Waters Corp

Latest Waters Corp News and Updates

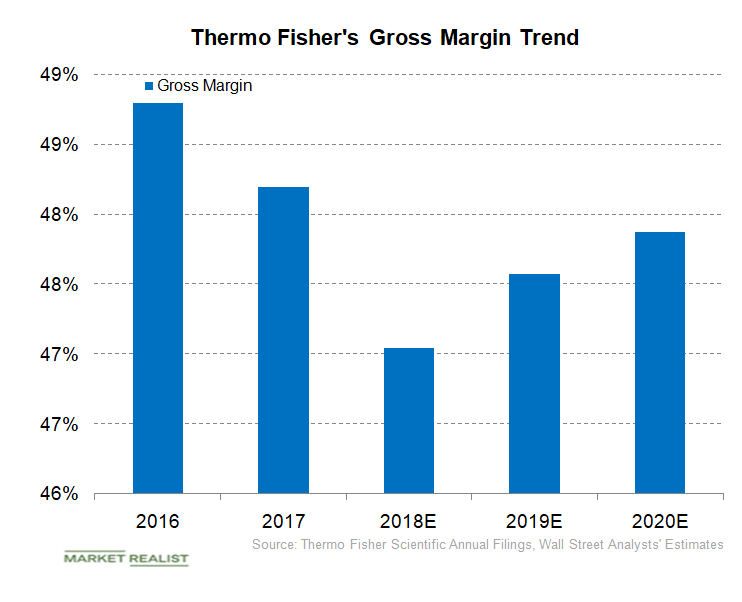

Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

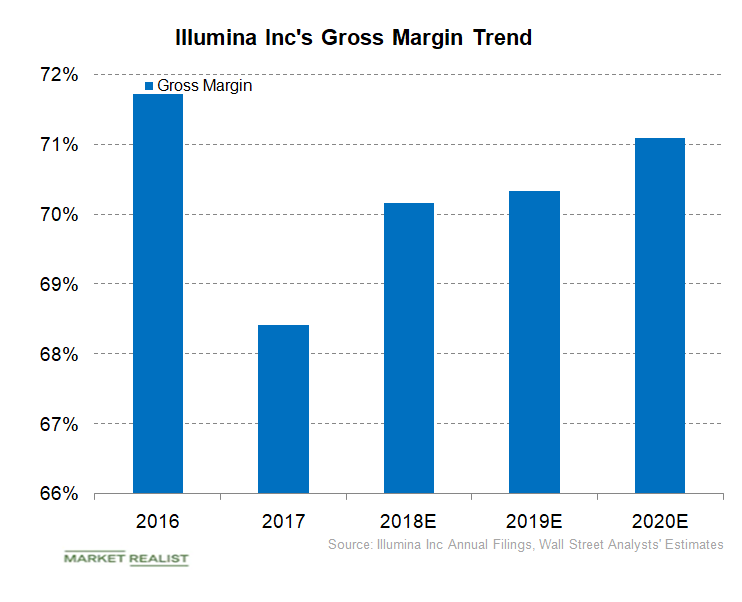

Understanding Illumina’s Gross Margin Trend

Illumina’s cost of product revenue increased from $173.0 million in the third quarter of 2017 to $184.0 million in the third quarter of 2018.

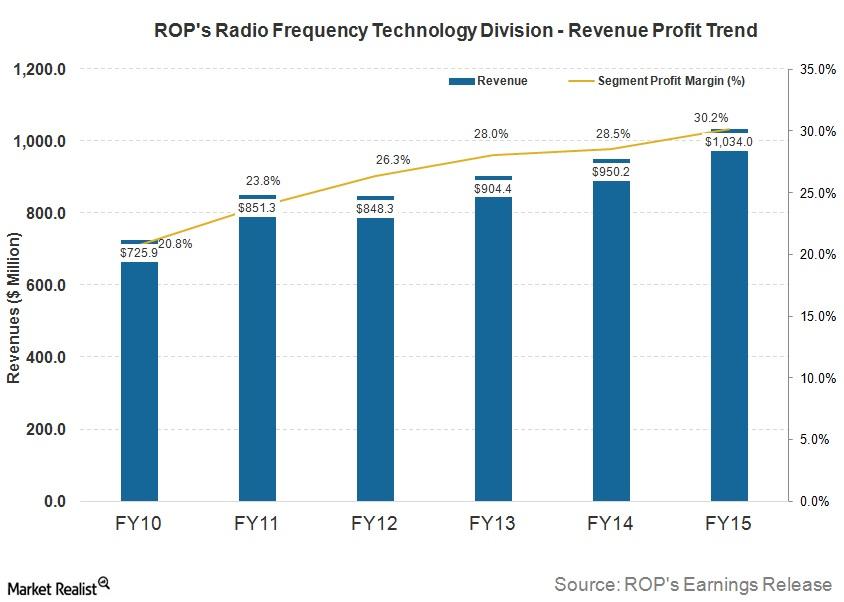

ROP’s Second-Largest Segment: Radio Frequency Technology

In 2015, ROP’s Radio Frequency Technology segment contributed ~28.9% to its total consolidated revenue and ~30.4% to its consolidated operating profit

Roper Technologies: Recent Acquisitions That Count

Since its inception, Roper Technologies (ROP) has followed an acquisition-based growth strategy. The company has acquired over 50 companies since 1981.

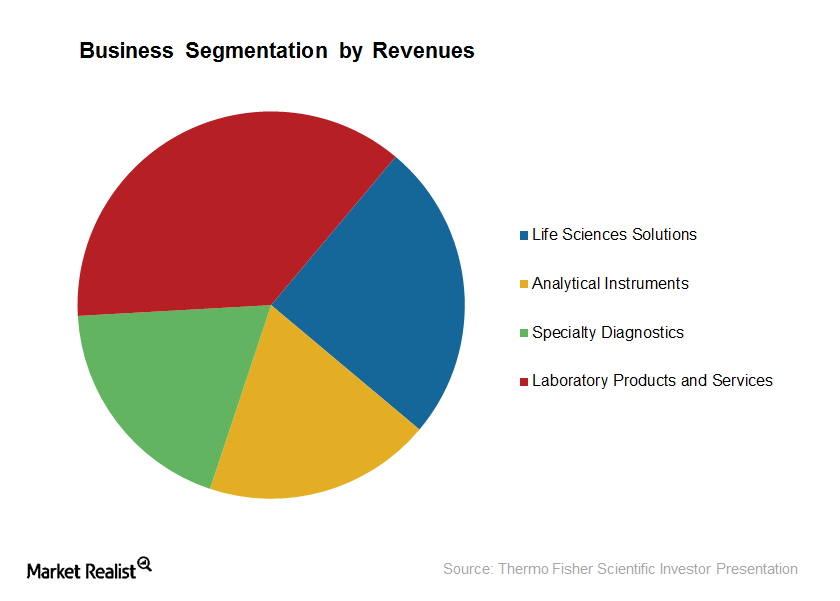

An Overview of Thermo Fisher Scientific’s Business Model

Thermo Fisher Scientific (TMO) has made a number of acquisitions over the years, resulting in the expansion of the company’s product portfolio with the inclusion of a number of premium brands.