Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

April 26 2019, Published 11:08 a.m. ET

Earnings estimates

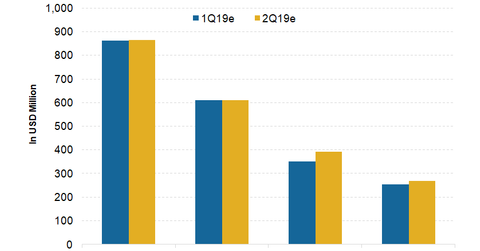

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter. They expect it to rise less than its revenue due to higher costs.

Kinross Gold

Analysts expect Kinross Gold’s (KGC) EBITDA to fall 31.4% YoY in the first quarter, in line with their revenue estimate. This year, they expect KGC’s EBITDA to rise 12.3% YoY.

Agnico Eagle and Yamana Gold

Analysts expect Agnico Eagle Mines’ (AEM) EBITDA to fall 10.5% YoY in the first quarter, but rise 29% YoY to $972 million this year. The company’s profitability is expected to start climbing later this year after project completion.

Analysts expect Yamana Gold’s (AUY) EBITDA to rise 0.2% YoY to $157.0 million in the first quarter. After the start-up of its Cerro Moro mine, its earnings have flattened. This year, its EBITDA are expected to be more or less flat at $697 million, falling just 0.2% YoY.