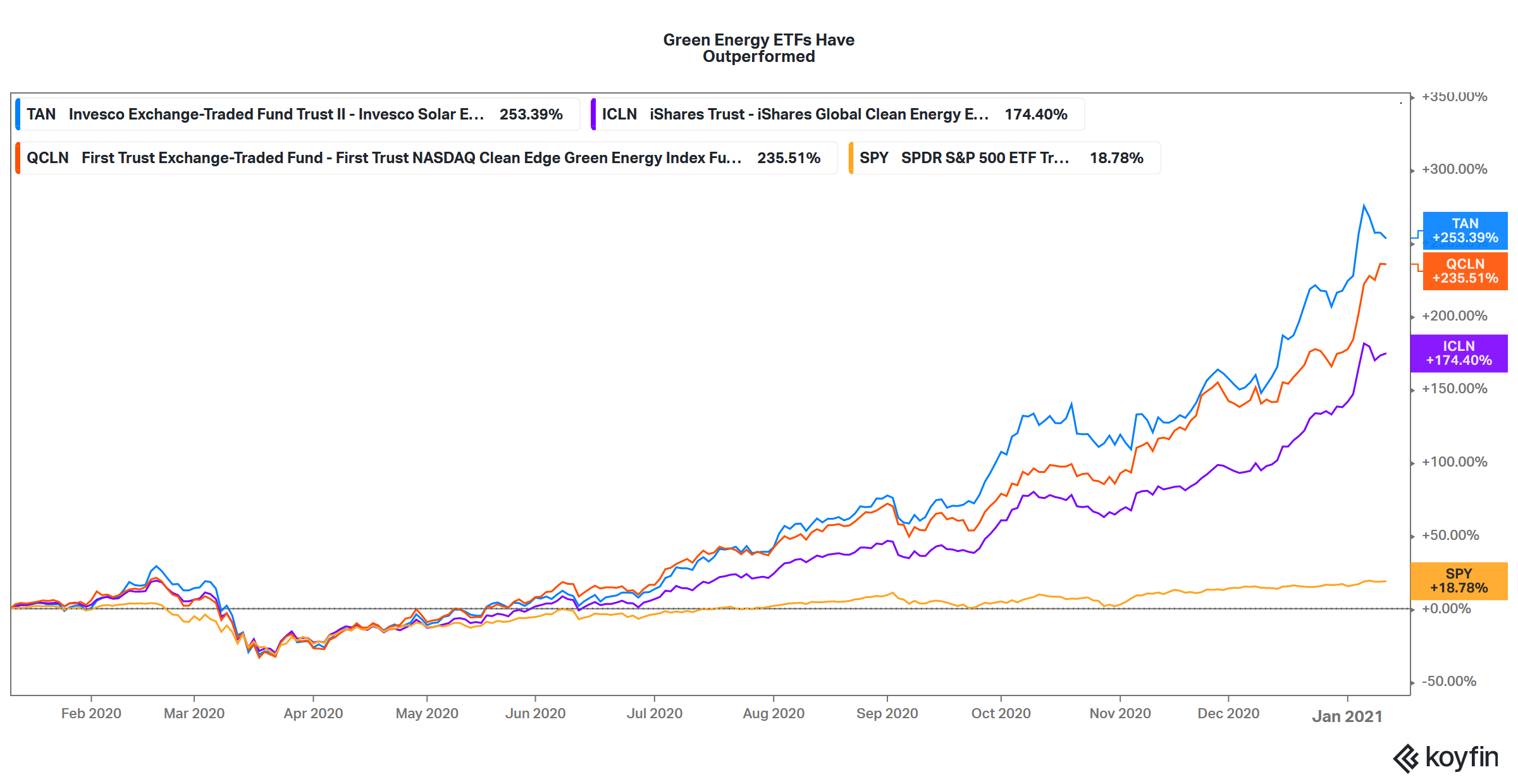

Green energy stocks and U.S. tech stocks were on investors' radar in 2020. The rally in green energy stocks also lifted the ETFs that invest in these companies. The momentum has continued into 2021 after the Democrats won control of the U.S. Senate. With Joe Biden as the 46th U.S. president, green energy ETFs could deliver good returns.

Biden’s administration is expected to rejoin the Paris Climate Deal. He has also talked about pivoting the U.S. toward renewable energy. As a result, green energy stocks were rerated after his election.

What green energy stocks cover

Green energy stocks cover various industries including:

- EV (electric vehicle) producers

- Ancillary EV plays like parts manufacturers and charging-infrastructure companies

- Alternative energy producers like wind and solar companies

- Fuel cell companies

- Utility companies

- Parts manufacturers for green energy generation companies

- Alternate fuel companies like biogas producers and biomass companies

How investors can access green energy stocks

One approach to investing in the green energy ecosystem would be to pick individual stocks. This approach works if you can identify opportunities early and are willing to take time to analyze individual stocks. Some renewable energy stocks have returned over 2,000 percent in the last year.

However, an easier approach might be to look at ETFs that invest in green energy stocks. You can have diversified exposure to the sector. ETFs are cost-effective investments. Passive investing has been gaining in popularity. Many active funds haven’t outperformed their benchmarks despite charging higher fees than passive funds.

Best green energy ETFs

To choose a good ETF, you should look at its expense ratio, liquidity, and total assets. There are some green energy ETFs that look good in 2021.

- The iShares Global Green Energy ETF has a diversified portfolio and invests across the globe. According to ETF.com, it has the highest assets in its category. Its expense ratio is also low at 0.48 percent.

- The First Trust Nasdaq Clean Edge Green Energy Index Fund has almost 80 percent of its holdings in U.S.-based companies. The ETF has assets of $2.68 billion and an expense ratio of 0.60 percent.

- The Invesco Solar ETF is a good way to invest in solar energy. Almost half of its diversified portfolio consists of non-U.S. companies. It has assets of $4.64 billion and an expense ratio of 0.69 percent.

Green energy's outlook

Green energy's horizon looks positive considering the global shift from fossil fuels. While the U.S. pulled out from the Paris Climate Deal under Trump’s presidency, other countries are looking to expand their commitments. Now, the U.S. is set to pivot to renewable energy again under the Biden presidency. As a result, green energy stocks could see some momentum.

Markets are already factoring in a lot of positives for green energy. These stocks' valuations have surged over the last year. In some cases, it looks like a bubble is forming. Through an ETF, you can diversify the risk of investing in a single stock.