Recent Changes in Enterprise Products Partners’ Short Interest

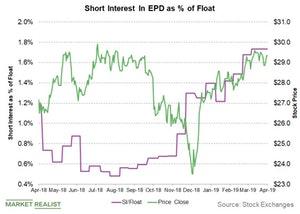

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

April 25 2019, Published 12:20 p.m. ET

Short interest in EPD

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29. The next short interest data are scheduled for release on April 25.

The short interest in Enterprise Products Partners as a percentage of its float is 1.7%, higher than its five-year average of 1.1%.

A rise in short interest indicates that more investors expect the price of a stock to fall in the near term. Investors could, however, be wrong in their expectations.

Enterprise Products Partners’ short interest ratio is ~8x. The ratio, calculated as short interest divided by average trading volume, shows how many days it will take to cover all the open short positions in a stock. If a stock’s price doesn’t fall as expected by the short sellers, the buying pressure to cover its short positions may actually push its price higher. The higher the number of days there are to cover, the more prolonged the rally will be, resulting in greater losses for short sellers.

Peers’ short interests

The short interest in Kinder Morgan (KMI) stock rose 7.3% recently. Based on its average trading volume, it may take about four days to cover all the open short positions in the stock. The short interest in ONEOK (OKE) fell 12.5%, and it rose 0.8% in Plains All American Pipeline (PAA) recently. The short interest in Magellan Midstream Partners (MMP) fell 5.8% recently.