Does July’s CPI Report Mean That Inflation Has Peaked?

The markets were eagerly awaiting the July inflation report for more clues regarding its direction. It was released on Aug. 10. We'll explain the July CPI report.

Aug. 10 2022, Published 1:59 p.m. ET

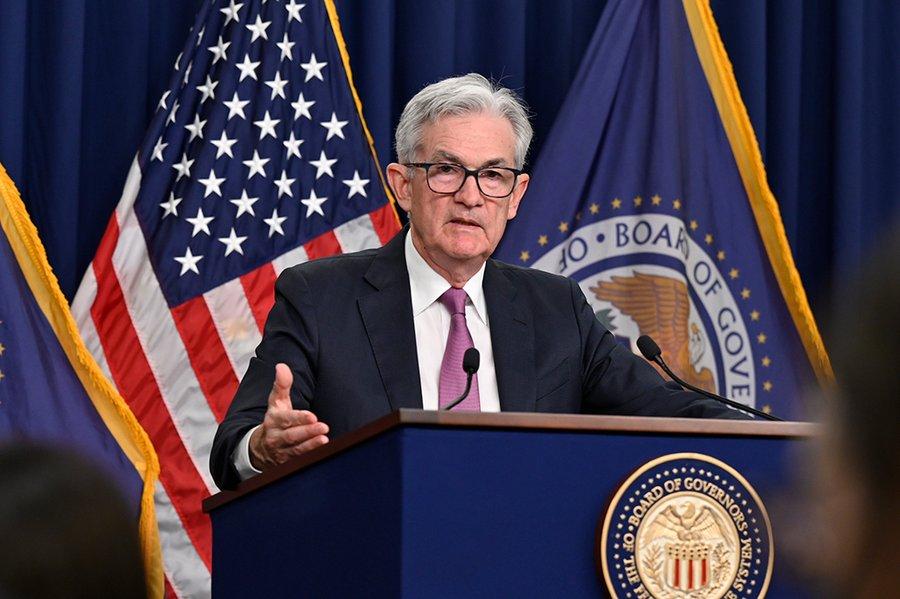

Rising inflation has given markets nightmares for the last few months. For June, the U.S. Consumer Price Inflation (CPI) came in at 9.1 percent, a fresh four-decade high. This forced the Fed to be even more aggressive in hiking rates. It has raised the rates by 75 basis points each at back-to-back meetings. All the eyes were now on July’s CPI print to get more clues about the monetary policy. Here are the details of the July CPI report.

The Bureau of Labor Statistics released the U.S. July CPI on Aug. 10. Inflation slowed down to 8.5 percent in July. In contrast to last month’s report, this reading was slower than expected. Economists were expecting inflation to come in at 8.7 percent for the month. The core inflation, which strips out more volatile food and energy components, also grew by 5.9 percent, which was less than the expected 6.1 percent.

Inflation has slowed down as gas prices ease.

The slowdown in inflation was expected as gas prices have taken a breather. The supply issues also started abating somewhat, which were expected to be reflected in lower prices. The July inflation print didn't disappoint. The gasoline index fell 7.7 percent and offset the increase in the food and shelter indices. The overall price level was flat month-over-month.

Other factors that helped cool the inflation trend were lower airline fares (down 7.8 percent), used cars and trucks (down 9.5 percent), communication, and apparel.

Markets rallied on slower-than-expected inflation print.

While one month doesn’t dictate a trend, markets took heart in the fact that the rising trend in inflation has started abating. Many economists thought that we might have reached peak inflation in June. July’s report stands to corroborate this view, at least temporarily. This could slow the Fed a bit since the committee was also looking at July’s report, which it will take into consideration at its September meeting.

Inflation is still high and close to a four-decade high but if the current downward trend continues, it could be a very positive signal for the markets. This was the reason that the markets reacted positively to the report and rallied. The markets have started factoring in the likelihood of a recession. It would be challenging for the Fed to maintain a balance between keeping the economic growth intact and managing the pressures of inflation.

Has inflation peaked?

The market participants who were concerned about inflation now think that the worst may be behind us. Tesla CEO Elon Musk recently mentioned that inflation has peaked and the prices for the commodities used by the company are already falling. He expects this trend to continue for the next six months, which should result in inflation falling rapidly.

The markets are now looking towards the next big clue, the Fed’s move at its September meeting. While July’s report might have taken some pressure off the Fed, inflation still remains way above its goal and as such it should continue with the hikes. Overall, the inflation crisis is still far from over.