What Are Analysts’ Recommendations for Hotel Stocks?

Wyndham has the highest return potential of 21% with a target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15.

Sept. 30 2016, Updated 8:04 a.m. ET

Analysts’ recommendations

It’s important for investors to be aware of analysts’ recommendations. Recommendations or changes to recommendations can have a significant impact on stock prices. Changes can also indicate a shift in a company’s long-term trend.

Peer comparisons

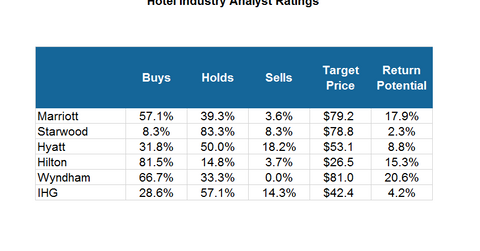

As you can see in the above chart, with an 81.5% “buy” rating from analysts, Hilton (HLT) seems to be the most favored. It’s important to note that 14.8% of the analysts recommend a “hold” and 3.7% recommend a “sell.” Wyndham Worldwide (WYN) comes in second with a 66.7% “buy” rating and a 33.3% “hold” rating. It doesn’t have any “sell” ratings.

Marriott (MAR) has a 57.1% “buy” rating, a 39.3% “hold” rating, and a 3.6% “sell” rating. Hyatt (H) has a 31.8% “buy” rating, a 50% “hold” rating, and an 18.2% “sell” rating. Intercontinental Group (IHG) has a 28.6% “buy” rating, a 57.1% “hold” rating, and a 14.3% “sell” rating. Starwood (HOT) has an 8.3% “buy” rating, an 83.3% “hold” rating, and an 8.3% “sell” rating.

Return potential

Wyndham has the highest return potential of 21% with a 12-month consensus target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15. It’s followed by Hilton with a return potential of 15% and a target price of $26.45.

Hyatt has a return potential of 9% with a target price of $53.11. IHG has a return potential of 4% with a target price of $42.37. Starwood has a return potential of 2% with a target price of $78.8.

Investors can gain exposure to the hotel sector by investing in the iShares Russell 1000 Growth ETF (IWF), which invests in the hotel sector. Next, we’ll see how the stock market reacted to the merger news.