Are Meme Stocks Dead or Will They Bounce Back?

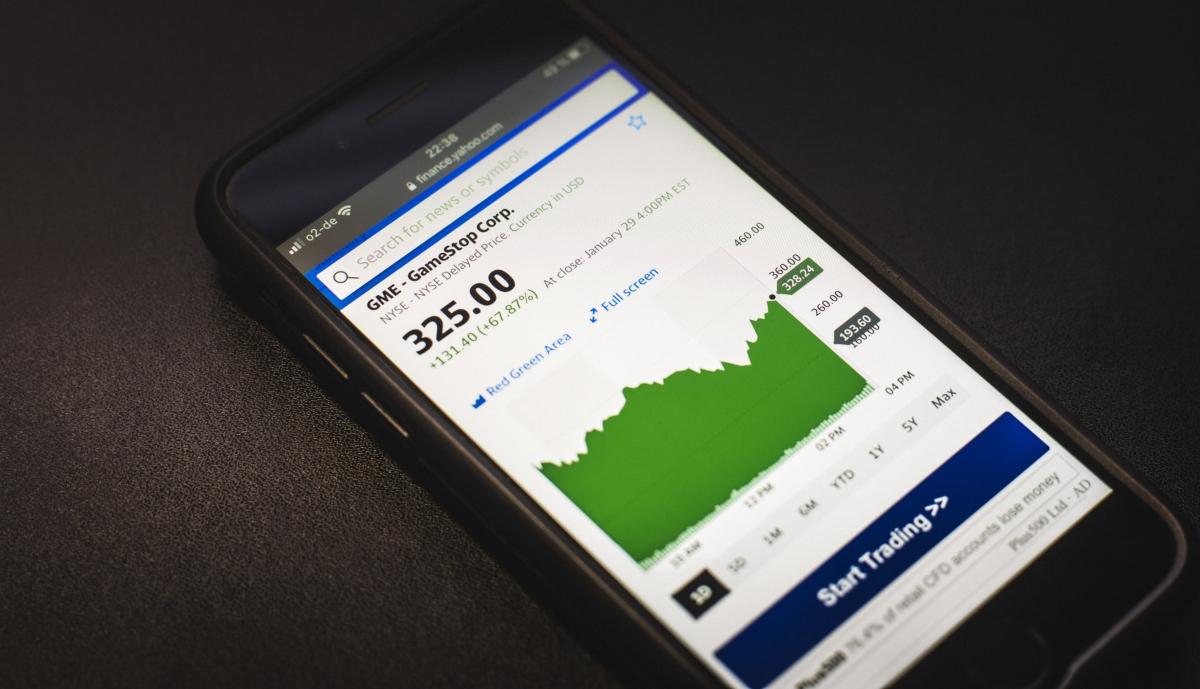

Meme stocks, like AMC Entertainment and GameStop, have now fallen to multi-month lows. Are meme stocks dead or will they bounce back?

Dec. 17 2021, Published 9:20 a.m. ET

Meme stocks, which rose sharply at the beginning of the first quarter and then again towards the beginning of the second quarter, have now fallen to multi-month lows. Are meme stocks dead or will they bounce back?

The group of meme stocks that includes the likes of AMC Entertainment and GameStop have fallen sharply from their highs even though they're still up considerably for the year. However, some of the meme stocks like Clover Health and Bed Bath & Beyond are trading near their 52-week lows.

Meme stocks aren't as popular.

Meme stocks have been falling in popularity, which is reflected in their Google search. The search around the term “meme stock” surged in January and then again in May and June. Since then, the search has decreased.

Reddit group WallStreetBets, which was at the forefront of the meme stock trade, has also been losing popularity. Unsurprisingly, Google searches for WallStreetBets and even “short squeeze” have tumbled.

Why are meme stocks falling?

Simply put, the rise in meme stocks was built around hype. Names like GameStop and AMC Entertainment deserve special mention here. While GameStop is a struggling gaming retailer looking for a turnaround and redemption under activist investor and Chewy cofounder Ryan Cohen, AMC is looking for relevance in a world that's moving towards streaming.

However, the meme trade doesn't mask the fact that streaming has led to permanent demand destruction for cinema chains, while gaming is gradually moving online. While GameStop is a turnaround candidate and is diversifying its revenue base, hiring Amazon executives wouldn’t merely make it the Amazon of gaming.

There's a new era of capitalism amid the meme stock mania.

Meanwhile, we saw a new kind of capitalism at play amid the meme stock mania. A lot of investors in meme stocks also buy products from these companies. AMC is a perfect example. These companies have also been trying to connect directly with retail stockholders. AMC even rewarded stockholders with free popcorn at the cinemas.

Companies connecting with retail stockholders is a welcome step. However, not taking analysts' questions, as GameStop did, isn't a shining example of transparency.

Is the meme stock trade dead?

Meme stocks attracted a lot of traders at the peak. A lot of retail investors go into these names without realizing the risks and the unjustifiable valuations. Some of the traders were looking to fund their retirement or pay off their debt and mortgages by investing in meme stocks.

Indeed, social media is filled with such self-claimed meme stock millionaires. While some traders indeed made money by trading in meme stocks, not all of them were lucky. Like a typical pyramid scheme, those who entered at the beginning made money, while late entrants are left holding stocks that they bought at elevated price levels.

There are still hardcore meme stock bulls—for example, the “apes” in AMC stock. Indeed, data suggests that retail traders have been adding more shares in some of the meme stocks. However, the meme mania among the broader public is ending because a lot of retail traders have burnt their fingers.

While meme stock mania might not totally die down, it's losing its charm. The group of meme stock traders might eventually become smaller, which would also hamper their ability to collectively trigger those magical short squeezes. Like all such parties, it would be fair to say, “It was good while it lasted.”