How Jeff Bezos’s Workday and Domo Investments Fared in 2018

Twitter stock surged by about 73% in the first trading day after its IPO to $44.90.

Nov. 20 2020, Updated 2:02 p.m. ET

In the previous part of this series, we looked at Amazon (AMZN) founder Jeff Bezos’s investment in Twitter (TWTR). Twitter stock surged by about 73% in the first trading day after its IPO to $44.90. However, the stock couldn’t manage to hold these gains, and as of January 8, 2019, it was trading at $31.80 per share. Now, let’s take a look at Bezos’s other key investments in companies that are listed and how these companies fared in 2018.

Workday and Domo investments

According to the data compiled by crunchbase.com, Bezos directly invested about $60 million in American software firm Domo (DOMO). The company got listed on the NASDAQ in 2018 with an IPO priced at $21 per share. As of January 8, DOMO was trading with 7.7% gains at $21.14 month-to-date after ending the fourth quarter of 2018 with 8.5% losses. Thus, DOMO stock wasn’t far away from its IPO price of $21.

Similarly, Bezos invested about $85 million in the American cloud-based financial management services provider Workday (WDAY) in 2011 through his investment firm, Bezos Expeditions. WDAY was listed on the NASDAQ in 2012 with an IPO priced at $28 per share. In 2018, the company yielded solid 56.9% returns despite a 3.9% and 6.2% drop in the NASDAQ Composite and the S&P 500 Index (SPY), respectively.

Note that in in the fourth quarter of 2018, Apple (AAPL), Amazon, Microsoft (MSFT), Alphabet (GOOG), NVIDIA (NVDA), Facebook (FB), and Netflix (NFLX) lost 30.1%, 25.0%, 11.2%, 13.4%, 52.5%, 20.3%, and 28.5%, respectively. During the same quarter, Workday’s stock rose 9.4%.

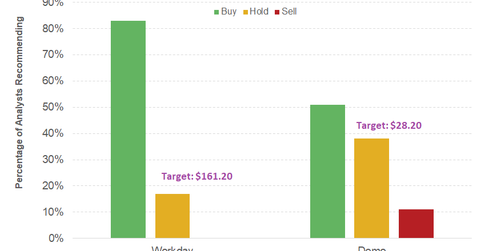

According to the latest data by Reuters, 83% and 51% of analysts covering DOMO and WDAY recommended a “buy,” respectively. Analysts’ 12-month consensus target price for Domo reflected ~33.4% upside potential, while Workday was already above analysts’ consensus target price of $161.20.