Henry Kallstrom

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Henry Kallstrom

Must-know: Top auto industry ETFs for investors

The First Trust NASDAQ Global Auto ETF (CARZ) is the most traded auto-focused ETF. The three-year return for the ETF is 48.32%. YTD, CARZ provided a return of 2.23%.

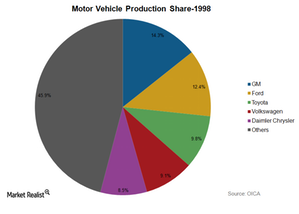

What makes the auto industry highly concentrated?

The automobile industry is one of the most highly concentrated industries in the world. The market continues to be dominated by a few major companies.

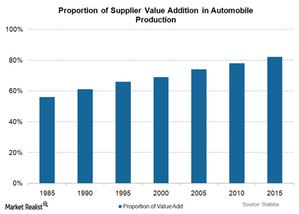

Suppliers’ power is increasing in the automobile industry

Auto suppliers’ contribution increased from 56% in 1985 to about 82% now. Automakers are becoming more like assemblers and less like manufacturers.

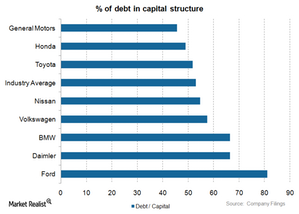

Ford, Daimler, and BMW employ high financial leverage

Ford (F) uses a high amount of financial leverage. Its debt-to-capital ratio is 81.1%. This is significantly above the industry average of 53.1%.

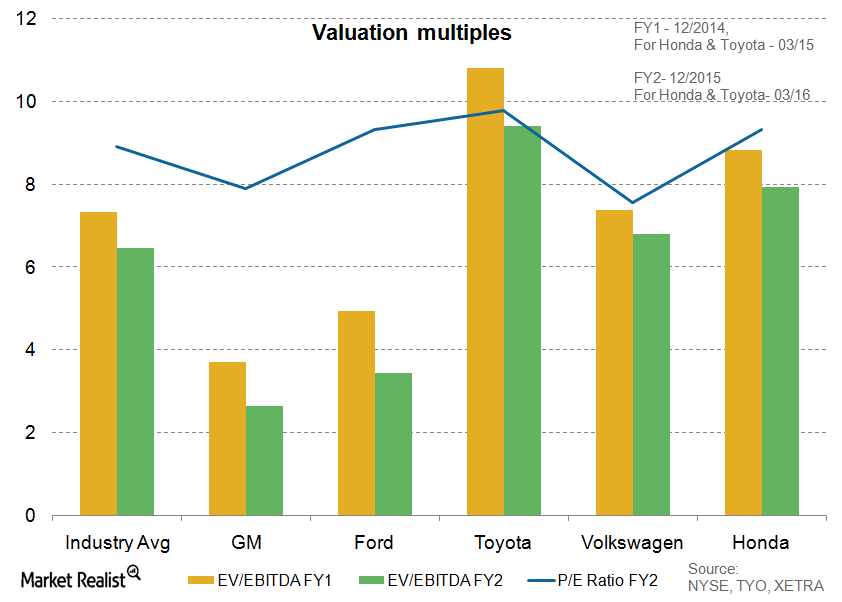

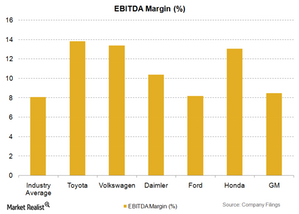

Intense competition leads to low profit margins for automakers

The auto industry has lower margins primarily because of intense competition. It makes it difficult for companies to pass on increases in raw material prices to the customer.

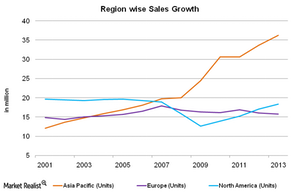

Why growth shifted in the global automotive industry

The automotive industry is geographically concentrated. The top 15 countries produce 88% of the world’s vehicles. Almost all of the G20 nations have a manufacturing unit.

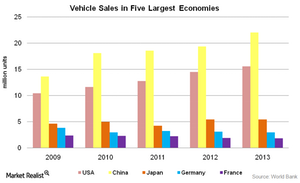

Why GDP and automotive industry growth are related

There’s a direct correlation between the size of a country’s GDP and its automotive industry. The auto industry has been expanding at a fast pace over the past several years.

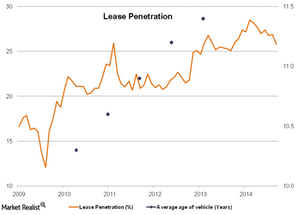

Vehicle leasing is driven by life cycles and innovation

There are higher maintenance and repair costs as a car gets older. This supports the option of leasing a vehicle.

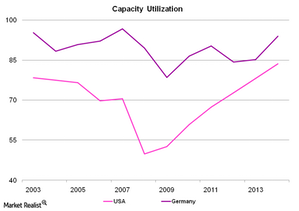

High operating leverage impacts the auto industry

The auto industry has high operating leverage. Operating leverage represents fixed costs as a percentage of total costs. High operating leverage magnifies gains and losses.

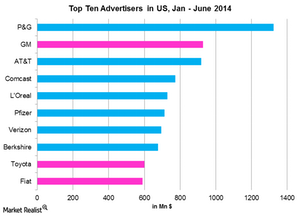

Advertising is key for automotive companies

The automotive industry is one of the biggest spenders when it comes to advertising. General Motors (GM) paid out $928 million during the first half of 2014.

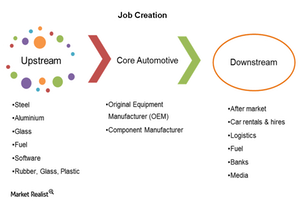

Why the automotive industry generates employment

The automotive sector plays a crucial role in job creation. Car manufacturing activity has an employment multiplier value of five.

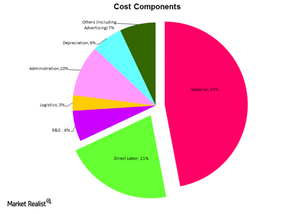

Raw materials – the biggest cost driver in the auto industry

Raw materials contribute about 47% to the cost of a vehicle. On average, an automobile is 47% steel, 8% iron, 8% plastic, 7% aluminum, and 3% glass.

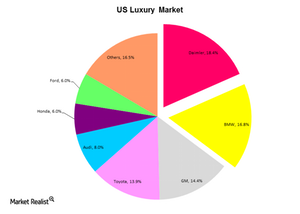

Daimler and BMW dominate the luxury car segment

German automakers lead the luxury space in the US. Daimler AG had an 18.4% share. It was followed by BMW. It had a 16.8% share.