Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

Jan. 23 2019, Updated 11:40 a.m. ET

Williams Companies

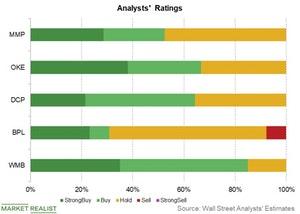

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.” Among the 20 analysts surveyed by Reuters covering Williams Companies, seven recommended a “strong buy,” ten recommended a “buy,” and three recommended a “hold.” The median target price for Williams Companies is $32, which implies an upside potential of 21% from its current price.

Magellan Midstream Partners

On January 16, Barclays cut its target price for Magellan Midstream Partners (MMP) from $70 to $64. On January 15, Credit Suisse cut its target price for Magellan Midstream Partners by $1 to $76. Among the 21 analysts covering Magellan Midstream Partners, six recommended a “strong buy,” five recommended a “buy,” and ten recommended a “hold.” Magellan Midstream Partners’ median target price of $75 implies an upside potential of 21% in a year.

ONEOK

On January 16, Barclays cut its target price for ONEOK (OKE) from $70 to $66. On January 14, UBS cut its target price for ONEOK from $75 to $68. Among the 21 analysts covering ONEOK, eight recommended a “strong buy,” six recommended a “buy,” and seven recommended a “hold.” ONEOK has a potential upside of 11% based on its median target price of $70.

Other updates

On January 16, Barclays raised its rating for Buckeye Partners (BPL) from “equal weight” to “overweight.” Barclays raised its target price for the stock from $35 to $38. The median target price for Buckeye Partners is $36.

Barclays cut its target price for DCP Midstream (DCP) from $41 to $33. The median target price for DCP Midstream is $37.5.