Is the Oil Market Balancing?

On October 31, 2017, US crude oil (USO) December 2018 futures settled $1.4 below December 2017 futures.

Nov. 2 2017, Updated 9:03 a.m. ET

Futures spread

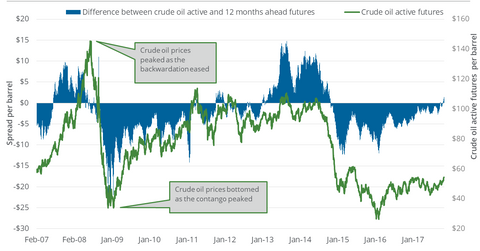

On October 31, 2017, US crude oil (USO) December 2018 futures settled $1.4 below December 2017 futures. In other words, the futures spread was at a discount of $1.4. On October 24, 2017, the futures spread was at a discount of $0.8. Between October 24 and October 31, 2017, US crude oil December futures rose 3.6%.

Discount

The futures spread at a discount could be a positive development for oil prices. Moreover, any expansion in the discount could add gains to oil prices. For example, on June 20, 2014, the futures spread was at a discount of $10.53. On the same day, US crude oil active futures settled at their peak before more than three years of bearishness in the oil market.

Premium

On the other hand, the futures spread at a premium could adversely impact oil prices. Moreover, any expansion in the premium could increase oil’s weakness. For example, on February 11, 2016, the futures spread was at a premium of ~$12. On the same day, US crude oil active futures settled at their lowest closing price in the last 12 years.

In the seven calendar days to October 31, 2017, the spread discount expanded, and oil prices rose, which usually happens as the oil market tightens.

Energy sector

US oil producers (XOP) (DRIP) (IEO) use the US crude oil futures’ forward curve for risk management of their output prices. The curve also influences midstream (AMLP) oil transportation and storage operations.

On October 24, 2017, US crude oil futures contracts for delivery until March 2018 settled at progressively higher prices. Because the curve is upward sloped, ETFs that are supposed to track oil futures may fare worse than oil futures, which helps us understand the underperformance of the United States 12 Month Oil ETF (USL), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil (UCO) compared to US crude oil futures.