Mark Jonker

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mark Jonker

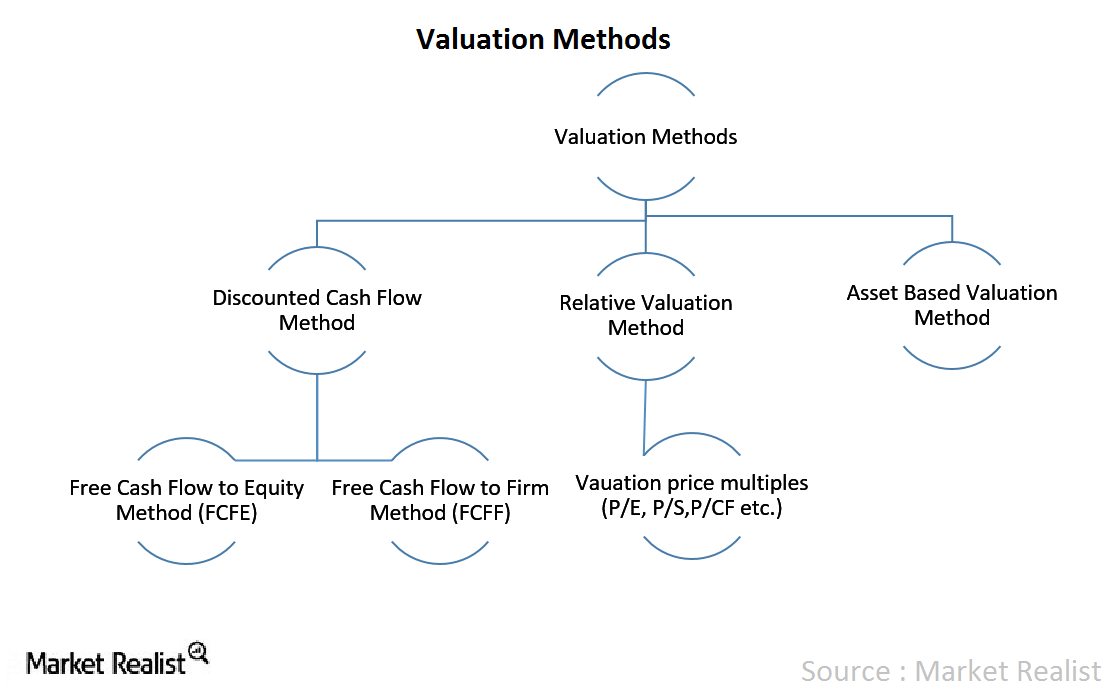

What Investors Need to Know about Valuation Price Multiples

Valuation price multiples are used in the relative valuation technique. This is the most common method used by Wall Street to value stocks.

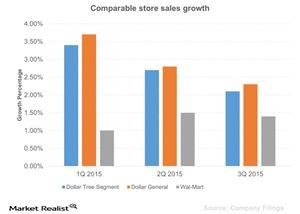

Dollar Tree: A Positive Mix of Organic and Inorganic Growth

Dollar Tree (DLTR) (XRT) (XLY) is pretty consistent for extracting organic growth from its business, seeing growth in the mid-single digits over the years.

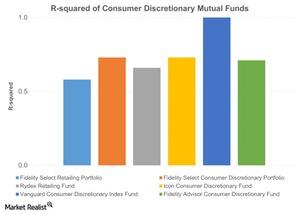

Mutual Funds: A Comparative Analysis Using R-Squared Values

The R-squared value is a statistical measure that compares the movement of a fund against that of its benchmark index.

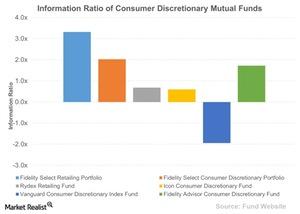

Mutual Funds: A Comparative Analysis Using Information Ratios

The information ratio can be used evaluate the performance of an actively managed fund.

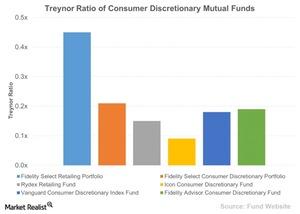

Mutual Funds: A Comparative Analysis Using the Treynor Ratio

The Treynor ratio calculates how much an investment has earned above the risk-free market rate for every unit of risk assumed.

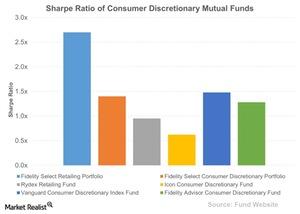

Mutual Funds: A Comparative Analysis Using the Sharpe Ratio

Investors often use the Sharpe ratio to gauge the performance of portfolios of investments.

Breaking Down Nordstrom’s Revenue Growth

In the last fiscal year, Nordstrom’s revenue growth was 7.7%, a substantial number when compared to its peers.

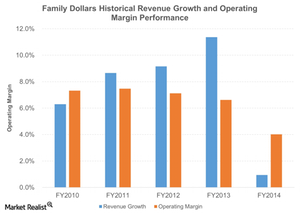

A Glance at Family Dollar’s Historical Performance

Over the last five years, Family Dollar was able to generate a five-year CAGR revenue of 7.2%. That looks decent when you look at it alone. But let’s compare it to its peers.

What Does the ShopperTrak Retail Traffic Index Indicate?

Retail traffic dipped in July 2015 after increasing in June 2015. The July numbers came in 17% below what was recorded by ShopperTrak in June.

The Relationship between the Retail Industry and the US Economy

When we compare the S&P 500 (SPX) with the SPDR S&P Retail ETF (XRT), the retail ETF has beaten the broad market index on a trailing one-year basis.

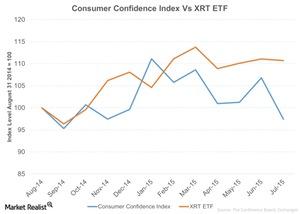

How Are Consumer Confidence and the Retail Sector Related?

Consumer confidence is one of the major factors that affect consumer spending. As a result, the retail sector has had a direct relationship with this metric.

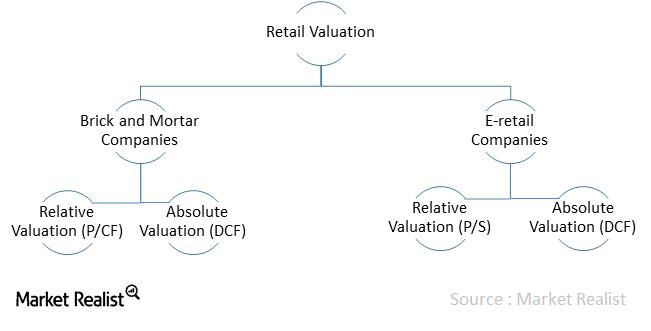

Is Relative Valuation Alone Sufficient to Value Retail Companies?

When we talk about retail valuations, it is important not to generalize that all the companies in the SPDR S&P Retail ETF can be valued using the PCF or the PS multiple.

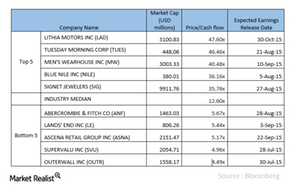

How Are Brick and Mortar Retail Companies Valued?

Brick and mortar retail companies have high inventory levels and are very capital-intensive companies that require a significant amount of working capital and capital expenditure.