Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

Nov. 20 2020, Updated 12:55 p.m. ET

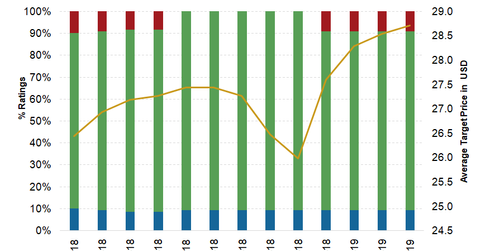

Analysts’ ratings for WPM

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%. According to the consensus compiled by Thomson Reuters, 11 Wall Street analysts are currently covering WPM.

At the end of November, the stock had “buy” ratings from 100% of the analysts covering it. Credit Suisse (CS) downgraded it from “outperform” to “neutral” in December.

Distinct business model

Wheaton Precious Metals is a royalty and streaming company with a different business model than its mining peers (NUGT). Streaming companies don’t own the mines but just provide up-front finance to miners in exchange for the right to buy their product streams at lower prices in the future.

Future development potential

After falling 11.7% in 2018, WPM’s stock has gained 27% year-to-date as of March 25. It has significantly outperformed the VanEck Vectors Gold Miners ETF (GDX), which has gained 10.3%. The most recent boost to its share price was from the favorable settlement of its long-standing tax dispute with the Canada Revenue Agency. Moreover, its growth profile seems to be balanced with a large part of its production tied to the geographically stable Americas region.

Analysts expect Wheaton’s revenue to rise 7.6% in 2019 and 7.1% in 2020 after a fall of 5.8% in 2018. Its EBITDA is also expected to rise 12% and 7.8%, respectively, in 2019 and 2020, implying margins of 65.8% and 66.2%, respectively, compared to 62.9% in 2018.