Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

Dec. 30 2018, Updated 12:05 p.m. ET

Revenue forecast

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017. Meanwhile, peers Intuitive Surgical (ISRG), Johnson & Johnson (JNJ), and Waters (WAT) are expected to have revenue of $3.71 billion, $81.34 billion, and $2.41 billion, respectively, in fiscal 2018. Thermo Fisher’s cash per share is $2.68, while Intuitive Surgical, Johnson & Johnson, and Waters have cash per share of $26.36, $6.50, and $27.20, respectively.

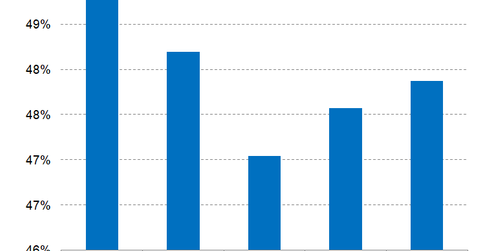

Gross margins

In the third quarter of this year, Thermo Fisher’s cost of product revenue rose YoY (year-over-year) to $2.36 billion from $2.17 billion, while its cost of service revenue rose YoY to $948.0 million from $642.0 million. Its gross margin contracted YoY to 46.25% from 48.39%.

Expected trends

Thermo Fisher’s gross margin is expected to be 47.04% and 47.57%, respectively, in fiscal 2018 and fiscal 2019, compared with 48.19% in fiscal 2017. Meanwhile, Intuitive Surgical, Johnson & Johnson, and Waters are expected to have gross margins of 71.04%, 71.09%, and 58.93%, respectively, in fiscal 2018.

Valuation metrics

Thermo Fisher’s EV (enterprise value) is $106.29 billion, and its EV-to-revenue ratio is 4.45x. Its price-to-sales ratio is 3.62x, and its price-to-book ratio is 3.12x. Intuitive Surgical, Johnson & Johnson, and Waters have price-to-book ratios of 7.89x, 5.10x, and 7.08x, respectively. Next, we’ll look at Thermo Fisher’s operational performance.