Why Amazon Is a Good Stock to Buy After the Pullback

Amazon stock has looked weak over the last six months. However, the forecast for AMZN stock looks bullish and it could reach $4,000.

March 4 2021, Published 8:31 a.m. ET

So far, Amazon (AMZN) stock has lost 7.7 percent in 2021 and is down 15 percent from its 52-week highs. The stock peaked in September 2020 and has looked weak since then. What’s the forecast for AMZN stock in 2021? Will it keep falling or can investors expect better days?

Overall, 2020 was a good year for Amazon and other U.S. tech companies. AMZN rose 76 percent in 2020 and was the second-best performing FAANG stock after Apple. Markets were bullish on e-commerce companies in 2020. Online sales soared due to the COVID-19 pandemic.

Why Amazon stock is falling

U.S. tech stocks came under pressure as investors shifted money to the so-called “reopening stocks” after positive trial results from COVID-19 vaccine candidates. The shift from growth to value stocks triggered a sell-off in most tech names and AMZN isn't an exception.

Rising bond yields, which recently reached the highest level in a year, triggered a sell-off in markets. Rising bond yields are negative for stocks since they could prompt central banks to raise rates. This would have an impact on the liquidity that has been among the prime factors enabling the market rally.

Analysts' forecast for AMZN stock in 2021

According to the estimates compiled by CNN Business, 49 out of 51 analysts covering AMZN stock have given it a buy or equivalent rating, while the remaining two analysts rate it as a hold. None of the analysts have a sell rating on the stock.

AMZN’s median target price of $4,000 is a 33 percent premium over its March 3 closing prices. The stock is even trading 13.8 percent above its lowest target price of $3,420, while it's trading at a premium of 73 percent over its street high target price of $5,200.

Last month, several brokerages including Stifel, Truist, Susquehanna, Goldman Sachs, Guggenheim, Oppenheimer, MKM Partners, and KeyCorp boosted their target price on AMZN stock after the company’s fourth-quarter earnings release.

Will AMZN stock reach $4,000?

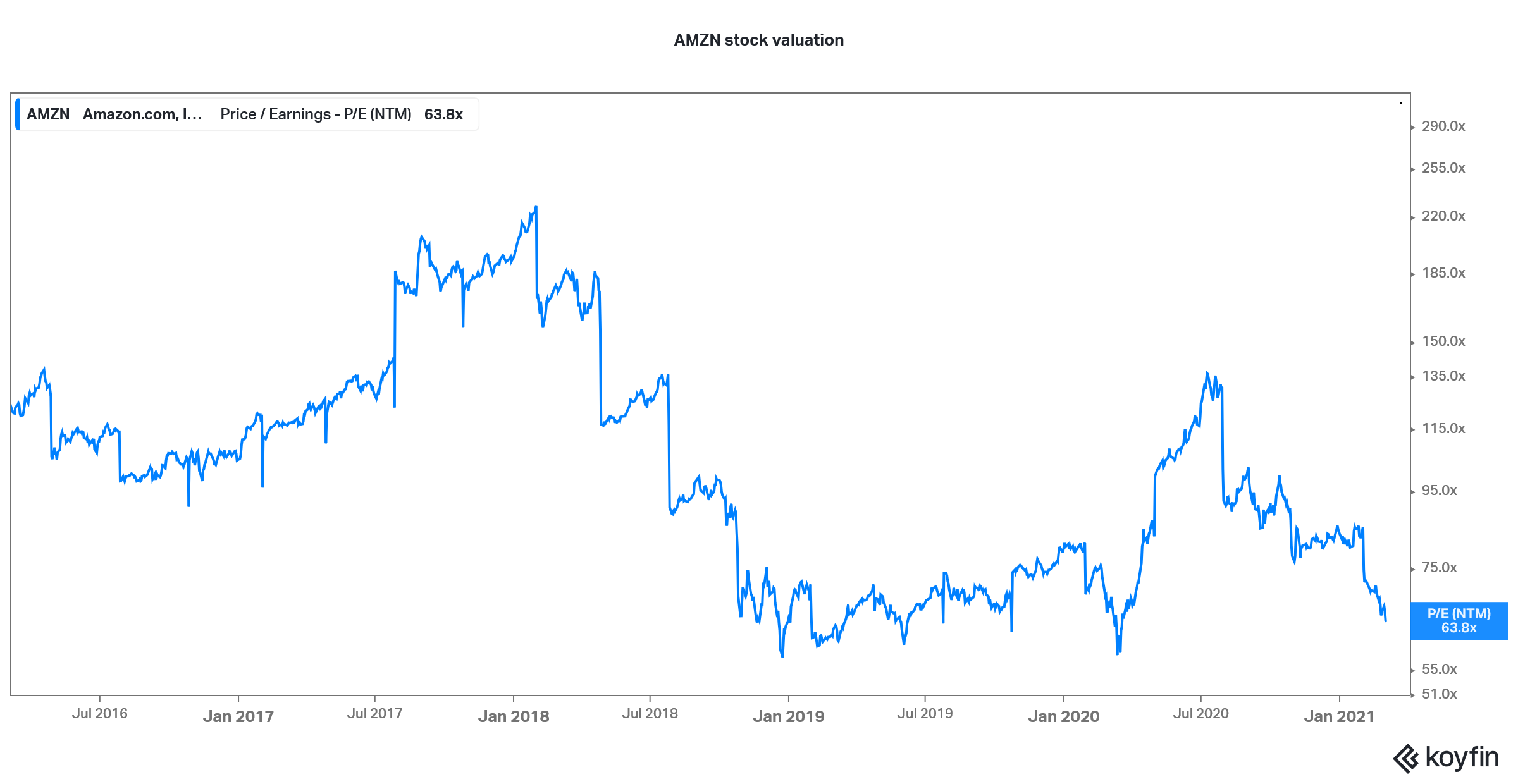

Many analysts expect AMZN stock to reach $4,000 in 2021. AMZN stock trades at an NTM PE multiple of 63.8x, which is way below its historical multiples. While the multiples might still look expensive and could taper down more over the long term, markets might be underappreciating Amazon’s earnings power.

AMZN NTM PE multiple

Analysts expect Amazon’s earnings to rise 15 percent in 2021 and 41 percent in 2022. Some of the investments that Amazon is currently making, including in emerging markets like India, will start contributing to its earnings in the medium to long term. Also, Amazon’s cloud operations would continue to contribute handsomely to the company’s growth.

AMZN stock might hit $4,000 by the end of the year like analysts expect. The stock has been in the penalty box amid the sectoral shift to cyclical plays but the tide might turn soon. Amazon will keep growing its top line and bottom line irrespective of how the COVID-19 pandemic situation evolves.

Outlook for AMZN stock

Currently, AMZN stock is trading near the $3,000 price level, which looks like a decent entry point into the company. There has been a structural shift towards e-commerce globally, which accelerated amid the COVID-19 pandemic. As online sales continue to soar, it would mean more revenues for companies like AMZN.

Buy Amazon stock on the dip

There are fears of a pullback in broader markets on valuation concerns. However, any fall in AMZN stock could be an opportunity to add more stocks. I would call it the typical buy-on-dip stock. The company has a big moat in e-commerce as well as cloud operations and could continue to deliver good returns on the back of these two growth engines.