Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Oct. 5 2018, Updated 3:05 p.m. ET

Powell’s comments

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

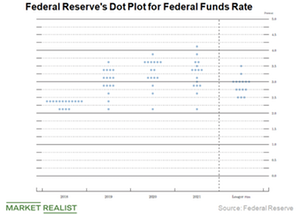

While speaking at the annual meeting of the National Association of Business Economics, Powell said, “The historically rare pairing of steady, low inflation and very low unemployment is testament to the fact that we remain in extraordinary times.” On October 3, he mentioned, “We may go past neutral, but we’re a long way from neutral at this point, probably.”

Rates and US stocks

Investors are worried that better-than-expected data could push the Fed to tighten its policy even more. Increasing interest rates (TLT) affect companies, which have to borrow funds to run their day-to-day businesses and expand. Higher rates could deter investment and increase the cost of borrowing, which could impact companies’ earnings and stock prices. When rates increase, future cash flows, which are discounted at a higher rate, aren’t worth as much.

Markets focus on data

Inflation figures have been hugely important for the markets in 2018, as they’re one of the most important deciding factors in terms of the Fed’s future interest rate path. Investors will be looking forward to today’s non-farm payroll data—especially the wage growth component, which could give further clues regarding the Fed’s future movements.

Investors may recall that after the average hourly earnings in January rose the most since the recession (though they were later revised downward), the US markets fell due to expectations of more aggressive rate hikes by the Fed.

The S&P 500 Index (SPY) fell 6.2% in the two days following the jobs report, while the Dow Jones Industrial Average Index (DIA) and the NASDAQ Composite Index (QQQ) fell 7.1% and 5.9%, respectively.

In the past few years, one of the factors fueling US equity markets has been cheap money. The end of easy money could put the brakes on the economy. The concern is echoed by many market participants and experts. JPMorgan Chase’s (JPM) CEO, Jamie Dimon, mentioned in August that unwinding the Fed’s unprecedented quantitative program could backfire on the economy or even spark a market panic.