What Synergies Does Newmont Expect from Merger with Goldcorp?

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger.

July 31 2019, Updated 2:46 p.m. ET

Newmont-Goldcorp merger

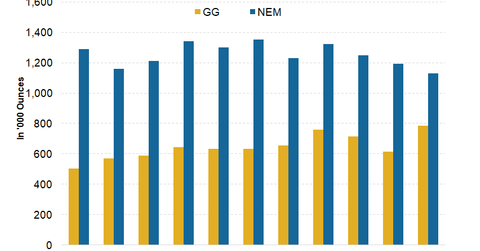

As we highlighted in Newmont (NEM) and Goldcorp Merge, Form World’s Largest Gold Company, the merger of Newmont and Goldcorp was completed on April 18. This merger resulted in the creation of the world’s largest gold miner (GLD). This merger combined Newmont’s 68.5 million ounces and Goldcorp’s 52.8 million ounces to form the world’s largest asset base.

During its Q1 2019 results, the company provided further updates regarding the merger and its priorities going forward. During the conference call, NEM’s CEO Gary Goldberg said the company is targeting six to seven million ounces of gold production per year from the combined entity. He also mentioned that the company expects to improve the annual revenues by another $1.5 billion per year through silver (SLV), zinc, and copper production.

Merger synergies

Regarding synergies from the merger, Goldberg stated that the company is expecting to generate $365 million in annual pre-tax savings. These savings would be mainly due to the general and administration synergies, supply chain efficiencies, and full potential improvements. Combined, the above-mentioned efforts could lead to the potential value creation of $4.4 billion.

Increased shareholder returns

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger. The combined company is set to deliver stable free cash flow from steady production and improving cost profile. It is also expecting to unlock further value through portfolio optimization, project sequencing, exploration, and divestments. The company is expected to deliver the highest dividend among senior gold producers (GDX).