InterContinental Hotels Group PLC

Latest InterContinental Hotels Group PLC News and Updates

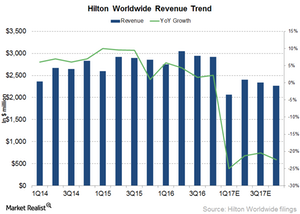

Will Hilton’s Top Line Grow in 2017?

For 1Q17, analysts are estimating Hilton’s (HLT) revenue to fall 25% to $2.1 billion.

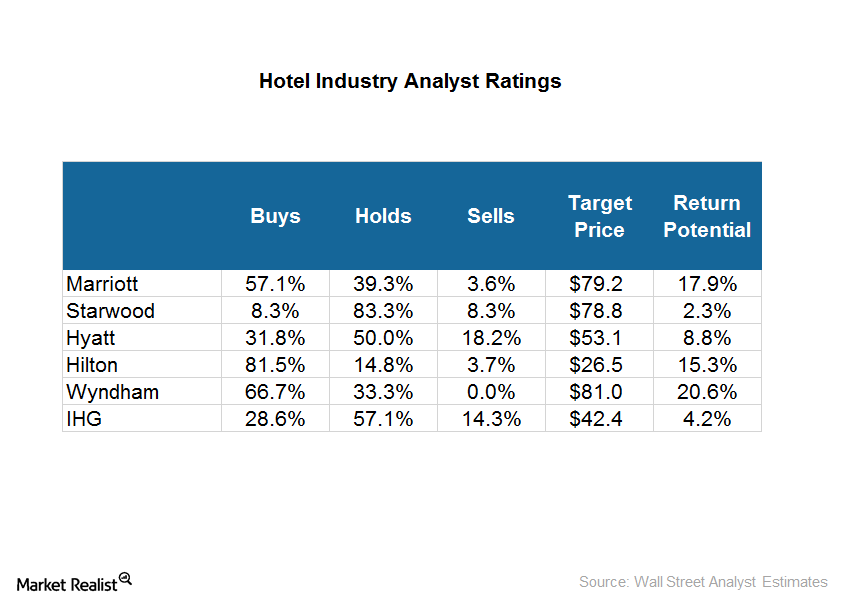

What Are Analysts’ Recommendations for Hotel Stocks?

Wyndham has the highest return potential of 21% with a target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15.

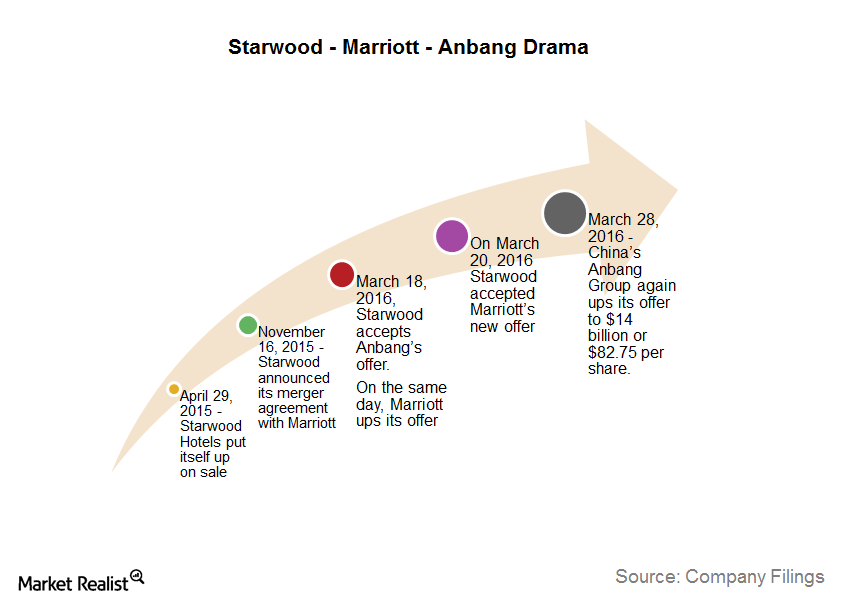

The Starwood Sale: The Story to Date

In this series, we will discuss why Starwood (HOT) decided to put itself up for sale, how a merger with Starwood would benefit either Marriott or Anbang, and who could probably win this takeover tussle.

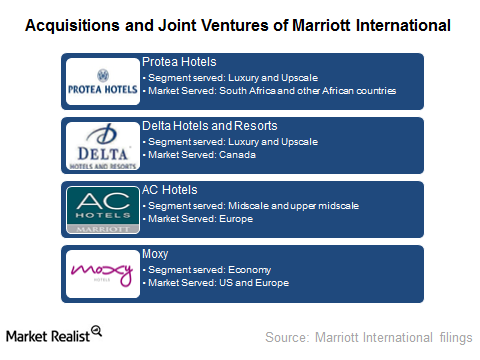

Acquisitions and Joint Ventures Drive Marriott’s International Expansions

Marriott has been able to expand its international business by both acquiring and creating brands that enable it to enter new markets and market segments.Consumer Why InterContinental Hotels’ “asset-light” strategy drives growth

The company said on its website that its “business model is focused on franchising and managing hotels, rather than owning them, enabling us to grow at an accelerated pace with limited capital investment—we call this ‘asset light.’