Is David Tepper Right About Beachbody Stock?

David Tepper’s Appaloosa hedge fund has made a big bet on Beachbody (BODY) stock. Here's the fitness stock’s price forecast.

Aug. 17 2021, Published 6:52 a.m. ET

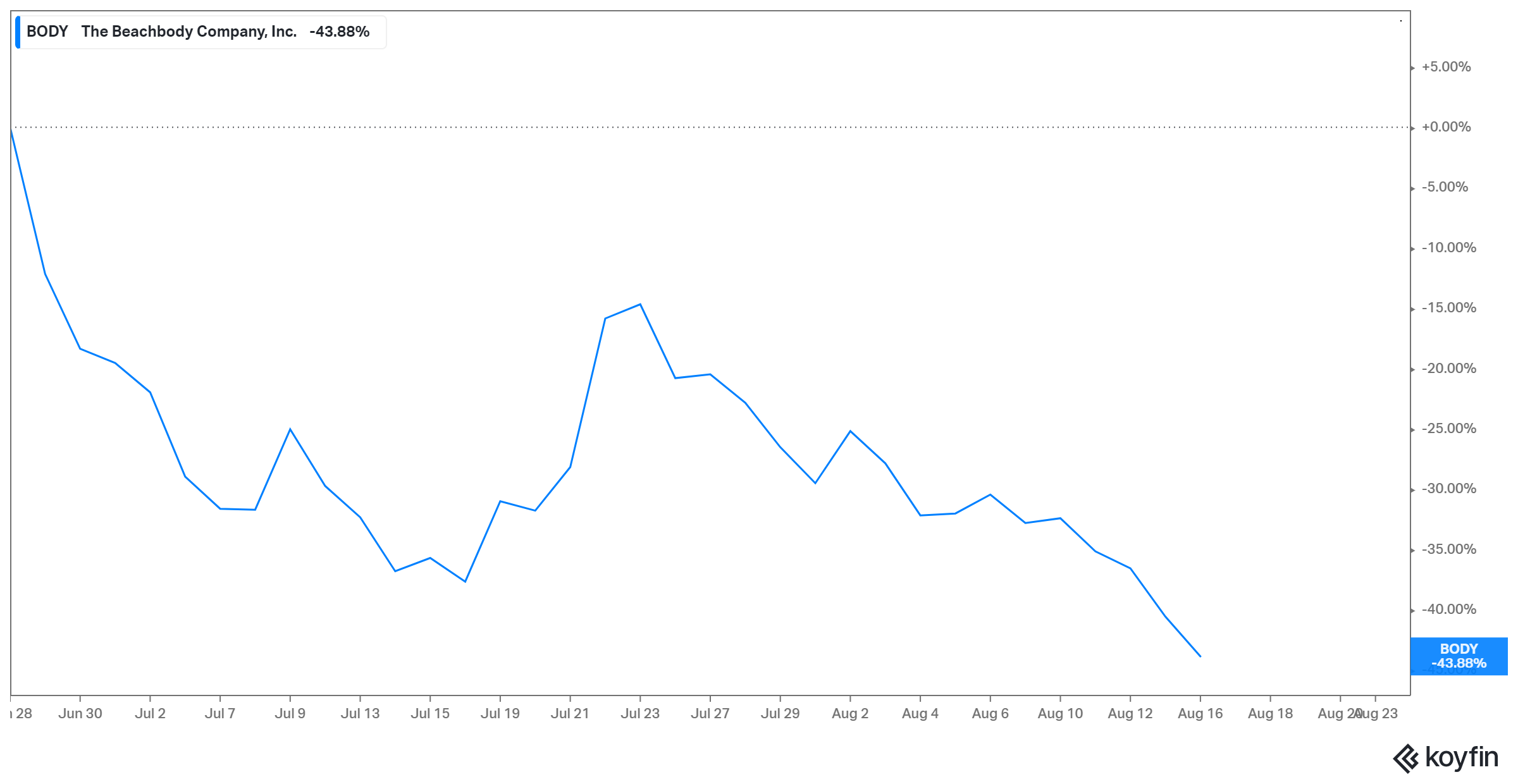

Beachbody (BODY) stock has been under pressure lately, dropping more than 15 percent in the past week and 30 percent since its public debut. Beachbody shares closed at $7.15 on Aug. 16. Investors are eager to know Beachbody’s stock forecast after David Tepper’s hedge fund disclosed a large stake in the company.

Beachbody is a fitness and media company. It competes with Peloton (PTON), whose stock has also been under pressure and is down nearly 30 percent year-to-date. Beachbody made its public market debut in Jun. 2021 through a SPAC merger.

Why has Beachbody (BODY) stock been falling?

Several factors can explain Beachbody stock's decline. First, the company's second-quarter results didn’t entirely impress investors. Although its EPS of -$0.05 were better than the -$0.08 Wall Street anticipated, its revenue of $223 million was far below the expectation of $260 million.

On top of the revenue miss, the company issued weak guidance for 2021. Its revenue forecast of $930 million–$960 million fell short of analysts' average estimate of $1.1 billion.

Another reason behind the stock’s fall is investors’ concern about the future of at-home fitness products as COVID-19 pandemic restrictions ease and people return to gyms.

David Tepper’s Appaloosa fund takes a position in Beachbody (BODY) stock

The hedge fund Appaloosa Management bought 2 million Beachbody shares during the second quarter, along with opening new positions in Uber and PulteGroup. The fund’s top holdings are Micron, Amazon, and Facebook.

Is Beachbody (BODY) stock undervalued?

After learning that Appaloosa took a large stake in Beachbody during the second quarter, many investors want to know what motivated David Tepper to buy BODY.

Appaloosa’s portfolio reveals a mix of value and growth stocks across diverse industries. Beachbody stock’s 30 percent drop since going public and 60 percent decline from its all-time high may attract bargain investors' attention.

Should you buy Beachbody stock like David Tepper?

Although some investors may be worried about the outlook for at-home fitness products as gyms reopen, Beachbody management sees growth opportunities ahead. The company has more than $347 million in cash, and management plans to increase investments in key growth areas.

Beachbody explained that the delay in closing the SPAC merger disrupted investment plans and caused delays in some product launches, which may have contributed to its disappointing second-quarter results and 2021 guidance.

Beachbody (BODY) stock forecast

Beachbody shares rose in premarket trading on Aug. 17. Analysts' average target of $12.13 for the stock suggests a 70 percent upside to its current price.

It's also worth noting that Beachbody stock carries minimal short interest and that the stock’s popularity on Reddit has declined. At the height of the GameStop short squeeze, Tepper cautioned investors to be careful with Reddit meme stocks.