International Stocks Are Undervalued, Offer Diversification With Some Risks

Although international stocks look undervalued compared to U.S. stocks, that shouldn't be the only reason to invest in them. Are international stocks good for investors?

Jan. 7 2021, Updated 8:18 a.m. ET

Diversification is among the most basic premise of portfolio management. Along with diversification across asset classes, some investors also focus on diversification within an asset class. Investing in international stocks is one of the most popular diversification strategies. Are international stocks undervalued compared to U.S. stocks and should you invest in them?

First, investing in foreign stocks has its own sets of risks and the risk-return trade-off is different than investing in domestic stocks. Along with the systemic stock market risk that you assume while investing in domestic stocks, there are political risks, currency risks, and liquidity risks when investing in international stocks. Also, you may not be as well versed with the fundamentals of a foreign company compared to domestic stocks.

International stocks are undervalued

There are many metrics that you can use to value individual stocks. However, while looking at the market-wide valuation, it's better to look at the PE ratio. Also, while there can be many indices in a country like the Dow Jones, the Nasdaq, the S&P 500, and the Russell 2000 in the U.S., we should look at the most liquid and broad-based index.

For U.S. markets, we can take the S&P 500, which is the world’s most popular and indexed index, as a proxy. According to Yardeni Research, the S&P 500 has a forward PE ratio of 22.3x. In contrast, China’s Shanghai Index has a PE ratio of around 17x.

According to data compiled by the CEIC (Census and Economic Information Center), Hong Kong markets have a PE ratio of 14.2x, while Singapore stocks have a PE ratio of 13.3x. Looking at the European markets, Italy and the U.K. have PE ratios of 11.3x and 20.4x. South Korean and Indian stocks have PE ratios of 30.6x and 33.5x. Most of the global stock markets have a lower PE ratio than U.S. stock markets, which suggests that international stocks are undervalued compared to U.S. stocks.

Investing in international stocks

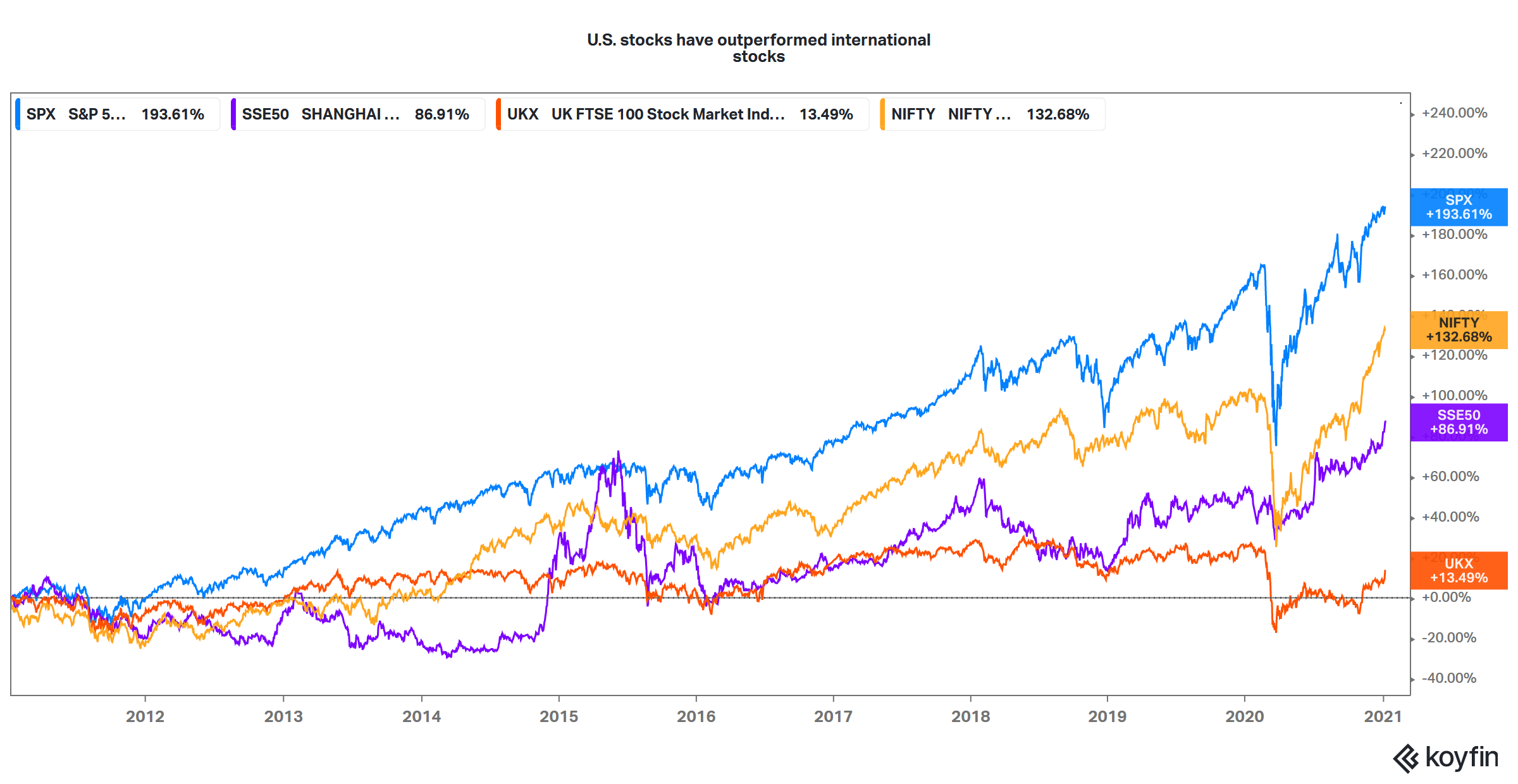

From a theoretical definition perspective, investing in international stocks would lead to a more diversified portfolio and hence better risk-adjusted returns. However, in practice, this hasn’t been the case over the last decade. U.S. stocks outperformed international stocks by a wide margin in the last decade. Incidentally, China, which was the fastest-growing major economy during this period, was among the worst performers and the Shanghai Composite Index is still below its 2007 highs.

U.S. stocks continued to outperform international stocks in 2020 and the gap only widened. Despite being the worst affected country from the COVID-19 pandemic, U.S. stock markets were the best performing major stock market in the year with the Nasdaq 100 Index rising above 40 percent. From a risk-adjusted basis also, U.S. stocks were better than international stocks over the last decade.

How to buy foreign stocks

There are many ways for investors to buy foreign stocks including:

- Buy international stocks that are listed on U.S. stock markets including companies like Alibaba, Baidu, NIO, and JD.com.

- Buy the stocks of foreign companies that trade on the OTC markets including companies like Tencent, Volkswagen, and BYD Company Limited.

- Open an account with a broker that lets you trade in foreign listed stocks. Many brokers let you trade on stocks that are listed on the foreign stock markets.

Another approach would be to invest in ETFs that invest in foreign companies. You would get the benefit of investing in a diversified basket of foreign stocks. You may choose from a passive or an active fund based on your preference and investment objective.