Best Copper Stock to Buy Now, Prices Forecast to Reach $15,000

Goldman Sachs expects copper prices to reach $15,000 by 2025. Which copper stocks can you buy now to benefit from the spike?

May 27 2021, Published 9:40 a.m. ET

Commodity prices have been red hot in 2021. Copper hit its all-time high earlier in May and Goldman Sachs is forecasting that prices could reach $15,000 per metric ton. What are the best copper stocks to buy now?

A simple glance at the S&P 500 gainers tells us about the party of a lifetime that investors in metal and mining companies are enjoying in 2021. Nucor, the largest U.S.-based steel company, is the biggest gainer in the index. Freeport-McMoRan, the largest publicly traded copper miner, is up over 56 percent and is among the top 10 gainers in the index.

Will copper prices continue to rise?

We are in a commodity bull market. While higher commodity prices are stoking inflation fears, the bull market looks here to stay. The demand side of the equation looks strong for copper given the expected increase in demand from electric vehicles and renewable energy generation, which have a higher copper intensity.

Also, from a supply perspective, years of underinvestment in new mines due to low copper prices is expected to lead us to a structural supply deficit. The demand-supply scenario looks very bullish for copper which could lead prices higher.

Most brokerages are bullish on copper. While Goldman Sachs expects prices to reach $15,000 by 2025, Bank of America sees them hitting $20,000 by that year.

Best copper stocks to buy now

Now, invariably all of the copper mining companies would stand to benefit from the rise in prices. However, CFRA has picked four that it thinks can outperform. The brokerage has a strong buy rating on Teck Resources and Freeport-McMoRan. It rates Southern Copper and Canadian mining company First Quantum as a buy.

Previously, I listed Freeport-McMoRan, Southern Copper, and First Quantum Minerals as good copper stocks to buy. While Teck Resources is expanding its copper portfolio, it also produces other commodities like coal and zinc and has interests in energy. This would make it a diversified company and not a pure-play copper miner. Teck Resources is a good diversified mining stock to buy since all of the commodities that it produces are trading at high price levels.

This would leave us with Freeport-McMoRan, Southern Copper, and First Quantum Minerals. All of these companies are ramping up their production, which would hit the market at a time when prices are high. Also, their unit cash costs are expected to come down with the ramped-up production. Finally, all of these companies have strong balance sheets.

Is FCX the best copper stock to buy now?

FCX is the best copper stock to buy now. The company has low-cost diversified operations and 42 percent of its reserves are in North America where it also has the opportunity to ramp up production.

The Grasberg ramp-up is progressing well and the company has ended the geopolitical uncertainty after it agreed to sell the stake in the mine to an Indonesian company. It's also setting up a smelter in Indonesia to adhere to the country’s requirements.

There's always a risk that the Indonesian government might increase the royalties or taxes on Freeport’s operations in the country. After the revenue loss due to the COVID-19 pandemic, countries are looking for ways to increase their revenues.

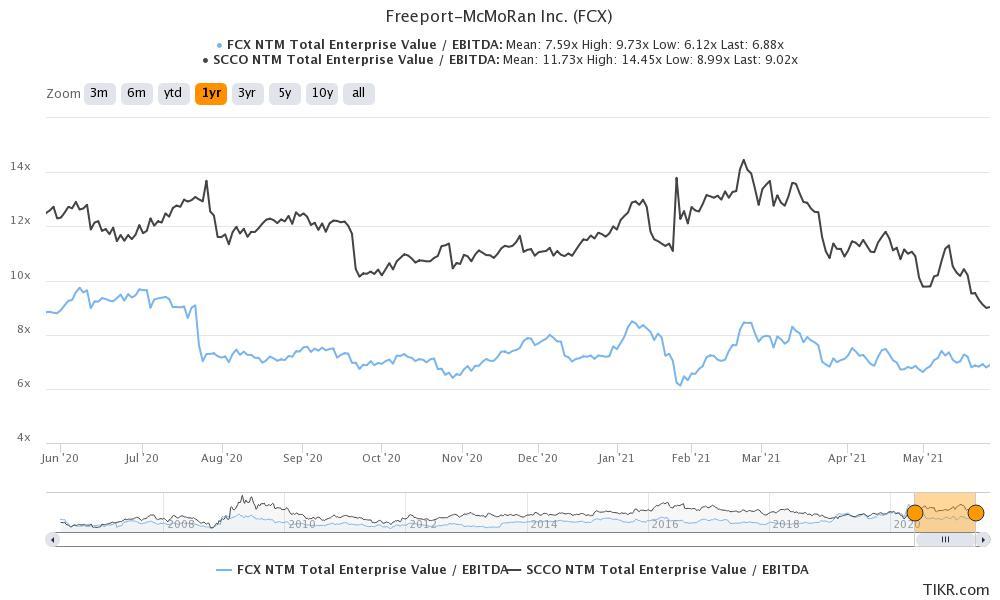

FCX versus SCCO valuation

FCX stock looks attractive at these prices.

From a valuation perspective, FCX looks attractive too. Freeport-McMoRan expects to post an adjusted EBITDA of $17 billion annually in 2022 and 2023 if copper prices average $4 per pound. The company’s EV is around $74 billion, which would mean a 2022/2023 EV-to-EBITDA multiple of around 4.3x.

While the valuation multiples for cyclical companies are highest at the peak, we might not have seen the peak in copper prices yet. If copper runs to the price levels that brokerages like Goldman Sachs and Bank of America are projecting, copper stocks could continue to fly high.