Biden's Mortgage Plan Will Impact Borrowing Fees, Target Responsible Homeowners

What is the Biden mortgage plan doing to borrowing costs? Penalties for lower credit scores will decrease, and Republicans aren't happy about it.

April 28 2023, Published 10:46 a.m. ET

Republicans are criticizing Biden's mortgage plan for unfairly penalizing those with higher credit scores.

A new pricing structure for mortgages backed by Fannie Mae and Freddie Mac has Republicans worried. They're upset at how the so-called "Biden mortgage plan" seems to target responsible borrowers and make home-buying more difficult. What exactly do the fee changes mean for those buying a home starting in May?

CNN Business reported that changes to Freddie Mac and Fannie Mae mortgage fees are set to take effect in May 2023. Some Republicans have signed a letter criticizing the policy change, saying it adds to financial pressures felt by Fed interest rate hikes and overall inflation.

What fees are changing under the Biden administration's mortgage plan?

CNN Business notes that the Federal Housing Finance Agency (FHFA) is making a new Loan Level Price Adjustment (LLPA) to shift how Fannie Mae and Freddie Mac manage risk in mortgage lending. This latest change lowers the penalty for borrowers with low credit scores and may increase fees for borrowers with higher credit scores.

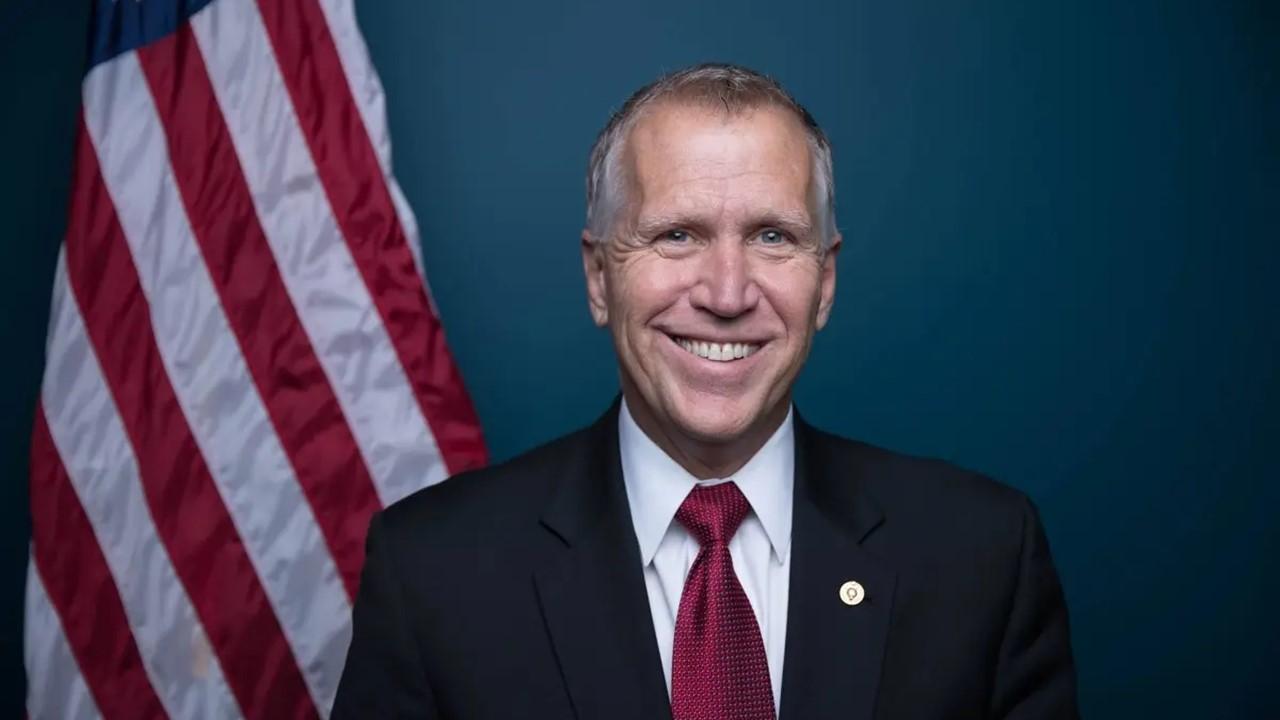

Senator Thom Tillis, a Republican from North Carolina, is among over a dozen GOP Senators who signed a letter of warning to FHFA Director Sandra Thompson, Fox News reported. The letter criticizes the fee change for lowering mortgage rates for "riskier individuals with lower credit scores" and raising rates on those with higher credit scores.

Senator Tillis stated, "This proposed rule by the Biden Administration is a gross injustice that penalizes hard-working Americans who are financially responsible."

Senator Roger Marshall told Fox News Digital, "This is illogical. The Biden administration must answer for why they are punishing Americans who have diligently met their financial obligations and earned higher credit scores."

Fannie Mae and Freddie Mac are government entities that the FHFA oversees.

How does Biden's mortgage plan affect homeowners and those seeking to buy homes?

Critics note that the plan will impact not only prospective buyers, but current homeowners as well. A Newsweek article states that the mortgage change has brought on debate over whether mortgage defaults could increase and property values decrease as a result. The idea is that making borrowing easier for those with low credit scores might lead to more defaults when those borrowers can't pay.

Joe Nunziata, co-CEO of Orlando-based lender FBC Mortgage, told Newsweek that default risk could go up in low-income and high-income neighborhoods. However, property values wouldn't necessarily go down as a direct result of more defaults in a neighborhood.

The new FHFA rules mean that a borrower with a lower credit score may see a reduction in mortgage fees. CNN reports that it might be 0.75 percent lower for someone with a 640 credit score and a 20 percent down payment. A buyer with a 740 credit score, also putting 20 percent down, may see fees go up by 0.375 percent.

Although fees are going up for some borrowers with higher credit scores and down for borrowers with lower credit scores, there's more to a mortgage than one's credit score. Overall, borrowers with lower credit scores will still pay more when taking a mortgage than those with better credit, but the penalty for that credit score won't be quite as steep.

Lenders will still examine a borrower's employment history, income, and other factors to determine creditworthiness. The credit score isn't the only factor considered.

Senator Tillis is among the GOP senators challenging the mortgage plan in a letter to the FHFA director.

Who will find borrowing more affordable under the new provision?

Essentially, people with lower credit scores will find it easier to buy a home (and over time, build wealth) under the new rules. Critics say that it is forcing responsible borrowers to "subsidize" riskier borrowers getting a mortgage, but the goal is to make homeownership more affordable for those struggling to accomplish that goal.

Some believe the new rules make it harder for "well-qualified borrowers" to get into the housing market. CNN spoke to Pierre Debbas, managing partner at real estate law firm Romer Debbas, who said that though the initiative of helping lower-income borrowers with lower credit scores and smaller down payments is important, "doing so at the expense of other consumers who are already struggling to enter the market is a mistake.”

The Republican Senators' letter could indicate plans to challenge the legality of the Biden mortgage plan. The idea that people with good credit scores will be penalized doesn't sit well with critics of the plan.